For many of us, the idea of using a monthly budget to guide our money life was not something we grew up with. In fact, if you are like me growing up, a budget was nothing more than an idea nobody ever really talked about. By the time I was 22 years old and out of college my concept of people who had money fell into about 2 categories.

- Doctors, lawyers, and others in high-paying professions.

- People who were lucky and must have inherited money or were born into wealthy families.

Of course, this is nonsense however without any financial education growing up my imagination filled in the gaps. As I got older and began to see my peers slowly building better lives my questions (and curiosity) began. What were they doing to achieve their standard of living? After all, I knew many of these people didn’t come from wealthy backgrounds, and, their work as teachers or non-profit professionals didn’t align with my preconception that they had high-paying careers either. So how did so many of my peers build better lives while I was using a credit card just to be able to take the family out for dinner? As it turns out, my imagination led me in the completely wrong direction.

As the years progressed I began learning that having some money is, comparatively speaking, rarely about having a high-paying career or having “lucky” family circumstances. Certainly, those people do exist but as the data shows, being a millionaire in the United States today comes down to doing the little things, the correct way, over a long period of time. Most millionaires in the US today have a propensity for saving, a natural aversion to wasting money, and most importantly, the ability to choose what they want most, over what they want now.

In the end, I learned that living a comfortable financial life had nothing to do with luck or professions. It had everything to do with intentionality, discipline, and 5th-grade math. Spend less than you earn (Intentionality), learn how to say no (Discipline), and stay out of debt (5th Grade Math). Coincidentally, when these 3 qualities come together within the context of handling your monthly budget, good things happen.

What is a budget? A budget is how you achieve a dignified financial life. If you are struggling to pay your bills or save for the future or if you simply feel that there must be a better way continue reading. A budget is more than you might think. As I’ve learned over the past nearly 20 years, a budget is an indispensable tool for financial freedom.

What is a Budget?

1. A Budget is Freedom

A budget is freedom. Most people think of a budget as something that is too restrictive; almost like it is a big stop sign. They think once they are on a budget, they’ll have to say no to all the good stuff in life and kiss fun goodbye, right? Not exactly. We think of a budget as the exact opposite. A budget is freedom. Yep, you read that right. Freedom.

A budget is telling your money you are in charge. And once you are making your money behave all that worrying about loss of freedom actually turns into the control you’ve been missing. Being in charge and being in control doesn’t sound restrictive to me. It actually sounds a lot more like freedom.

2. A Budget is the Pillar of Financial Control

A budget is the pillar of financial control. It is an indispensable part of money wisdom. If your spending is out of control, you need a budget. In fact, you need a budget regardless. Simply put, a budget is the assignment of your dollars before the month begins. Each dollar of income is organized on paper according to the places you plan to spend (or save) it. A budget is a written plan for your money before you receive it. A budget is the pillar of financial control.

3. A Budget is Telling your Money Where to Go Before Wondering Where it Went

According to author John Maxwell and often repeated by Dave Ramsey, “a budget is telling your money where to go before wondering where it went”. A budget helps you organize your money so you can win with money. A budget helps you visualize where to allocate your money so you can see what winning looks like on paper.

4. A Budget is the Assignment of Your Dollars Before the Month Begins

A budget is when you tell your money, in advance, where it is going to go and what job you want it to do. If you are going to win with money, you need to do the little things right. Make your budget before the month begins.

5. A Budget is Telling Your Money You Are in Charge.

A budget is you taking charge of your money. A budget is telling your money where it is going to be spent, what it is going to be spent on, and when. When you plan your money in advance, take charge of it, and make it behave, it is less likely to be spent on something that you didn’t need.

6. A budget is How You Win With Money

Your money will walk off if you don’t take charge. Winning with money is achieved through a budget and on purpose. Remember the freedom you want? A budget is the freedom to spend when the time is right. A budget is how you win with money.

How Do You Make a Budget?

