Whether you work as a freelancer or rely on commission-based pay, budgeting with unpredictable cash flow can feel challenging. One month you may earn more than expected, while the next month’s earnings may fall short of your expectations. This inconsistency makes creating a realistic budget seem impossible, and it can leave you feeling stressed and overwhelmed. However, we have some great news! Budgeting for an irregular income is not that hard and we are going to show you how.

Budgeting irregular income is based on the same principles that zero-based budgeting use. However when budgeting for an irregular income you make adjustments on payday according to your actual pay. Let’s take a journey with Olivia who has an irregular income and see how she makes it all work.

Budgeting with an Irregular Income

Step 1. Write down your best conservative estimate for the month’s income.

Olivia has three jobs that each pay differently. Her day job pays her a regular salaried paycheck every other week $1,400. She also is a referee for soccer games at night which varies by season. Usually, Olivia can make about $300 a month as a referee however it can be as low as $50 for some months. Lastly, Olivia is a server on the weekends at a local restaurant that her parents own. She can count on tips ranging from $600 to $900 each month.

When Olivia budgets with a variable income she begins the month using the lowest average income expected. Based on her three sources of income Olivia can expect a maximum income for the month of $3,800 ( = salaried paycheck of $1,400 twice for the month + $300 as a referee + $900 in server tips). However, Olivia is smart and knows that since some of that income is not guaranteed she better use a conservative number so she doesn’t end up spending more than she earns for the month. So Olivia decides to budget for her guaranteed salaried paycheck of $2,800 for the month + $50 as a referee and $600 in server tips for a total of $3,450 for the month.

Olivia records $3,450 as her initial conservative estimate for the month’s income. Let’s move on to step 2.

Step 2. Write down all of your expenses for the month.

