Financial wellness programs are a very helpful tool to guide your personal financial journey. However, just like any educational opportunity the details matter. And in the personal finance space, the details matter even more. Good financial wellness programs must include these 8 standards to be truly effective.

Good financial wellness programs including these 8 standards will guide you away from risk. They will also include guidance on long-term planning and risk reduction. The best financial wellness programs teach you to eliminate debt (risk) and build emergency funds to address unforeseen financial events.

In this post, we outline the top 8 standards any financial wellness program must include.

Good Financial Wellness Programs Must Include These 8 Standards

1. True Financial Wellness Means Being Debt Free

Debt-free equals financial wellness

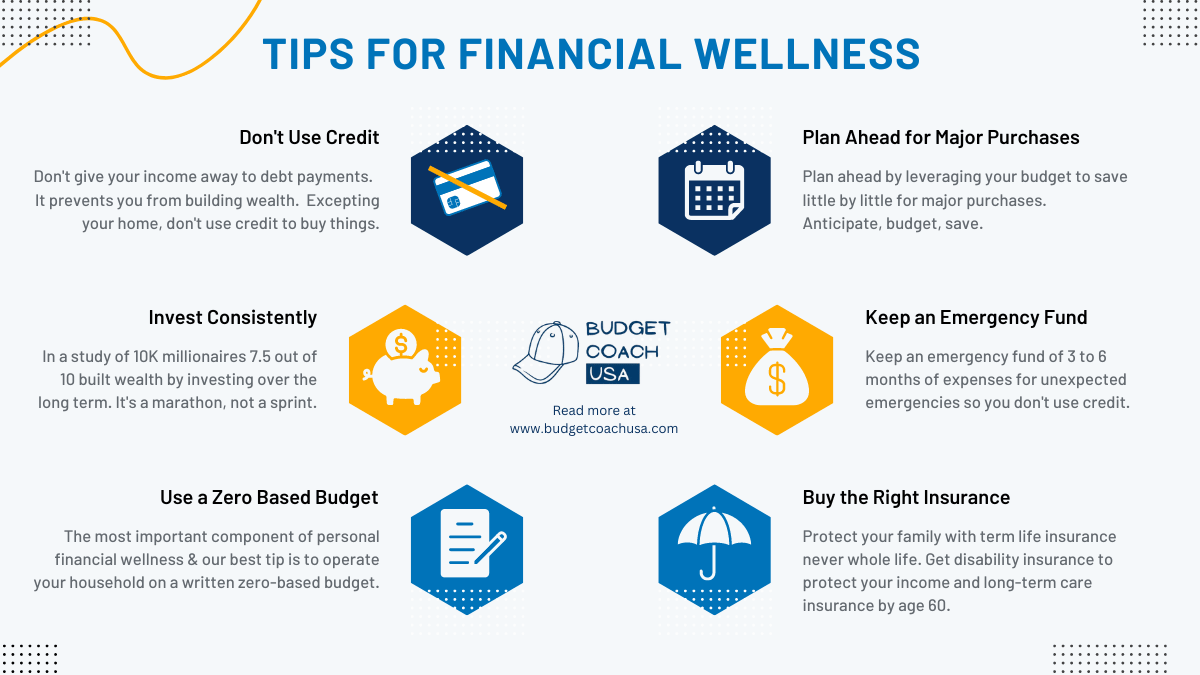

Good financial wellness programs teach you to become debt-free because it gives you financial peace of mind. Debt equals risk and when risks are reduced the anxiety level reduces as well. Most people experience anxiety around money because they don’t really know where their money is going or if they’ll have enough when they need it. What if I told you that you could know with almost certainty that when your car breaks down, you’ll have enough money to pay for the repairs in cash? Or that if your home’s roof springs a leak, you can handle the new roof without using credit? I bet your anxiety level would be reduced. A well-planned and executed zero-based budget allows you to know where your money is, where it is going, and how much you need to save to keep “Murphy’s law” from your front door.

Financial wellness means control over your financial future

It is hard to think about a future that you control if you are always giving away your hard-earned money for debt payments. When you organize your money ahead of time and on purpose (using a budget), you can save for the future and for short-term goals like that new outdoor patio set. Debt equals risk and is the opposite of financial freedom. Using a budget helps you pay off debt and have the things you want from life and financial freedom as well. It is the best of both worlds!

2. Financial Wellness Programs Teach Investing Over the Long-Term

In a survey of over 10,000 millionaires in the United States Ramsey Solutions discovered that 8 of every 10 millionaires in the survey invested consistently, over the long term, in their employer’s 401K program. And 7.5 of every 10 invested additional money in their own retirement savings. Eight out of every ten received no inheritance from parents or other family members. 1 in 5 received some inheritance and only 3 in 10 received a million or more. The takeaway from this study is that, according to Ramsey, millionaires are made, not born.

