Are you tired of constantly swiping your debit card and watching your bank account balance dwindle faster than a popsicle on a hot summer day? Well, it’s time to put those spending habits on ice and embrace the No Spend Month challenge. This financial detox may sound intimidating, but with a few simple rules and some determination, you’ll save a ton of cash and gain some perspective on your spending habits. So grab a pen and paper (or open up that budgeting app) because we’re about to dive into the world of No-Spend Month Rules.

What is No Spend Month?

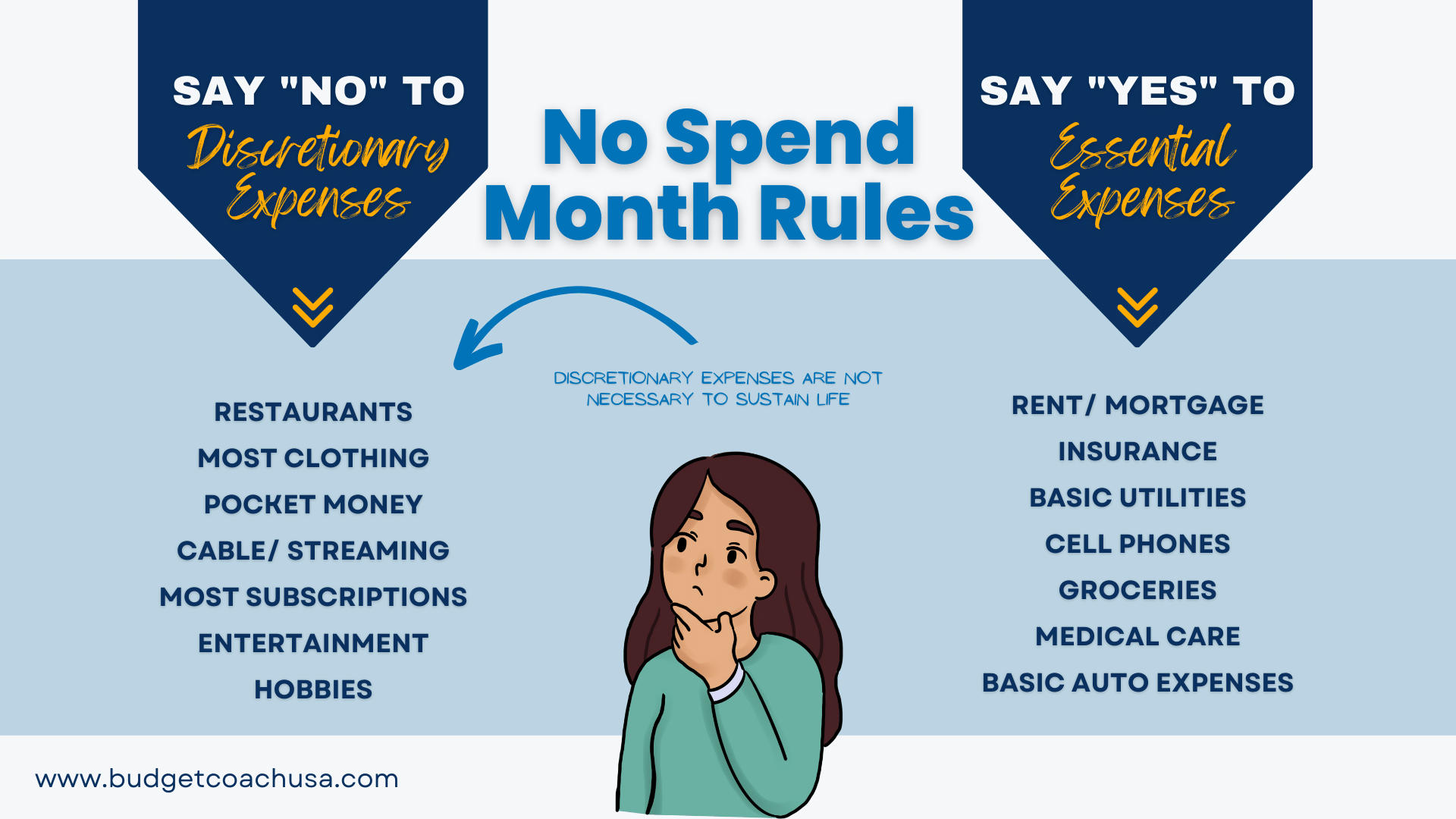

No spend month is a month in which you do not spend any money apart from absolute necessities. In other words, if it doesn’t put a dry climate-controlled roof over your head, keep you supplied with transportation for work, put food in your stomach, respond to a medical need, or pay a debt obligation you don’t spend it. What about restaurants? That is food in my stomach, right? Well, yes but to honor the spirit of no spend month you’ll need to differentiate between essential expenses and discretionary expenses. Essential expenses solve your need for survival at a basic level; hence the shelter, food, medical, and transportation acknowledgments. Discretionary expenses are things you can live without. More on that below.

