If you’ve been feeling the need to get a better grasp on your finances a no-spend month is a great way to start. It will teach you more about your money habits and where you can make improvements. Of course, any money challenge will require your commitment to make it work. But first, let’s get acquainted with what a no-spend month is and take a tour of our 12 no-spend month tips to help you be successful.

What is a No Spend Month

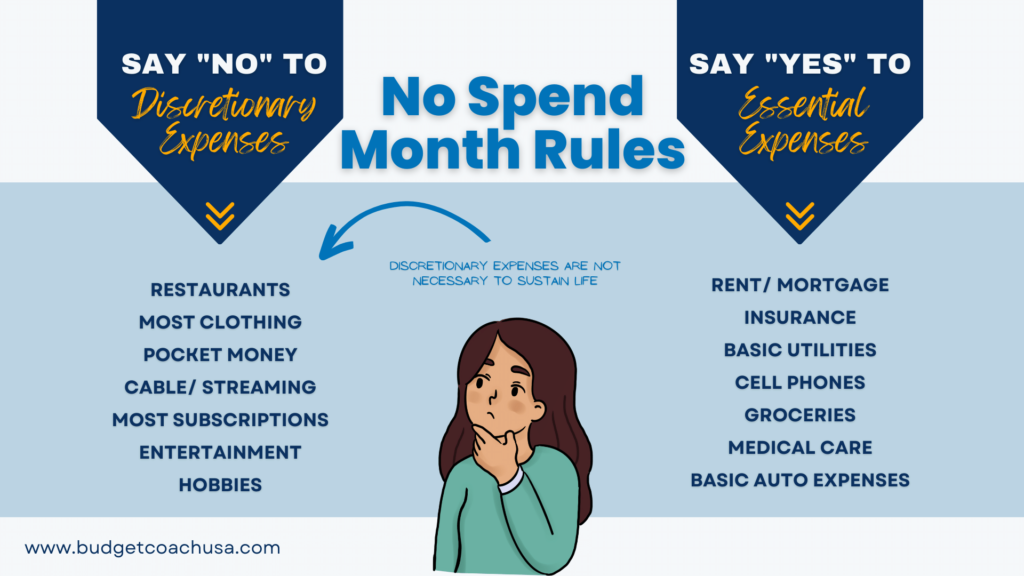

No spend month is a month in which you do not spend any money apart from absolute necessities. In other words, if it doesn’t put a dry climate-controlled roof over your head, keep you supplied with transportation for work, put food in your stomach, respond to a medical need, or pay a debt obligation you don’t spend it. What about restaurants? That is food in my stomach, right? Well, yes but to honor the spirit of no spend month you’ll need to differentiate between core expenses and discretionary expenses. Core expenses solve your need for survival at a basic level; hence the shelter, food, medical, and transportation acknowledgments. Discretionary expenses are things you can live without.

No Spend Month Rules

There are just a couple of no-spend month rules and they are probably what you could guess. The no-spend month rules are:

No Discretionary Spending

No discretionary spending. Is it necessary to operate your home, utilities, basic food, medical, or transportation? If the answer is no, the no-spend month rules don’t allow it. Take a look at the no-spend month explainer below to see a quick snapshot of the differences between core and discretionary spending.

Real Emergencies Don’t Count

Emergency spending doesn’t count. No spend month is meant to shine a light on your spending habits and shows you how much money you actually spend on discretionary things. Emergencies (like the pump on my septic tank just pooped out), obviously need to be addressed. Addressing emergencies doesn’t prevent you from learning about your discretionary spending habits. Just remember, fufu coffee isn’t an emergency!

Benefits of a No-Spend Month

No spend month is more than just forgoing certain discretionary spending and waiting until the month ends. When you commit to a no spend month and abide by the rules you quickly learn there are really helpful benefits.

Saves Money

After you begin your no-spend month adventure it doesn’t take long to see more money saved in your checking account. You’ll be surprised by just how much money you spend on discretionary items. The first benefit you’ll see from a no-spend month challenge is more money in your checking account. That is a pretty good result on its own.

Teaches You About Your Money Habits

If you commit to a no-spend month adventure, you’ll begin to see your money habits revealed. Once this happens, you have a great opportunity to understand better how much your discretionary spending costs and whether it is worth what you are committing to it. After all, that money that is building up in your bank account looks pretty good too. Learning more about your money habits will give you a helpful perspective on the true cost of your spending and motivation to consider a different use for those funds.

Brings Couples Closer

If you are married, you’ll find communicating about your money is a huge benefit to a no-spend month. Couples that communicate about money are more successful in marriage and of course, finances. You can read more about this right here in our blog post How Do Success Married Couples Handle Finances?

12 No Spend Month Tips

Committing to a no-spend month challenge is meant to help you understand how to better use your resources and how to better arrange them to achieve your goals. Here are 12 tips to help you learn new ways to use resources and succeed in your no-spend month adventure.

1. Eat the food already in your pantry and refrigerator.

The single greatest area most people/ families overspend is on food. Hands down. Eating the food you already have on hand instead of letting it expire will show you just how much you can save on your grocery bill monthly and highlight how much of your grocery shopping could be considered discretionary spending.

2. Brown bag your lunch at work and school.

No restaurants are allowed during no spend month unless they are absolutely necessary for professional reasons at work. No cheating here when defining necessary. So you’ll need to brown bag your lunch. Again, you’ll be shocked at how much savings you’ll see when you eliminate this discretionary budget item.

