How much money should you keep in your checking account? We’ve got the answer for you right here and well…it all revolves around your monthly budget. Shocker right?

How Much Money Should I keep in my Checking Account?

Your checking account should be used for monthly operating expenses and should not be used as a savings solution. Think of your checking account as the place you keep just enough money to fund your monthly household expenses as calculated in your monthly budget. So if you want to know how much money to keep in your checking account, you should first know how much you spend every month on expenses. Once you have your budgeted monthly expenses established you can calculate how much to keep in your checking account. The best practice formula is to keep 1.5 X your budgeted monthly expenses. Let’s assume your monthly household expenses are $5,000. $5,000 X 1.5 equals $7,500. Based on a $5,000 monthly expense budget you should make sure that you start each month with a minimum of $7,500 in your checking account. This way you will always be prepared to handle your monthly expenses in a timely manner and always have a little extra for a buffer. In theory, we are sticking to our budget so carefully that a buffer isn’t necessary, but life and mistakes occasionally happen and that buffer will keep you from bouncing checks or getting declined with your debit card in the middle of a date.

How Much Money Should I Keep in my Savings Account?

Are you debt free? If not, we don’t recommend that you keep anything more than $1,000 in your savings account as an emergency fund until you are. Use all of your extra money to pay down your debts. Stick to a minimal lifestyle and monthly expense budget and throw every dollar you can find toward your debts.

After you have paid all of your debts off (not including your house) keep an emergency fund of 3 to 6 months of your monthly household expenses. Life isn’t as predictable as we would like so the wise thing to do is to keep some funds on hand for emergencies. When you set aside extra money in the right amount you protect yourself and your family from unexpected expenses that might cause financial stress. And if there is one thing we are about here at Budget Coach USA it is employing best practices, aided by the use of a budget so that financial stress is minimal, or even absent, in our lives. After all, money stress can steal moments from our lives that we should be enjoying the most.

