Introduction

Sometimes unexpected expenses pop up and knowing how to save 3000 in 6 months goes a long way toward ensuring you are prepared when life’s inevitable curve balls come your way. So we’ve listed some great steps you can take to achieve your goal in the blog post. And by the way, kudos to you for not pulling out the credit card to solve this problem. More debt only creates more problems. And we don’t want that.

Here’s How to Save $3,000 in 6 Months

1. Save in Bite-Sized Pieces.

Anytime you are trying to achieve a goal it helps to break it down into achievable steps. If you need to know how to save 3000 in 6 months, set a monthly goal of saving $500 for 6 months. That already sounds a lot easier.

2. Start Using a Zero-Based Budget.

Boring. Am I right? So tempting to check out and look for another answer. But the reality is that a zero-based budget is the pillar of financial control. And without a budget in place (that you are actually following) saving 3000 in 6 months will be difficult. That is because the money we have coming in (our income) is too often walking off to other priorities instead of solving the problem we want solved. Author John Maxwell, often repeated by Dave Ramsey, said once that “a budget is telling your money where to go instead of wondering where it went.” And seldom in the world of personal finance has a truer statement ever been uttered. Money, like diets, is all about the numbers. And if you don’t have control of the numbers failure is likely to follow.

So how do we create a zero-based budget? Follow these steps and list each dollar monthly that will be earned and assign each dollar a job. After all household expenses are covered, dollars left over are committed to your goal. In this case, you are trying to save $500 each month for 6 months.

How to Create a Zero-Based Budget

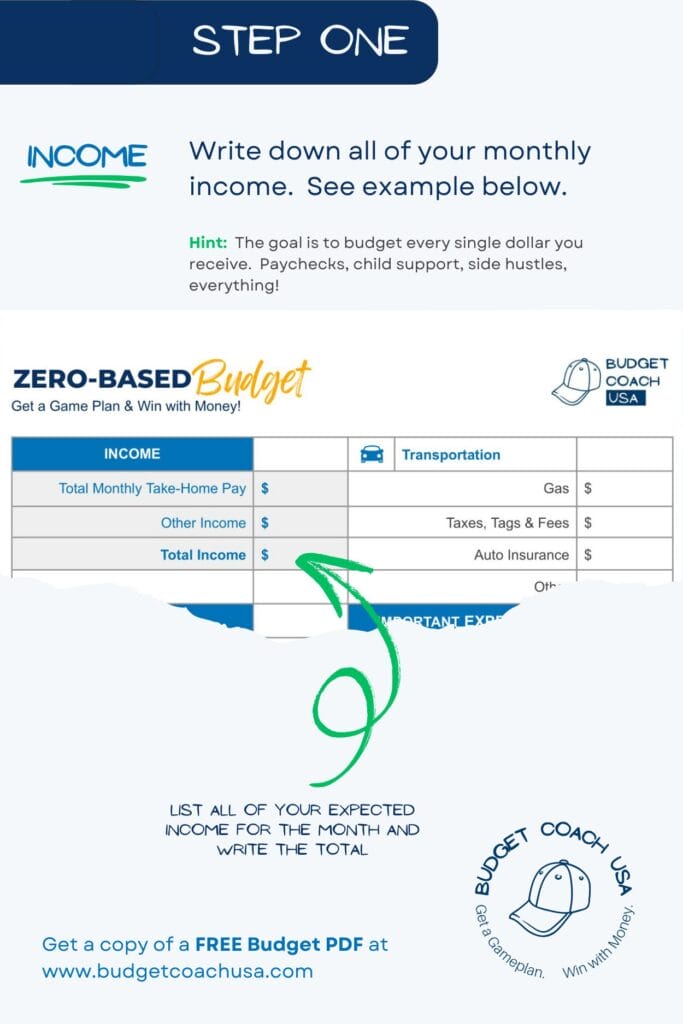

Step 1. Write your total household income for the month.

The goal is to capture every single dollar of income you receive for the month. Don’t leave anything out. Include paychecks, side hustles, child support etc…