Winning with money is about playing the long game. A good financial wellness program teaches you to play the long game which involves the least risk and historically generates the best returns. If you invest consistently over the long term you can improve your financial wellness without the stress involved with get-rich-quick schemes or risky ventures. If you want to improve financial wellness begin now to put at least 15% of your income into a tax-favored retirement plan in this order: 1st toward maximizing your employer-sponsored match plan, 2nd toward a ROTH IRA, and 3rd toward any other traditional IRA available with a track record of success. Automate your contributions before they hit your paycheck. If you do, you’ll be well on your way to reaching your financial wellness and retirement goals.

3. A Monthly Zero-Based Budget is the Pillar of Financial Control

The beginning point of financial wellness is the Zero-Based Budget. Most people think of a budget as something that is too restrictive; almost like it is a big stop sign. They think once they are on a budget, they’ll have to say no to all the good stuff in life and kiss fun goodbye, right? Not exactly. We think of a budget as the exact opposite. A budget is freedom. Yep, you read that right. Freedom.

A budget is telling your money you are in charge. And once you are making your money behave all that worrying about loss of freedom actually turns into the control you’ve been missing. Being in charge and being in control doesn’t sound restrictive to me. It actually sounds a lot more like freedom.

A budget is the pillar of financial control. It is an indispensable part of money wisdom. According to author John Maxwell and often repeated by Dave Ramsey, “a budget is telling your money where to go before wondering where it went”.

Simply put, a budget is the assignment of your dollars before the month begins. Each dollar of income is organized on paper according to the places you plan to spend (or save) it. A budget is a written plan for your money before you receive it. It is impossible to win with money if you are not actively controlling your money with a zero-based budget.

Get your free zero-based budget PDF here. Learn how to create a budget here.

4. Planning Ahead Keeps You Out of the (Financial) Weeds

It should not come as a surprise that the car you are driving today, probably won’t last forever. Or that the heat pump for your house won’t last past 20 years on average. Or that the family will want to take a vacation this year or the truck will need new tires. Major purchases should never come as a surprise. Those who achieve financial wellness have learned to budget and anticipate major purchases. They account for these purchases by saving a little each month and setting it aside for that purpose. Will you need another car in 5 years? If so, begin now to save $300 per month for the car. In 5 years you’ll have $18,000 for the purchase. This is what financial wellness looks like.

5. Good Insurance Protects Your Hard Work

Term Life Insurance

If you have little ones at home and or a spouse counting on you and your income always keep term life insurance in an amount of about 10X your annual income. Term Life Insurance is cheaper than you think and if anything ever happens to you they’ll be protected. Read about term life insurance vs. whole life insurance here.

Long-Term Disability Insurance

Long-term disability insurance protects you in the event you are unable to work. This is an important part of your financial wellness checklist. Read more about long-term disability insurance here.

Umbrella Insurance Coverage

An umbrella insurance policy helps fill gaps in your homeowners, auto, and even boat insurance policies. Umbrella insurance is a form of personal liability coverage that protects you (plus your family and other household members) from large claims or lawsuits that go above your other insurance policies.

Just like an umbrella protects you from getting wet, an umbrella policy protects your money by filling the financial gap that your primary liability insurance doesn’t cover. A good financial wellness program teaches you to buy the correct insurance so that you can protect your hard-earned financial achievements.

6. Pay Off the House Early and Achieve True Financial Freedom

Do you want to know what a person can do when they have no debt including their home? How about what can a person do when none of their earnings are being sent to debt payments? Anything they want! What we know about people who experience financial wellness is that they pay off their home mortgage as soon as possible. They don’t treat their mortgage as a fact of life they have no control over. They treat it like an unwanted guest and kick it out! This is what financial wellness looks like. Any good financial wellness program will encourage paying off your home early as part of their overall financial wellness plan.

