Are you tired of all those credit card offers flooding your mailbox like a tsunami? Do you find yourself wondering if you really need one of those shiny pieces of plastic in your wallet? Well, fear not, because we’re here to answer the age-old question: do I need a credit card? And let me tell you, the answer might surprise you (or not, but let’s pretend it will for dramatic effect). So let’s dig in and separate the facts from the fiction on credit cards.

Common Credit Card Fiction (Myths)

Credit cards are one of the most popular forms of payment in today’s world. Credit card issuers have sold the public on a lifestyle that has made them as commonplace as the family television set. In this article, we will separate the Facts from the Fiction of credit cards.

Myth: I need a credit card to rent a car.

This is one of the most popular myths perpetuated about credit cards. Listen up. You can rent a car with a debit card. Although you’ll have to jump through a few extra hoops and they will place a hold on your available funds it is a small price to pay to stay out of the debt trap of credit cards. Be sure to check with your specific rental car location to confirm before making firm plans.

Myth: I need a credit card to build my credit so I can buy a house.

“Building credit” is another popular reason people give to justify their credit card usage. They assert that if they do not have a credit card, they won’t be able to build the creditworthiness needed to buy a house. While it is true that you have to play the credit game with banks to have a FICO score, it is not true that you have to have a FICO score to buy a home. Some lenders, such as Churchill Mortgage in TN, offer manual underwriting which can be done without a credit score to qualify you for a mortgage.

Myth: A Debit Card Won’t Protect Against Fraud.

This is a myth. If your debit card carries the VISA or MasterCard logo you are protected the same as if you had a credit card. However, this myth is often used to convince people they “need” a credit card. And often perpetuated among cardholders either out of a lack of knowledge or just to make themselves feel better. The fact is you are protected the same for personal finance when your debit card carries the MasterCard or VISA logo.

Credit Card Facts (The Truth)

Fact: Credit Care Marketing is Powerful.

According to Statista.com the top five spenders for credit care marketing spent $559,000,000 (million) annually to convince you to use their credit card. With all that money being invested in capturing your attention you know there is a lot of money to be made. Banks and credit card issuers spend enormous amounts of money selling debt products because, sadly, the numbers say it is worth their advertising investment. And consumers lap it up instead of living on a budget, planning ahead for major purchases, and keeping emergency funds on hand to protect against unexpected expenses.

Fact: You DO NOT Need a Credit Card (or FICO) to Buy a House.

You do not need a credit score to buy a house. It is possible to accomplish a home purchase without a FICO score using manual underwriting. That is when an actual human being looks at your bank records, tax returns, and proof of bills paid to make a lending determination. FICO is a credit score that you can only get if you are in debt. And the people who created the FICO score (banks) are the ones who benefit if you are in debt. Getting the picture? The people who lend you money for a house are the ones who decide if you can have a credit score. But you have to be in debt (to them) to get a credit score. Is the picture clearing up? Churchill Mortgage in Tennessee is a manual underwriter of mortgages.

One more thing. If you have any debt, you will have a FICO score. If you have a FICO score underwriters will use it in making a lending determination. So if you want to use manual underwriting, you’ll need to be debt free first. But the fact remains. You do not need a credit card or FICO score to buy a home. I personally bought a home without a FICO score thru Churchill Mortgage.

Fact: A Debit Card Will Protect Me From Fraud the Same as a Credit Card.

If I have a credit card people can’t steal my money and keep it. While this is largely true, it is also largely true that they cannot steal your money and keep it if you use a debit card either. This is a popular myth that is not true. If you used a debit card and there are fraudulent transactions on your account, the bank is obligated by statute (if conditions are met) to return that money to your account. Learn more about this stature here.

Fact: Credit Card Rewards Are Fools Gold.

Banks and credit card issuers spend their entire professional existence crunching numbers so that their rewards programs earn money. They are not offered to you because they just love you. They are offered because they know in the end, they will win. You may get some “rewards” but at what cost? How much interest are you paying on balances to get your “rewards”. There are 3 rules to remember when thinking you can outwit our outplay bank credit card rewards programs. Are you ready?

Rule # 1. The banks will win eventually.

They invest a lot of money to win the game. You might be smart but eventually, you run the risk of carrying a credit card balance and paying interest. Once you’ve paid all that interest, the so-called rewards are fool’s gold. They know the numbers. They will win.

Rule # 2. You will lose eventually.

See rule number 1.

Rule # 3. You are not the exception.

With all of the time, money, and effort they are sinking into getting you into a cycle of debt, why would you play the game? You literally have better odds in Vegas!