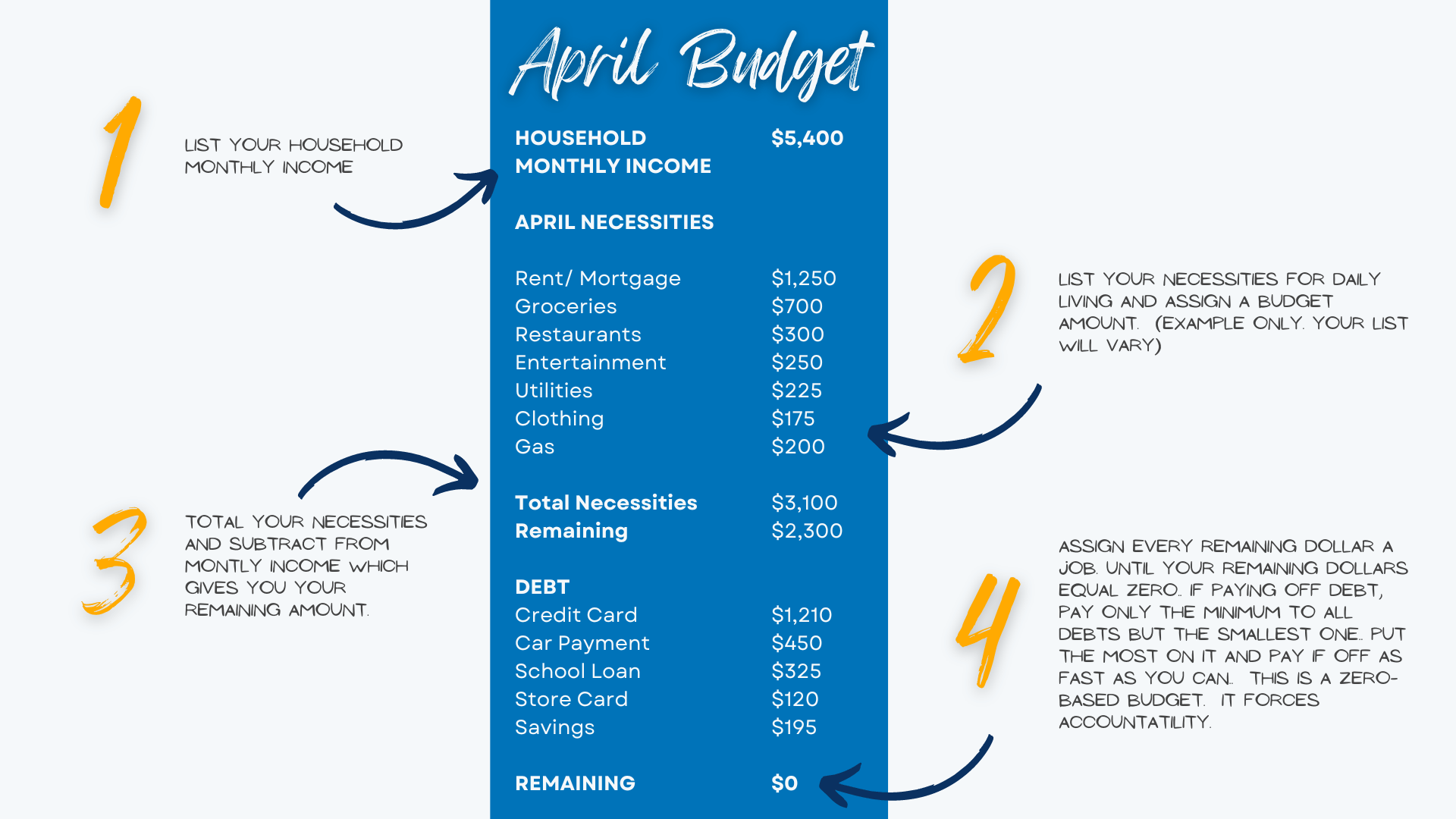

Step 1. Acknowledge and write down all of your monthly income. See step one in the illustration below.

Get started with making your own personal budget so you can win with money. The first step is to acknowledge how much money you are going to make this month…the month you are budgeting for. Write that down on the upper part of your paper. Write down and total ALL of your income for the month. Salary, side hustles, child support, government checks etc…

Get a free zero-based budget pdf download here. Start winning with money today.

Step 2. Next, let’s list out every category that you spend money on during any given month.

Now make a list of all of the categories you spend money on each month. I’m including a list here, but make sure you think about your own life and where you spend money.

- Tithes

- Charity & Offerings

- Emergency Fund

- Retirement Fund

- College Fund

- Mortgage/ Rent

- Real Estate Taxes

- Home Repairs & Maintenance

- Home Association Dues

- Electricity

- Gas

- Water

- Trash

- Phone/ Mobile

- Internet

- Cable/ TV

- Groceries

- Restaurants

- Clothing

- Auto Gas and Oil

- Auto Repairs & Tires

- Auto License & Taxes

- Auto Car Replacement Fund

- Medications

- Doctor bills

- Dentist

- Optometrist

- Life Insurance

- Health Insurance

- Homeowner Renter Insurance

- Auto Insurance

- Disability Insurance

- Identity Theft Coverage

- Child Care

- Toiletries

- Cosmetics and Hair Care

- Education/ Tuition

- Books/ Supplies

- Child Support

- Alimony

- Organization Dues

- Gifts (including Christmas)

- Baby Supplies

- Pet Supplies

- Car Payment 1

- Care Payment 2

- Credit Card 1

- Credit Card 2

- Student Loan 1

- Student Loan 2

- Other 1

- Other 2

Step 3. Got your list completed? Now let’s enter what we expect to spend in each category for the month.