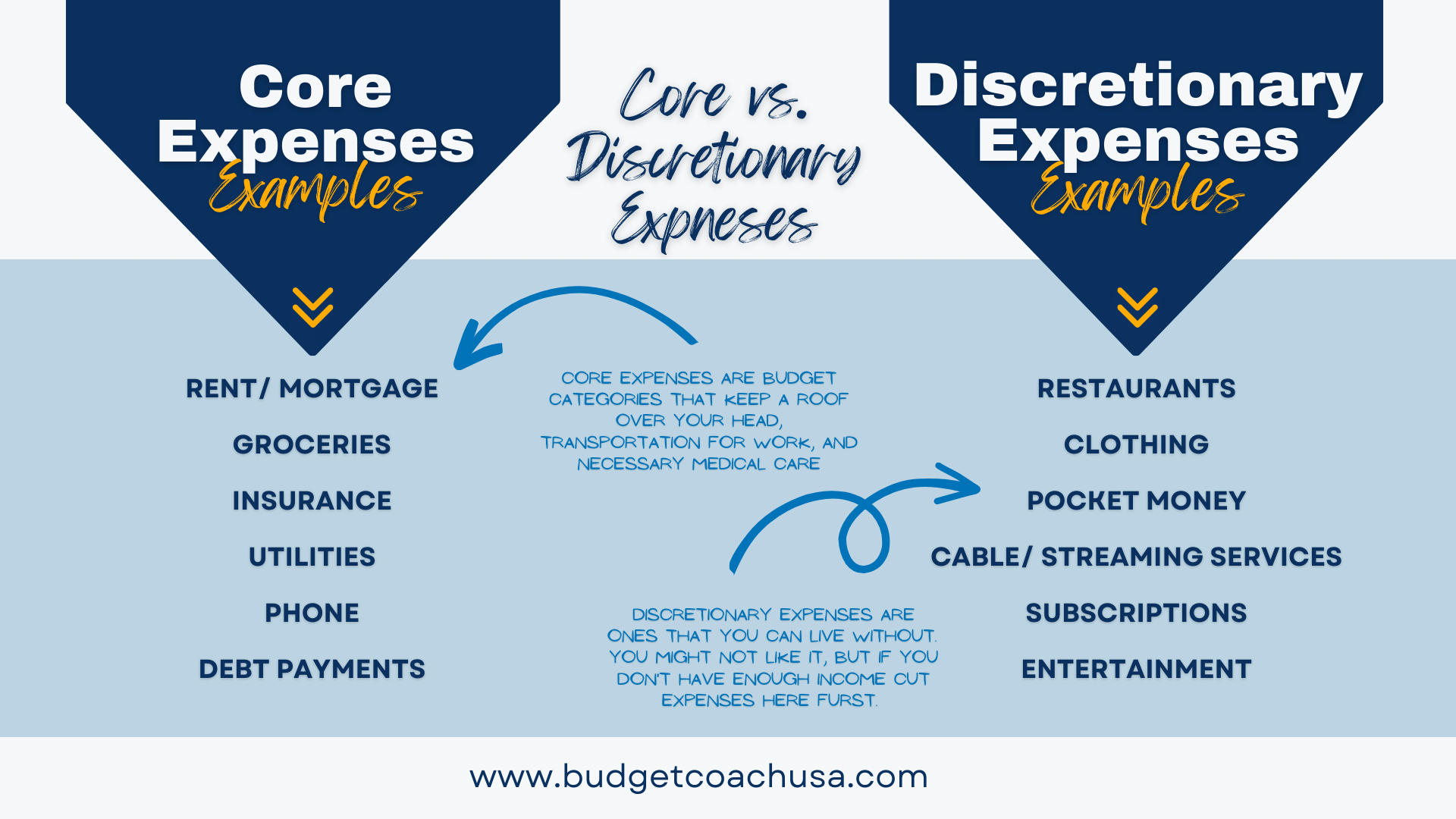

Now, Olivia writes down all of her expense categories for the month. Using an irregular income budget template she begins by acknowledging her Core Expenses such as rent, utilities, groceries, and transportation. Next, Olivia writes down other Important Expense categories like insurance, medical care, pet care, etc… Lastly, she writes down Discretionary Expenses for the month like restaurants, entertainment, subscriptions, and gifts. Olivia has goals for her future and her expense priorities in order. See our irregular income budget template.

