Introduction

Nothing strikes fear in the heart of a spender like the word “budget”. Most people think of a budget as something that is too restrictive; almost like it is a big stop sign. They think once they are on a budget, they’ll have to say no to all the good stuff in life and kiss fun goodbye, right? Not exactly. We think of a budget as the exact opposite. A budget is freedom. Yep, you read that right. Freedom. How to make a budget and stick to it can be challenging, but it offers great rewards.

A budget is telling your money you are in charge. And once you are making your money behave all that worrying about loss of freedom actually turns into the control you’ve been missing. So let’s dig in and learn how to make a budget, stick to it.

What is a budget?

A budget is the pillar of financial control. It is an indispensable part of money wisdom. If your spending is out of control, you need a budget. In fact, you need a budget regardless. According to author John Maxwell and often repeated by Dave Ramsey, “a budget is telling your money where to go before wondering where it went”.

Simply put, a budget is the assignment of your dollars before the month begins. Each dollar of income is organized on paper according to the places you plan to spend (or save) it. A budget is a written plan for your money before you receive it.

How do I make a budget and Stick to it?

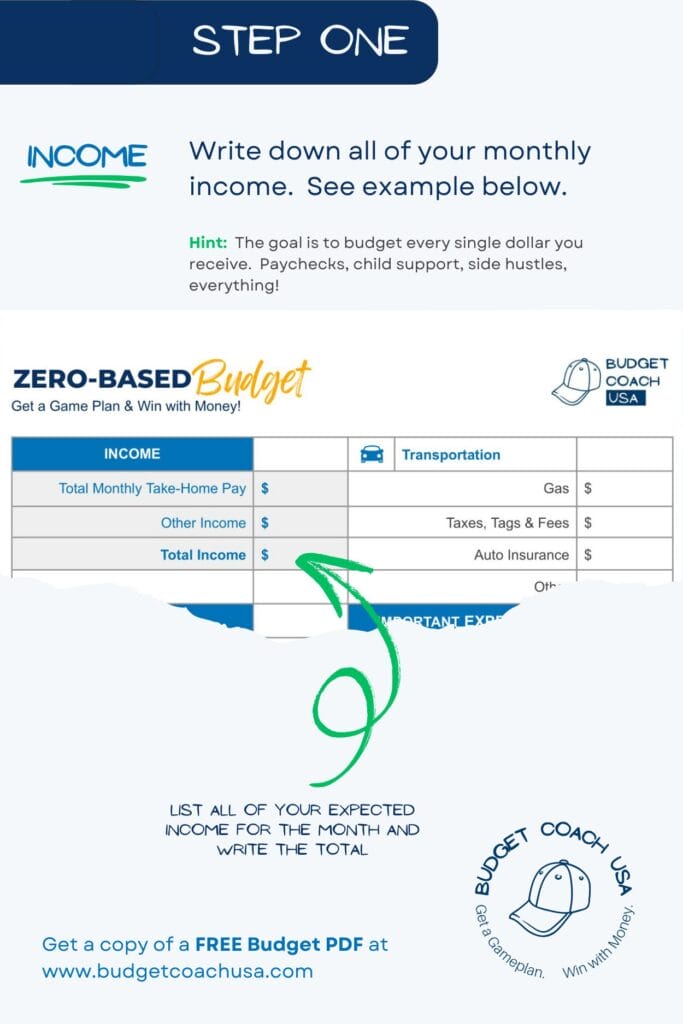

Making a budget is easier than you think. It is telling your money you are in charge. Download our free zero-based Budget PDF and let’s get started.

Step 1. Acknowledge and write down all of your monthly income.