Break Up With Your Habits: The No Spend Month Rules

No Spend Month Rule #1

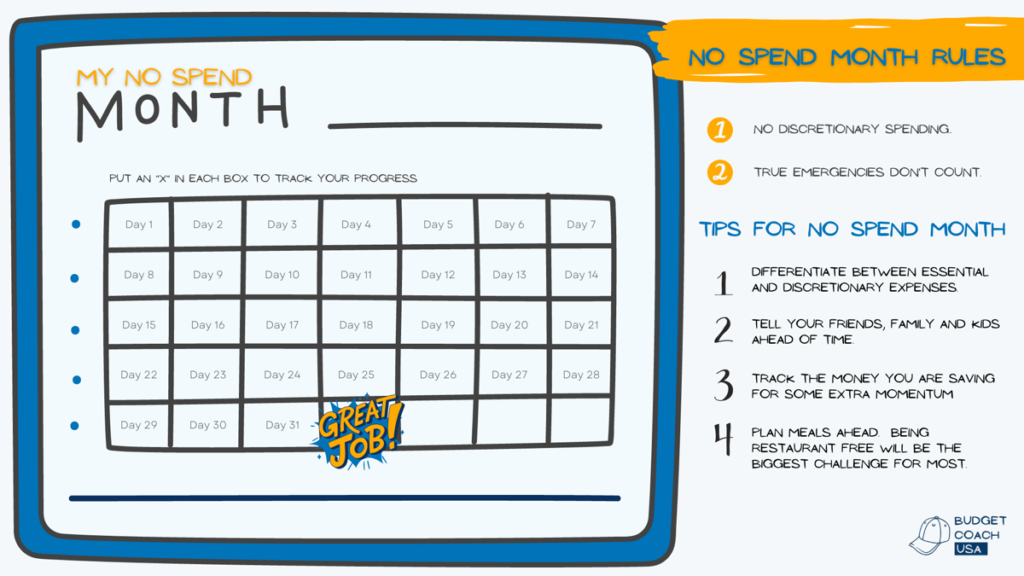

No discretionary spending. Is it necessary to operate your home, utilities, basic food, medical, or transportation? If the answer is no, the no-spend month rules don’t allow it.

No Spend Month Rule #2

Emergency spending doesn’t count. No spend month is meant to shine a light on your spending habits and shows you how much money you actually spend on discretionary things. Emergencies (like the pump on my septic tank just pooped out), obviously need to be addressed. Addressing emergencies doesn’t prevent you from learning about your discretionary spending habits. Just remember, fufu coffee isn’t an emergency!

Surviving a Month Without Spending: A Beginner’s Guide

Differentiate Between Essential and Discretionary Expenses.

To survive a no-spend month challenge differentiate between essential and discretionary expenses. Make your own list of things you are going to avoid such as fufu coffee, restaurants, and salon visits. Also, make a list of the things that are necessary to keep living like your mortgage, utilities, insurance, food, medical care, and transportation. This exercise will help you truly understand what discretionary spending really looks like.

Tell Your Friends and Family Ahead of Time

Beginning your spending detox is going to come as a shock to you and your friends. Head them off at the pass and let them know you won’t be accepting any invites to the bar or movies etc… Better yet, invite them to join you and set up a game night at your place. Letting people in your orbit know will prevent those awkward moments and might even encourage them to join.

Tell the Kids!

They’ll survive either way but to keep them from breaking the remote trying to get HULU to work, let them know ahead of time. Unless you just like messing with your kids and watching for their reaction. If you are not into torturing your kids in that way, then invite them to join you. They’ll learn some valuable lessons along the way.

Track the Money You are Saving

Add some juice to your momentum by tracking the money you are saving. Every time you say “no” to an expense write it down along with how much you would have spent on it. You know your normal patterns so this will come pretty easily. Just notice and take notes.

Tips for No-Spend Month

Only buy essentials such as groceries, gas, and bills.

Only the essentials. No discretionary spending allowed.

No eating out at restaurants or ordering takeout.

Restaurant food is discretionary. Brown bag that lunch and you’ll save more than you might think.

Cancel any unnecessary subscriptions like streaming services or gym memberships.

Hit up the library for free media if you need to. Or read that book that has been on your side table you’ve been meaning to get to. But cancel those subscriptions for the month and watch the savings roll in.

Use the library instead of buying books or renting movies.

They have the same stuff for free and most libraries have apps now so you don’t even have to go to the actual library. Just download it!

Plan meals ahead of time to avoid impulse grocery purchases.

Never shop at the grocery on an empty stomach. Plan ahead and only buy what is on your list.

Avoid online shopping and unsubscribe from promotional emails.

Its just one month. Stay off Amazon and see how much you can save during a no spend month.

Find free activities to do with friends and family like hiking or playing board games.

You’ll make better and longer enduring memories at the kitchen table playing games and sharing meals. Canceling those subscriptions helps you save more than just money.

Ditch the Debit Card: How to Stick to Your No-Spend Month Challenge.

Host potluck dinners with friends rather than going out to eat at restaurants

Have a dinner party. If you know your guests well enough make it a potluck.

Create a budget tracker that will help you control your finances better during the no-spend month.

Keep a calendar and mark each day off for the month so you can see your progress. The visual is encouraging.

Do a pantry challenge where you aim to cook only using ingredients already on hand.

It is amazing how creative you can be with the food already in your pantry when you take restaurants off the table. The savings are amazing.

Let others know ahead of time.

It is just for a month. Let your friends and family know ahead of time that your patterns will be changing for the month. Before you know it you might have company on your 30-day journey of financial discovery.

Final Thoughts

A no-spend month with our no-spend month rules is an excellent way to discover more about your spending habits. It will shine a light on your spending patterns and highlight the areas where you could tighten your controls and save more money. What is the worst that can happen? You’ll end the month with a bunch of money in the bank and know more about yourself.