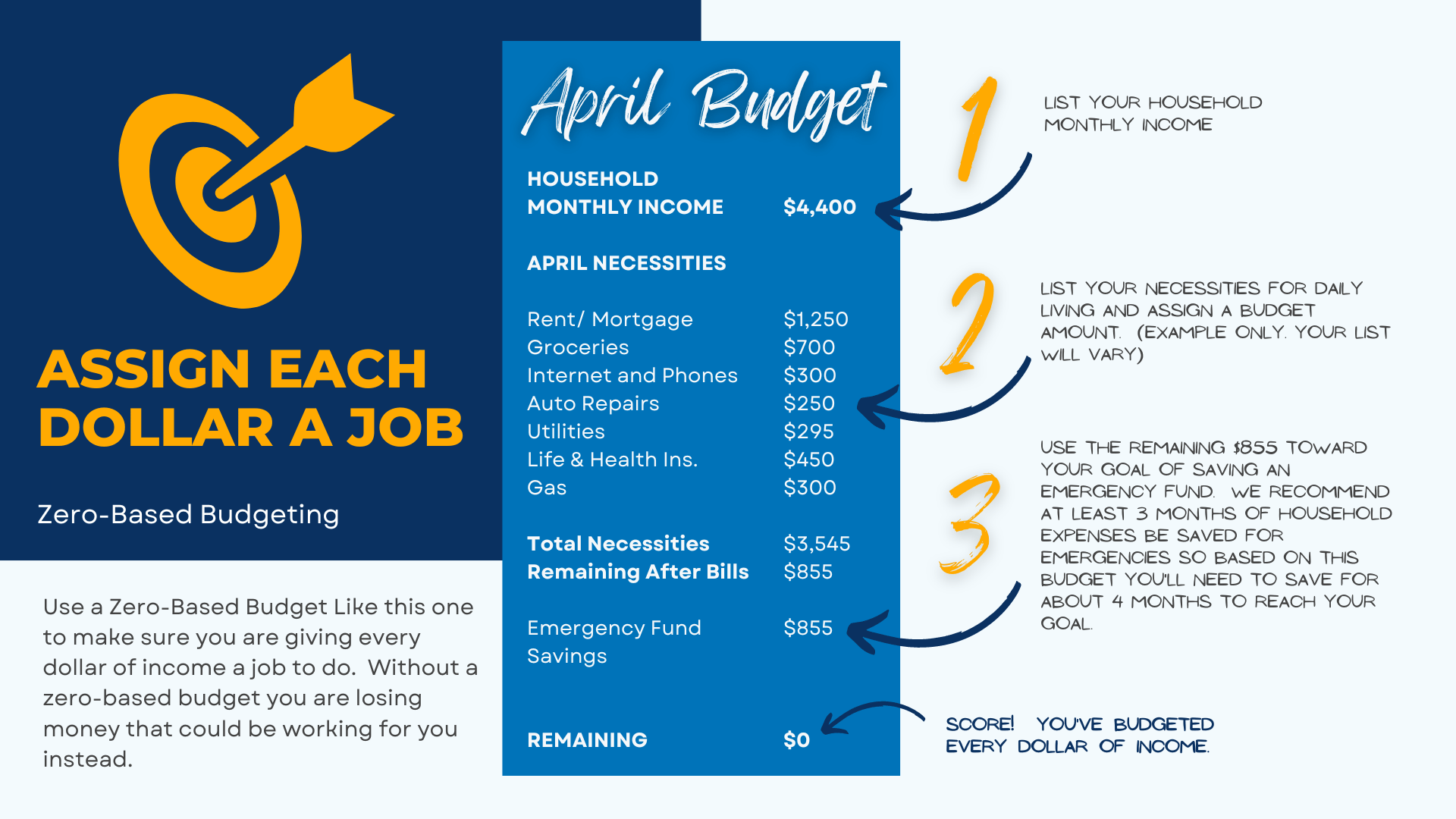

Step 3. Assign each dollar of estimated income to an expense (Zero-Based Budgeting).

Next Olivia assigns each dollar of estimated income to an expense. She doesn’t want any of her hard-earned money to go to waste so when makes sure that all dollars earned get a job. When Olivia is done her total expenses are the exact same amount as her total estimated income. Every dollar she planned to earn was assigned to a job. This is what is called zero-based budgeting. In the zero-based budgeting game, you want zero dollars without a job to do. Zero is the perfect score!

The new month has begun and Olivia’s zero-based budget built on her irregular income is set and ready to go. Olivia knows how much she conservatively will earn and how much she can spend accordingly. Let’s take a look at the next and final step in budgeting with an irregular income but first, let’s review the first 3 steps.

Steps 1 – 3 Review

- Olivia used an estimated income for the month that was the minimum she expected to make. That way she didn’t overspend and go into debt just in case her irregular income didn’t meet her expectations. Smart!

- Olivia then listed all of her expenses beginning with the most important Core Expenses. She then listed her other Important Expenses and lastly, she listed her Discretionary Expenses such as restaurants and subscriptions. Olivia knows her priorities!

- Next, she gave every dollar of income a job to do within her budgeted categories focusing on her Core Expenses and Important Expenses first and then allowing herself some Discretionary Expense luxuries. With this approach, Olivia will maximize her income to reach her goals and meet her obligations. She is well on her way to financial wellness.

Free Irregular Income Budgeting Template

Step 4. Adjust each time you get paid.

Olivia starts the month with her irregular income budget in place. Because she budgeted for a worst-case scenario for her irregular income, she has a budget in place that will keep her from overspending. Each time Olivia gets paid as a referee or receives tips for serving she records the amount on her irregular income budget template:

If Budgeted Irregular Income is More than Estimated

If her irregular income adds up to more than the estimated amount she started with she responds by giving this additional income a job. In other words, as additional income is received, Olivia adjusts her expense budget accordingly. Because Olivia is trying to get out of debt, she takes all of that extra income and uses it toward her debt snowball. When she gets paid each month she assigns those extra dollars to a job.

If Budgeted Irregular Income is Less than Estimated

If her irregular income adds up to less than the estimated amount she started with she responds by reducing some discretionary expenses so that she does not spend more than she is earning. Olivia knows that using debt will only make her future more difficult so she makes sure to maintain a zero-based budget even when her income is less than expected. Olivia doesn’t ignore the numbers. She acknowledges them and adjusts accordingly. Smart and mature!

Repeat Irregular Income Budget Each Month

All budgets, even irregular income budgets, should be based on what we anticipate actually happening in life for the month. And because no two months are ever the same our budgets shouldn’t be either. So before each month begins, you should budget your irregular income to reflect what you anticipate the next month will look like. Some things, like Christmas for instance, don’t sneak up on you as a surprise so those types of things should be planned for with intentionality each time you make a budget for your irregular income.

Goal of Budgeting

The goal of budgeting is to keep your financial life moving in the right direction. By creating a zero-based budget and avoiding money mistakes you can build the future that you want for yourself and your family. But when budgeting you have to be honest with yourself. Acknowledge each dollar of income and expense so that you can maximize their value toward your goals. In other words, to be successful with budgeting you need to align your actions with your goals. When budgeting be sure to create categories for debt elimination first, then for saving for retirement and future goals. Always budget to zero so you are sending money to all of your responsibilities and goals.

Recap: Budgeting with an Irregular Income

Budgeting with an irregular income is built on a zero-based budget. The primary difference is that you’ll begin with a conservative estimate of your income to begin the month so that you don’t overspend and go into debt. And on each payday, you’ll note the difference between your beginning estimate and the actual received. Next, you simply adjust your expenses to reflect the actual income always making sure that your expenses equal exactly your income.

Your budget should always include categories for debt elimination first, followed by saving for retirement and future goals such as buying a house.