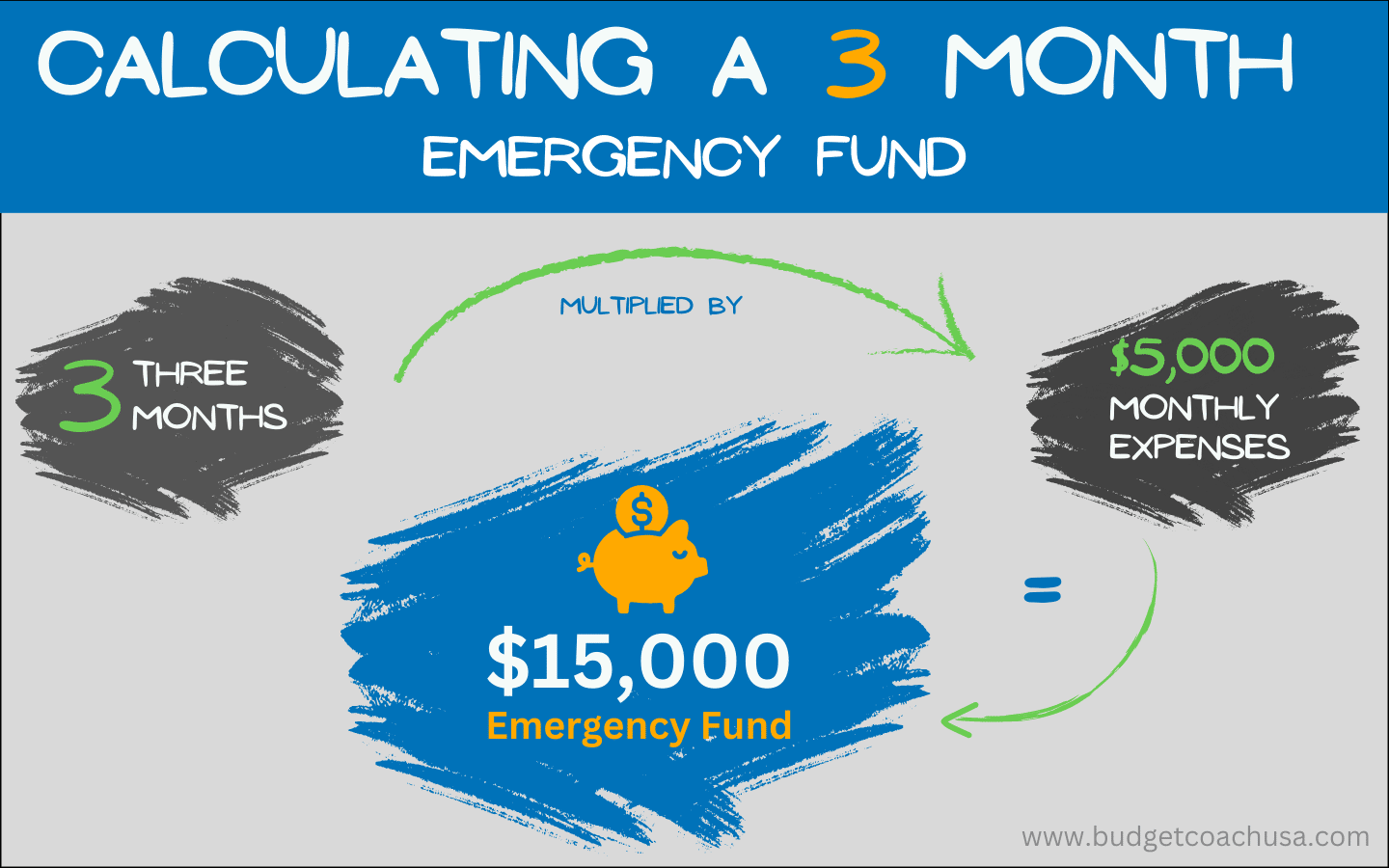

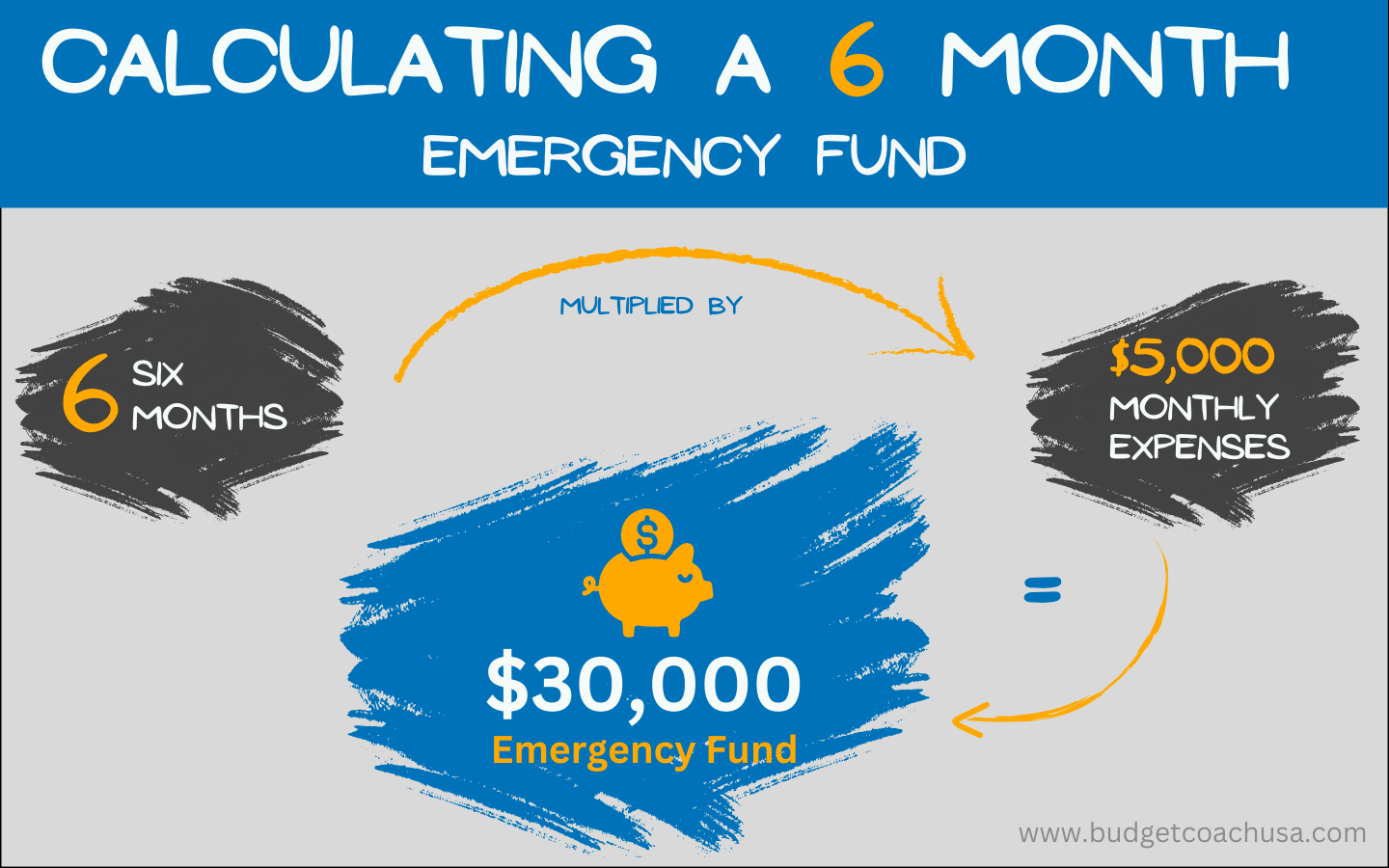

To calculate how much money you should keep in your savings account as a full emergency fund you should first know how much your monthly expenses are. Once again you need to know your monthly expense budget. Budget Coach USA recommends that, once you are debt free, you keep 3 to 6 months of expenses set aside for emergencies. Let’s say you spend an average of $5,000 per month on household expenses. Then you should keep between $15,000 and $30,000 in your emergency fund. See the illustrations below.

How to calculate a 3 month emergency fund.

How to calcuate a 6 month emergency fund

What Should I do With Extra Money?

Contribute 15% of your income toward a qualified retirement plan

Once you are debt-free and have a 3 to 6 month emergency fund in place begin contributing 15% of your gross income toward your retirement.

Save money towards your child’s college education

While saving for retirement, use any extra money to contribute to your child’s college or post high school education.

Use the rest to pay off your house as fast as possible.

If you still have some room left in the budget, apply the extra toward paying off your house early.