How to Live Without a Credit Card

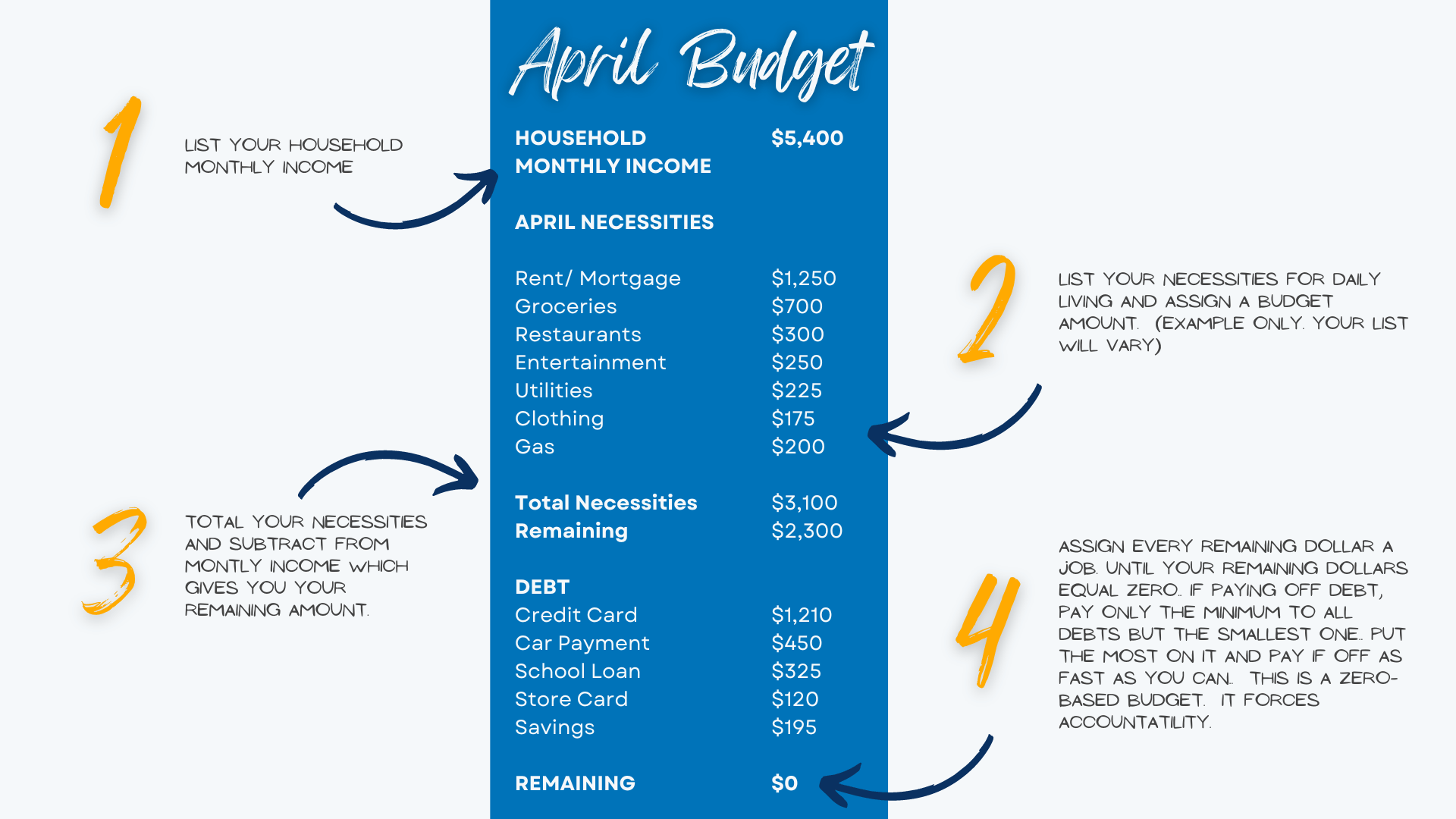

Get on a Zero-Based Budget

To live without a credit card you’ll first need to make and live on a zero-based budget. Learn how here. Once you are on a budget you can make your money pay for all of the essential things in life and prevent it from accidentally buying a bass boat. Making your money behave is the first step to eliminating your dependence on Credit Cards. A budget is the pillar of financial control.

Save for Emergencies

Next, save for emergencies so that credit cards are not used to pay for unexpected expenses. We recommend that you have an emergency fund of 3 to 6 months of household expenses set aside for emergencies.

Pay Off Your Debt

Use a debt snowball to pay off your existing debts and become debt-free. Learning to pay off your debts is the best way to prevent you from returning to debt using credit cards. The process of using a budget, saving for emergencies, and paying off debt leads to more clarity and control over yourself and your money.

Plan Ahead for Major Purchases

Lastly, plan ahead for major purchases like a car or a down payment on a home. When you plan ahead, you can eliminate the need to use a credit card to pay for purchases.

Conclusion: Do I Need a Credit Card?

Asking do I need a credit card is normal for most people. Credit cards are an enticing item because they seemingly offer you security and options. The reality is the security and options come at a very high price. We think that living a debt-free lifestyle, buttressed by wise budgeting habits and emergency funds is more secure and in the end provides the financial independence you are looking for.