Saving money with the envelope system is a great way to get control of your spending because it offers a visual (and emotional) cue to stop spending when the money in your envelope category is gone. Like any other system that attempts to get control over a bad habit, such as controlling overspending, it relies on at least some, on self-discipline.

The envelope system is a really simple way to visualize your savings and spending on a daily basis. Instead of swiping a debit card, cash is used. And spending cash just has a different emotional feel. When you spend with a debit card, you get to put your debit card back in your pocket. When you spend cash, they keep it. Saving money with the envelope system is a natural limiter.

In this post, we share exactly how to save money, envelope style!

Start with a zero-based budget

As with all things personal finance, it starts with a budget! We only use a zero-based budget described here because it is the best way to make sure that no dollar of income is ever wasted.

Write down the total income you expect for the month.

See the illustration above. Total all of your income expected for the month and write the total in the space provided.

Now budget each dollar of income to an expense category.

Download your zero-based budget template here. Budget all of your income into an expense category.

Subtract your expenses total from your income total.

Now subtract your expenses total from your income total using our free zero-based budget template and guide. Unused dollars that are not budgeted can be used in the next step.

Apply unused dollars to savings or goals.

Since you are trying to save money with the envelope system use any excess funds not budgeted toward an expense to fund your savings account. This is how to save money with the envelope system.

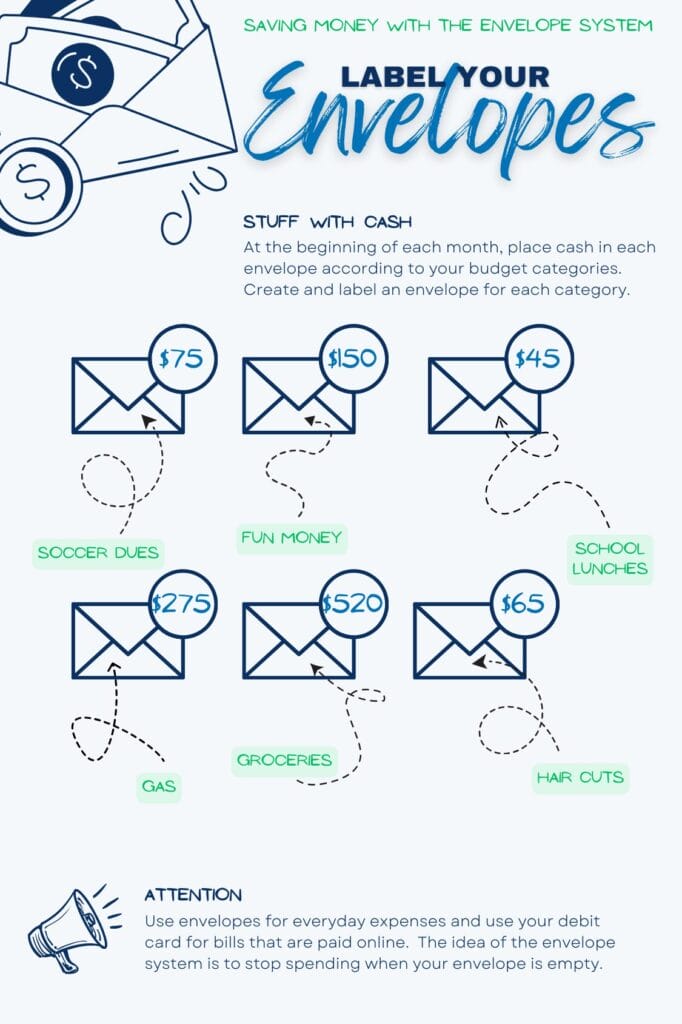

Label envelopes with each spending category

This is where the envelopes come in. Get crafty if you want but all that is really needed is a simple white envelope labeled with a pen or marker.

Label envelopes for daily expenses such as gas or groceries

This is where saving money with the envelope system gets its name. Label your envelopes for daily expenses such as gas, groceries, or “fun money”. Once your envelopes are labeled you can stuff them with the pre-budgted amount of cash.

Stuff with Cash!

This is the fun part. Stuff your labeled envelopes with the amount of money you budgeted for this month. Since you are probably getting your money for this from the bank it is a good idea to get some smaller bills for each envelope. Twenties and Fifties take up less space but smaller bills are easier to help track spending.

Limit your spending to what is in your envelopes.

When your envelope is empty, stop spending! This is how to stay on budget and avoid over-spending.

Attention

When your envelopes are empty stop spending until the next month. If your money did not last, adjust your habits to make it last until next month. The envelope system (as part of your monthly zero-based budget) is a powerful tool to help you control spending and win with money.

Saving money envelope system

The zero-based budget is the pillar of financial control. With the envelope system, you simply label everyday expense categories on an envelope and place the budgeted amount of cash in the envelope. This helps you visualize your spending as you see the money in your envelopes gradually go down. When the envelope is empty, stop spending. To save money with the envelope system, simply place unbudgeted dollars into your savings account. If you’re able to limit your spending to the money in your envelopes, you won’t need to dip into your savings to get through the month.

Budgeting takes practice. For most people, it takes months to learn your prior spending habits. Don’t give up though. Using a zero-based budget is the best way to control spending, build a nest egg, and get the life you want.

Learn more about saving, spending, and budgeting on our blog.