Don’t worry if you are feeling a little underwater at this point. If you’ve not been doing a budget it will take several months to iron things out. That is okay. The most important step is to get started. So go ahead and enter the amount you plan to spend in each category. Don’t forget to budget for replacement items like tires, real estate taxes, etc… If you are going to live debt-free you’ll need to have those things saved for and sitting in a fund when the bill comes due. Got it all down? At this point, your budget should look something like this below.

Get a free zero-based budget pdf download here. Start winning with money today.

Step 4. Almost Done. Next Step; Fine-Tune it.

The moment of truth. Add up your expenses and let’s compare them to your income. If you have more expenses than income, you’ll need to reduce expenses until your income is equal to your expenses. If you don’t you are just racking up debt and we don’t want that. If you have more income than you do expenses Kudos! But go ahead and assign those leftover dollars to a job. For instance, take the extra income and use it to pay down debt.

Our goal here is to give every dollar a job so we want a big fat “0” dollars left unassigned. This is called zero-based budgeting. Every dollar of income is allocated to a budget category so that no money is left unassigned at the end of the month. That way every dollar you earn has a purpose. See example above.

Get a free zero-based budget pdf download here. Start winning with money today.

Step 5. Track your spending and record each dollar spent in the appropriate budget category.

You can do this on paper or use a budget app like the one offered by Ramsey Solutions.

When budgeting always remember this:

- Give every dollar a job. No dollars left unassigned to a category. This is called a zero-based budget.

- Track your spending on a spreadsheet or in an app. This will take discipline but is the mark of a person who truly wants to make a change in their life.

- Give it time! It will take several months to fine-tune your budget. Don’t give up.

- Remember, if you have debt, keep your expenses as low as possible and apply the extra to debt until it is gone.

How to Stick to a Budget.

If a budget is telling your money you are in charge, sticking to a budget is showing your money you are in charge.

1. Have a Realistic Goal

Don’t try to do too much in the first month. Is your heart set on getting out of debt or taking charge of your money? That’s awesome! Just remember that you are learning a new skill and just like taking on a new exercise routine or hobby you are best served to leave yourself room to learn. So if the first couple of months is not perfect that’s okay. Learn and keep moving forward. You’ll be a budgeting pro in no time.

2. Plan Your Meals

For many people, the single biggest driver of discretionary spending is food. Yep. Food. By that, we mean groceries and restaurants. So if you don’t keep a close eye on the grocery and restaurant budget it can get out of hand fast. So plan those meals. Not every night can be seafood. A good old-fashioned Taco Tuesday never hurt anyone. If you plan your meals BEFORE you go to the store, you’ll be able to fill up your cart with groceries that are more likely to fit into your budget.

3. Check Your Budget Frequently

By frequently we mean daily. If you really want to be successful you have to know your numbers! That means checking in daily or at minimum 4 times a week on your spending. Record those expenses, see how much money is left in your budget, and behave accordingly. Doing this little by little will help you from overspending your budget categories.

4. Consider Your Social Calendar

Peer pressure is the enemy of diets and budgets. Are co-workers going out to eat? Do friends want to meet for drinks? That’s all fine if you have the money in your budget but what if you don’t? How about asking them to come to your house for a game night and grill out instead?

5. Choose What You Want Most Over What You Want Now

Choose what you want most over what you want now. If you are like me what you want now is to go out to eat. But what I want most is to be debt-free and have financial peace. So, I evaluate what I want now with my budget. If it doesn’t fit, I choose what I want most instead. Choose what you want most over what you want now.

7 Steps to Financial Wellness

- Save a starter emergency fund of $1,000 as fast as you can.

- Pay off your debt. Start by listing all of your debts except for your mortgage. Put them in order by balance from smallest to largest—regardless of interest rate. Pay minimum payments on everything but the little one. Focus on that one until it is gone. Then take that payment and put it toward the second-smallest debt, making minimum payments on the rest. That’s what’s called the debt snowball method, and you’ll use it to knock out your debts one by one until you are debt-free except for the house.

- Save a full emergency fund of 3 to 6 months of household expenses

- INVEST 15% of your gross income toward retirement.

- CONTRIBUTE to children’s college education fund.

- PAY off the house early.

- Build wealth and be generous.

Note: Steps 4,5 & 6 are worked on at the same time.