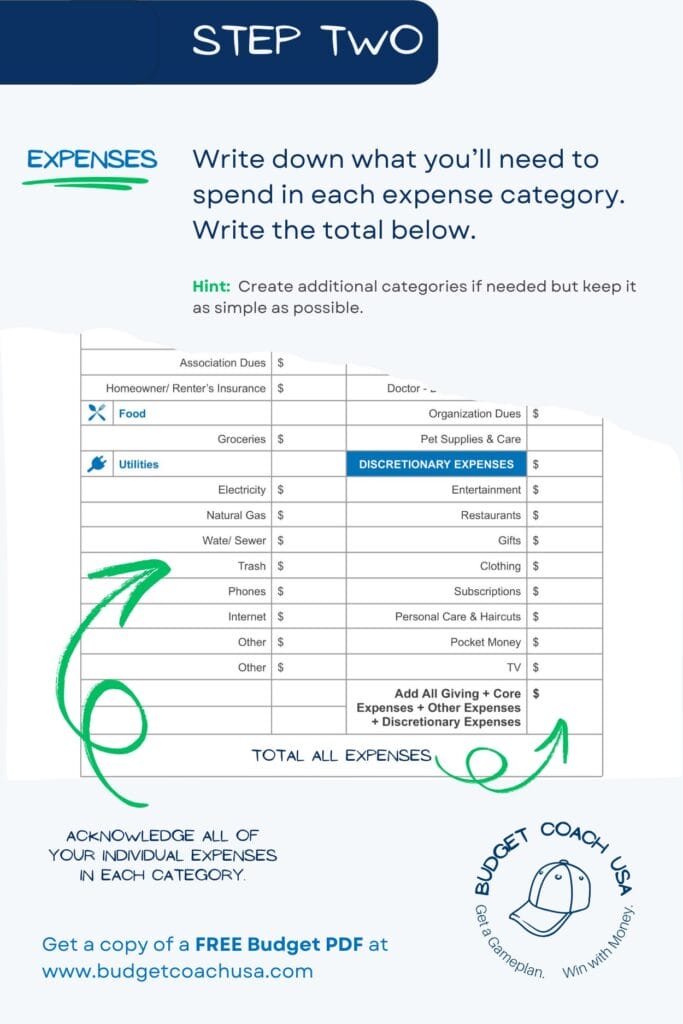

Step 2. Write down what you’ll need to spend in each expense category.

Create additional categories if needed but keep it as simple as possible.

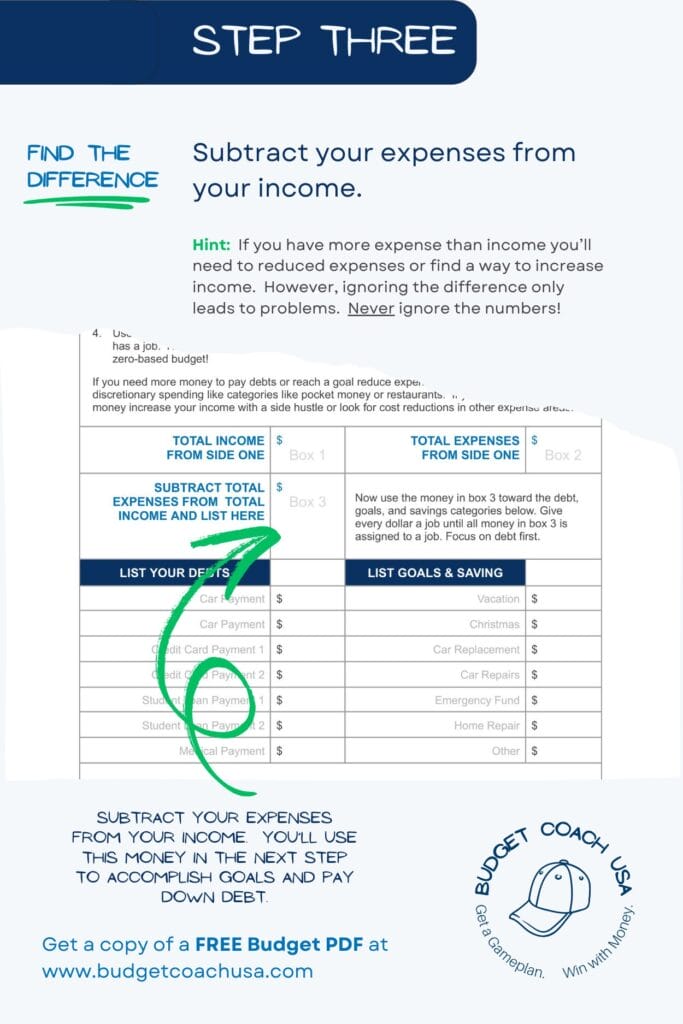

Step 3. Subtract your income from your expenses

If you have more expenses than income you’ll need to reduce expenses or find a way to increase income. However, ignoring the difference only leads to problems. Never ignore the numbers!