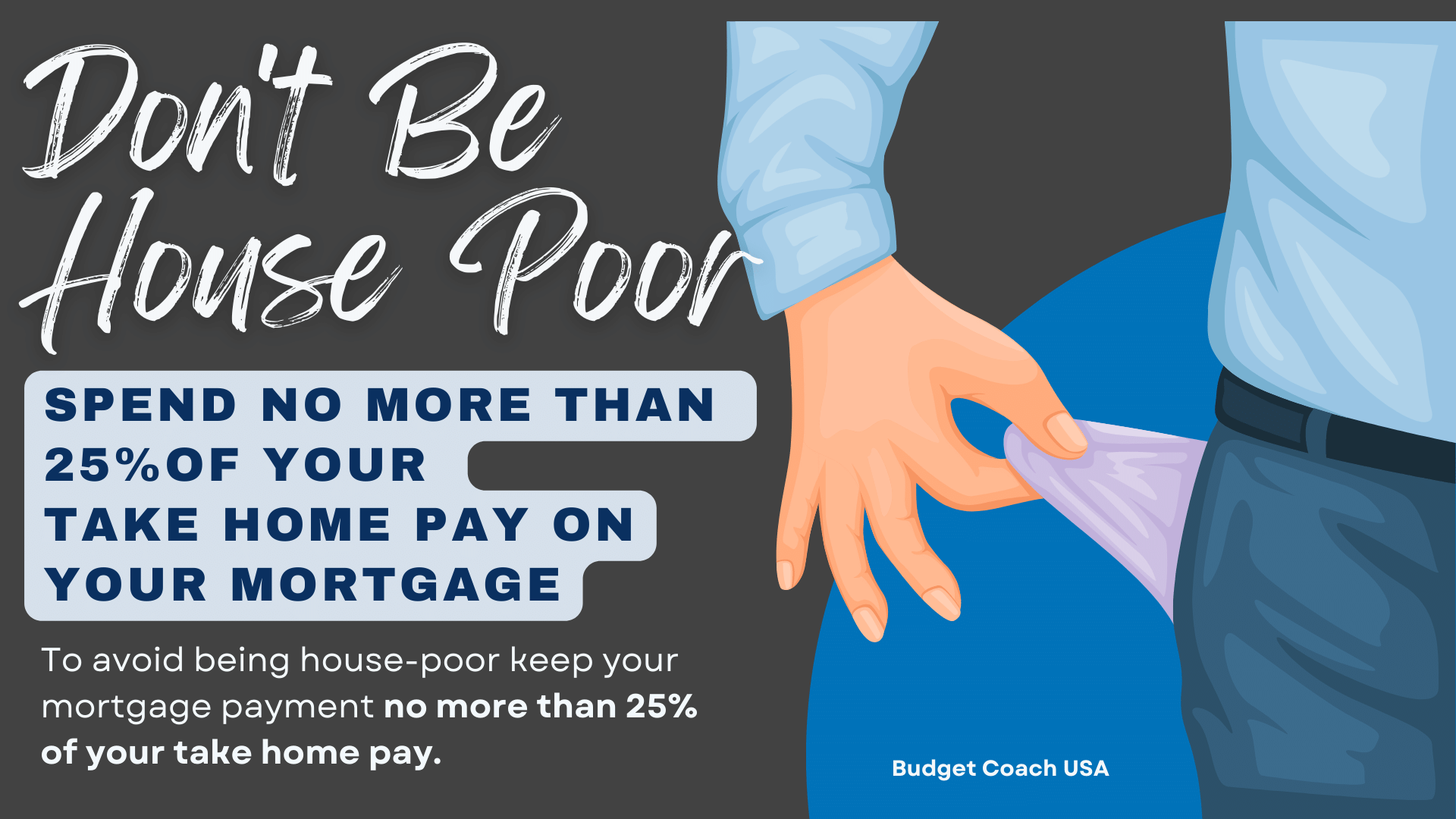

7. Don’t Be House Poor

Good financial wellness programs teach you to avoid being house-poor. What is house poor? You are house-poor if you buy too much house and cannot afford to comfortably make the mortgage payment and provide for home maintenance expenses. Based on experience, this line is crossed when a home borrower takes a loan with a monthly payment of more than 25% of their take-home pay. Many lenders will stretch this percentage to 40% (or more) in an effort to make the loan, however, do not make this mistake. The mortgage lender has a different motivation in your relationship. Do what is best for you regardless of what they say you can “afford”. Never take a home loan that requires a monthly payment in excess of 25% of your monthly take-home pay and budget accordingly.

8. Keep an Emergency Fund

Next on our list of 8 things a good financial wellness program must include is emergency funds. To improve your financial wellness build and keep an emergency fund of 3 to 6 months of expenses. To do this, leverage your zero-based budget. When life’s inevitable surprises come your way you’ll be prepared because you have an emergency fund to handle the expense. In fact, your emergency really becomes a simple inconvenience when you have an emergency fund in place. Having an emergency fund prevents you from taking on debt to cover unexpected expenses. And when you are able to pay cash for unexpected expenses your stress level stays low. This is what financial wellness looks like.