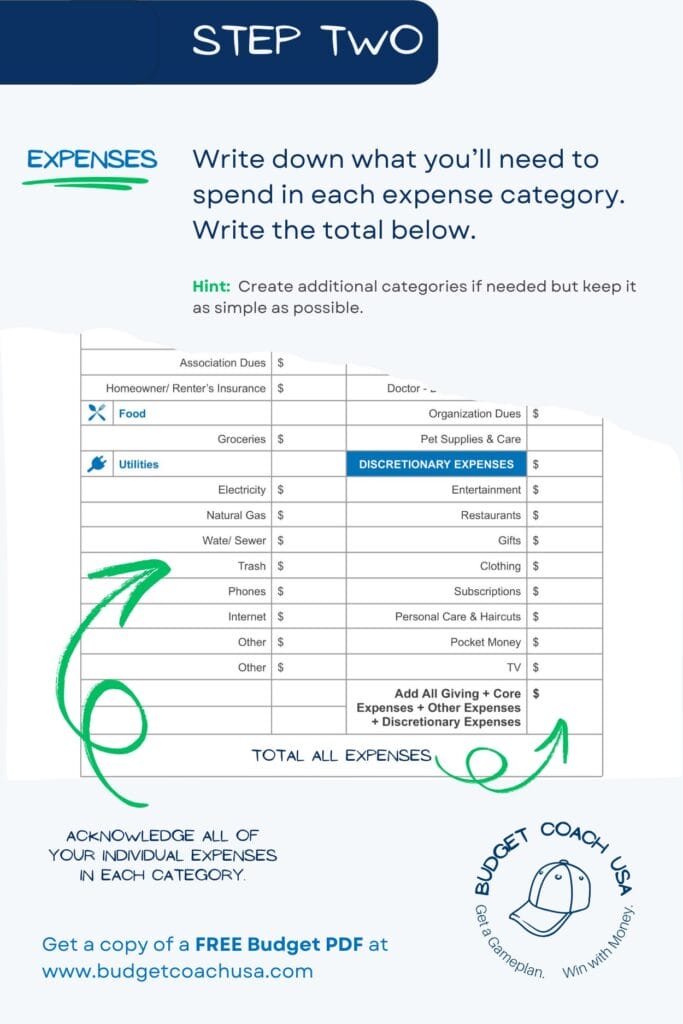

Step 2. List each household expense.

Now write the total of all expenses at the bottom. Examples of categories are mortgage, groceries, gas, debt payments, phones, utilities etc… Be honest and get all of your expenses accounted for and on paper.

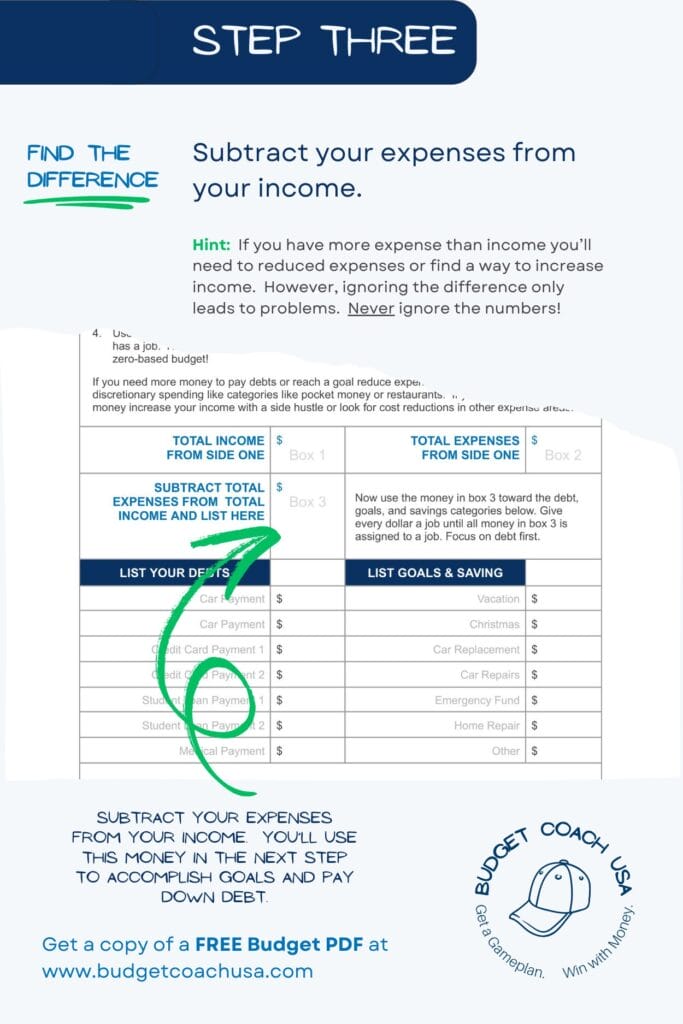

Step 3. Subtract your totaled expenses from your totaled income.

Subtract your expenses from your income. Whatever is left over is assigned a job such as paying down debt or trying to save 3,000 dollars in 6 months. The key is, every dollar of income gets a job to do. No dollar left behind!

3. Save 3000 in 6 Months with the Help of a Side Hustle

Let’s say that you have really tight budget and a limited income. After creating your zero-based budget and some very disciplined work, you are not able to forecast saving 3000 in 6 months. The next step is to increase our income with a side hustle. Check out these 14 side hustle ideas.

1. Become a Lyft or Uber Driver.

Drive for Lyft or Uber. You can take advantage of flexible scheduling and extra pay during peak hours.