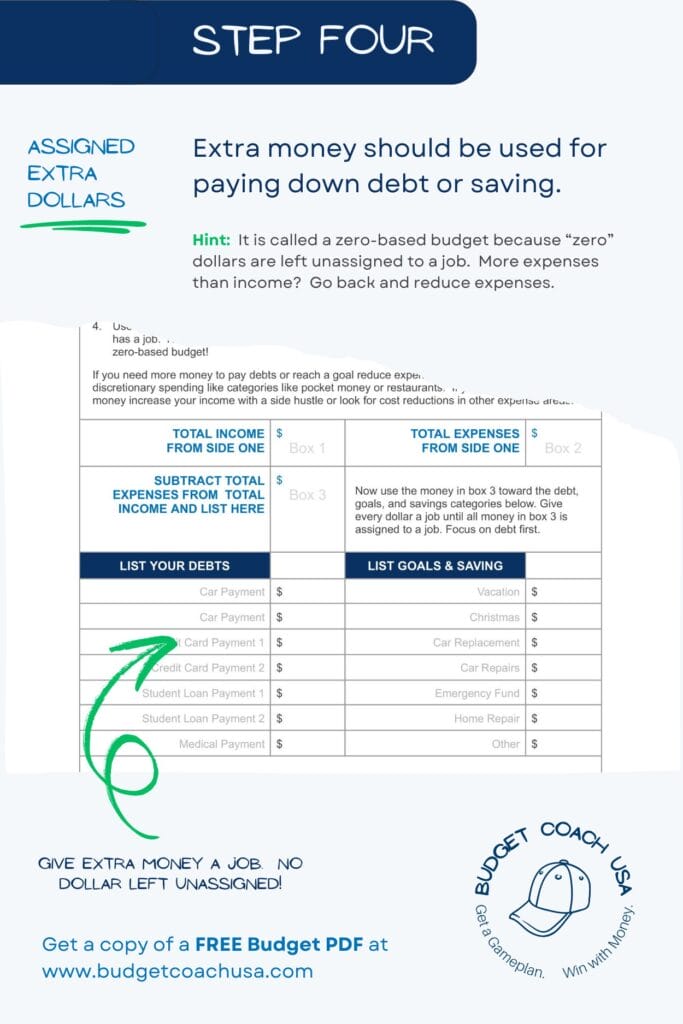

Step 4. Assign Extra Dollars

It is called a zero-based budget because “zero” dollars are left unassigned to a job. More expenses than income? Go back and reduce expenses.

Give every dollar a job.

No dollars left unassigned to a category. This is called a zero-based budget.

Adjust expenses downward if needed

It will take several months to fine-tune your budget. Don’t give up. If needed adjust your expenses downward.

Step 5. Track all expenses and income for the month.

Spend only if your budget allows. Success rests on your ability to be disciplined with your spending and stick to your budget. Choose what you want most over what you want now!

How do I Stick to a Budget?

If a budget is telling your money you are in charge, sticking to a budget is showing your money you are in charge.

1. Have a Realistic Goal

Don’t try to do too much in the first month. Is your heart set on getting out of debt or taking charge of your money? That’s awesome! Just remember that you are learning a new skill and just like taking on a new exercise routine or hobby you are best served to leave yourself room to learn. So if the first couple of months is not perfect that’s okay. Learn and keep moving forward. You’ll be a budgeting pro in no time.

2. Plan Your Meals

For many people, the single biggest driver of discretionary spending is food. Yep. Food. By that, we mean groceries and restaurants. So if you don’t keep a close eye on the grocery and restaurant budget it can get out of hand fast. So plan those meals. Not every night can be seafood. A good ol’ fashioned taco Tuesday never hurt anyone. If you plan your meals BEFORE you go to the store, you’ll be able to fill up your cart with groceries that are more likely to be on budget.

3. Check Your Budget Frequently

By frequently we mean daily. If you really want to be successful you have to know your numbers! That means checking in daily or at minimum 4 times a week on your spending. Record those expenses, see how much money is left in your budget, and behave accordingly. Doing this little by little will help you from overspending your budget categories.

4. Consider Your Social Calendar

Peer pressure is the enemy of diets and budgets. Are co-workers going out to eat? Do friends want to meet for drinks? That’s all fine if you have the money in your budget but what if you don’t? How about asking them to come to your house for a game night and grill out instead?

5. Choose What You Want Most Over What You Want Now

Choose what you want most over what you want now. If you are like me what you want now is to go out to eat. But what I want most is to be debt free and have financial peace. So, I evaluate what I want now with my budget. If it doesn’t fit, I choose what I want most instead. Choose what you want most over what you want now.

7 Steps to Financial Wellness

- Save a starter emergency fund of $1,000 as fast as you can.

- Pay off your debt. Start by listing all of your debts except for your mortgage. Put them in order by balance from smallest to largest—regardless of interest rate. Pay minimum payments on everything but the little one. Focus on that one until it is gone. Then take that payment and put it toward the second-smallest debt, making minimum payments on the rest. That’s what’s called the debt snowball method, and you’ll use it to knock out your debts one by one until you are debt-free except for the house.

- Save a full emergency fund of 3 to 6 months of household expenses

- INVEST 15% of your gross income toward retirement.

- CONTRIBUTE to children’s college education fund.

- PAY off the house early.

- Build wealth and be generous.

Note: Steps 4,5 & 6 are worked on at the same time.