3. Stay offline as much as possible.

Avoid the temptation to graze on Amazon. If you don’t you might accidentally end up buying a new pair of shoes. Online browsing is literally filled with ads trying to sell you something. So if you want a good no-spend month tip, stay offline and out of environments that tempt you to spend discretionary cash.

4. Borrow needed items from friends and family instead of buying them new.

Do you really need to buy that tool you’ll use only once? Or could you borrow it from a friend/ family member and get the job done without spending discretionary cash? Borrowing (and lending) is a great way to crush discretionary spending. You’ll see the savings in your bank account.

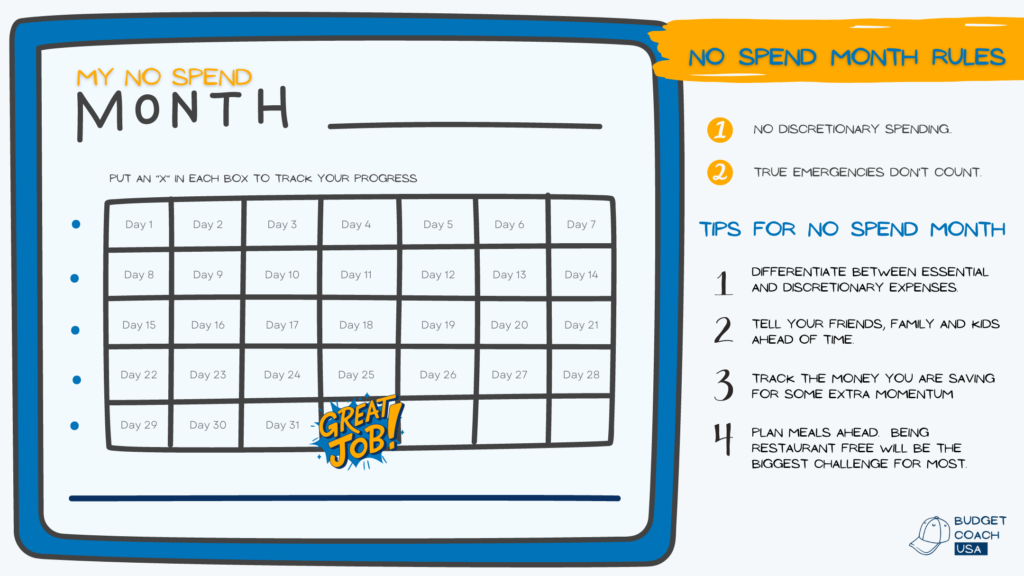

5. Tell your friends and family ahead of time.

Tip number five in our no-spend month tips list is to tell your friends and family ahead of time. You’ll be undertaking a noticeable change in your spending habits when you start your no-spend month challenge. After all that is the point right? But your friends and family will still be expecting your normal patterns and if you don’t tell them ahead of time that you won’t be accepting invitations to go out they might feel offended. So let people know ahead of time so you can avoid awkward conversations later. You might even get them to join you.

Download the no-spend month tips printable.

6. Remind yourself why you are doing a no-spend month.

What is your “why”? Knowing your “why” has become a popular question in recent years and for good reason. When we do hard things or challenge ourselves to accomplish difficult goals it is really helpful to remind yourself why you are doing it. So put a note on your bathroom mirror or place a sticky on your desk at the office; whatever works for you. It will help you keep your no-spend month on track.

7. When you shop (for groceries for instance) use a list so you can avoid impulse buys.

Did you know that there is a whole science and art behind product placement at the grocery store? Kids’ items are down lower because that is where their eyes are. When you shop for groceries don’t browse, use a list. In this way, you’ll be able to thwart even the best-planned product arrangements in favor of getting just the necessities. Remember, a no-spend month eliminates discretionary spending.

8. Use some gift cards you have on hand.

Hey, no spend month is about revealing all of the waste and lost savings that people leave on the table every day. Hunt up those gift cards, get the balance, and utilize them. They’ll help you save money and shine a light on less-than-optimal money habits.

9. Keep a list of the things you don’t buy during the month.

Every time you say no to a cappuccino or resist a lunch out, note how much you saved in your journal or on your phone’s note app. You’ll see savings in the bank but knowing exactly how much you saved from specific behaviors will also be enlightening.

10. Invite the kids to join in on the savings.

Before they find out the hard way that the Disney channel has been canceled for the month, let them in on the challenge ahead of time. Giving them a heads-up is the kind thing to do and you can invite them to join you at the same time.

11. Recruit an accountability partner.

Shoot for a month when you can get a co-worker or sibling to join you in the challenge. It is always helpful to have a partner when you are setting out on a new adventure. You can swap successes (and failures) and encourage one another along the way.

12. Cut yourself in on the savings at the end of the month.

Just like we have already mentioned. If you are all in on our no-spend month tips, you will see a prize in your bank account at the end of the month. So to give yourself a little motivation to end your month in style, let yourself have a cut of the prize as a reward.

Final Thoughts – No Spend Month Tips

A no-spend month with our no-spend month tips is an excellent way to discover more about your spending habits. It will shine a light on your spending patterns and highlight the areas where you could tighten your controls and save more money. What is the worst that can happen? You’ll end the month with a bunch of money in your checking account which could even be a kickstarter to your emergency fund.