2. Meal Delivery.

Grubhub, DoorDash or Uber Eats offer great opportunities to earn extra cash on a part-time basis. Like driving for Lyft or Uber you can take advantage of flexible scheduling.

3. Grocery Delivery.

Check out Instacart or Shipt. You can make extra money and help others at the same time. Not everyone who orders grocery delivery is just “too busy” Many older shut-ins truly need someone to bring them food because they no longer have the mobility to do it themselves. You can earn a few extra dollars and help vulnerable populations at the same time.

4. Be a Survey Taker.

Share your opinion. You can join a focus group (try Focus Group) or look into survey sites like MyPoints.com or Survey Junkie.

5. Rent your home or spare room on Airbnb.

Consider renting extra space on Airbnb.

6. Sell Items from Around Your Home.

You would be surprised at how much money you can make on eBay. People will buy almost anything on eBay. Take an hour and go thru your garage and closets and you will find a lot of items you no longer use and can make several hundred dollars or more in just 7 days which is the typical length of an eBay auction.

Sites like Facebook Marketplace, eBay, Poshmark, Thredup and GameStop are all great outlets for a quick sale of unused items in your home.

7. Use Your Creative Ability.

If you have creative skills, people need you. Sites like Fiverr, Upwork or 99designs connect freelancers specializing in writing, editing, graphic design, and voice-over work for clients who need those creative minds.

All you have to do to get started is create a profile (kind of like an online resumé) so potential employers can check out your experience, rates and specialties.

8. Babysit. The Old, but Effective, Standby

Maybe you did some babysitting when you were younger. But you can still snag some of that babysitting cash as an adult. Parents need sitters all the time for date nights or busy days. Just get the word out and tell people you know that you’re up for watching their kids (for pay, of course).

9. Dog Walk/ Pet Sit.

You can advertise your own pet-sitting business on social media, put up signs in your neighborhood, post at work, or use a website like Rover or Wag. They let you set your schedule and adjust your fees—but they do take a cut of your pay. If that seems like too much, try drumming up your own business with friends and family, and ask them to help you get the word out!

10. Cleaning.

Cleaning houses is hard work, but if you don’t mind getting your hands dirty, this could be the perfect fit for you. We all need our houses cleaned, and lots of people would rather pay someone else to do it. Jump on this opportunity!

11. Sell products on Etsy.

Are you crafty? Then maybe you should sell your crafty products on Etsy. Jewelry, scarves, paintings, hand-lettered inspirational prints, and more—Etsy’s a great place to sell anything you’re good at making.

12. Do tasks for people.

Are you a handyman or just the person who gets things done? Take advantage of that talent and put yourself up for rent. Anything is better than debt folks so put up some signs, post on social media, spend $18 on some business cards, and start making extra money doing odd jobs for people. You can haul their junk to the dump, paint a fence or wash windows. I know a guy in our community that makes a very handsome living washing windows and cleaning gutters, by himself. He hustles, does a great job at fair rates, and has a great reputation. You can do it part-time.

13. Wash and detail cars.

Like home cleaning, you’ll need to invest in some products (car wax, a shop vacuum, a leather cleaner, etc.). But they’ll go a long way, so you’re mostly investing time and energy, which are two of your best personal resources.

14. Mow lawns or do yard work.

Many people will gladly pay you to do yard work for them—like mowing, raking, hedge-trimming, and leaf-blowing (rich people are afraid of leaves). I have a brother-in-law who is begging someone to mow his lawn and can’t find anyone to do the job. You can grab seasonal hours with a local landscaping company, check out TaskEasy, or work on your own.

4. Learn How To Say “No”.

You can employ all of the advice we’ve outlined above but if you are unable to say “no” when you are tempted to spend outside of your budget, you’ll fail in your goal to save $3,000 in 6 months. That is because if you cannot control your spending, you’ll never be able to save the required amount of $500 per month. The most perfectly executed budget plan and the best-paying side hustle are no match for uncontrolled spending. If you want to save $3,000 in six months, learn how to say no to any purchase, not in your budget plan. Author and speaker Andy Stanly said it this way: “Choose what you want most, over what you want now”. If what you want most is to save $3,000 over the next 6 months, then say “no” to the things that prevent you from accomplishing that goal. You’ll be glad you did.

Wrap-Up – How to Save 3000 in 6 months.

As usual with most things, the answer is not always as simple as we would like it to be. However, if you are willing to use a zero-based budget to recapture wasted dollars, take on a side hustle, and especially learn how to say no to unnecessary expenses you can save $3,000 in 6 months. The key is focus and discipline.

Heya i am for the primary time here. I came across this board and I find It really helpful & it helped me out much. I am hoping to present something again and help others like you helped me.