Introduction

Getting married is a big step in anyone’s life, and one of the most significant changes that come with it is financial responsibility. Managing finances as a newlywed couple can be challenging, especially if you have different money habits. However, budgeting for newlyweds is an indispensable part of building a stable financial future together. So let’s take a look at some common questions, challenges, and solutions to budgeting for newlyweds.

How Can Newlyweds Budget Their Money Effectively Together?

Ensure Equal Access to Your Budgeting Tool

We like to think we marry people like ourselves but the reality is that we most of the time marry someone that is very different in a lot of ways. When it comes to money, a newlywed couple will often find out that one partner is very much a “nerd” or stickler for the numbers and the other will be more of a “free spirit”. The nerd will love using their budgeting tool and keeping it up to date and the free spirit is happy to leave that duty to their partner. Don’t fall for this trap! To be a successful money couple, each partner must be a participant in the budgeting process and an active participant in sticking to the budget. Each should have their budgeting app on their phone and each should participate.

Use One Bank Account

Be sure to combine your bank accounts and your money. Budgeting for newlyweds is about joining your lives together and if you keep separate bank accounts, you are failing to combine your financial lives in many ways. Assign one account as your “operating” account and the other as a savings account if you like. But combine your money, direct deposits, and financial efforts into one operating account.

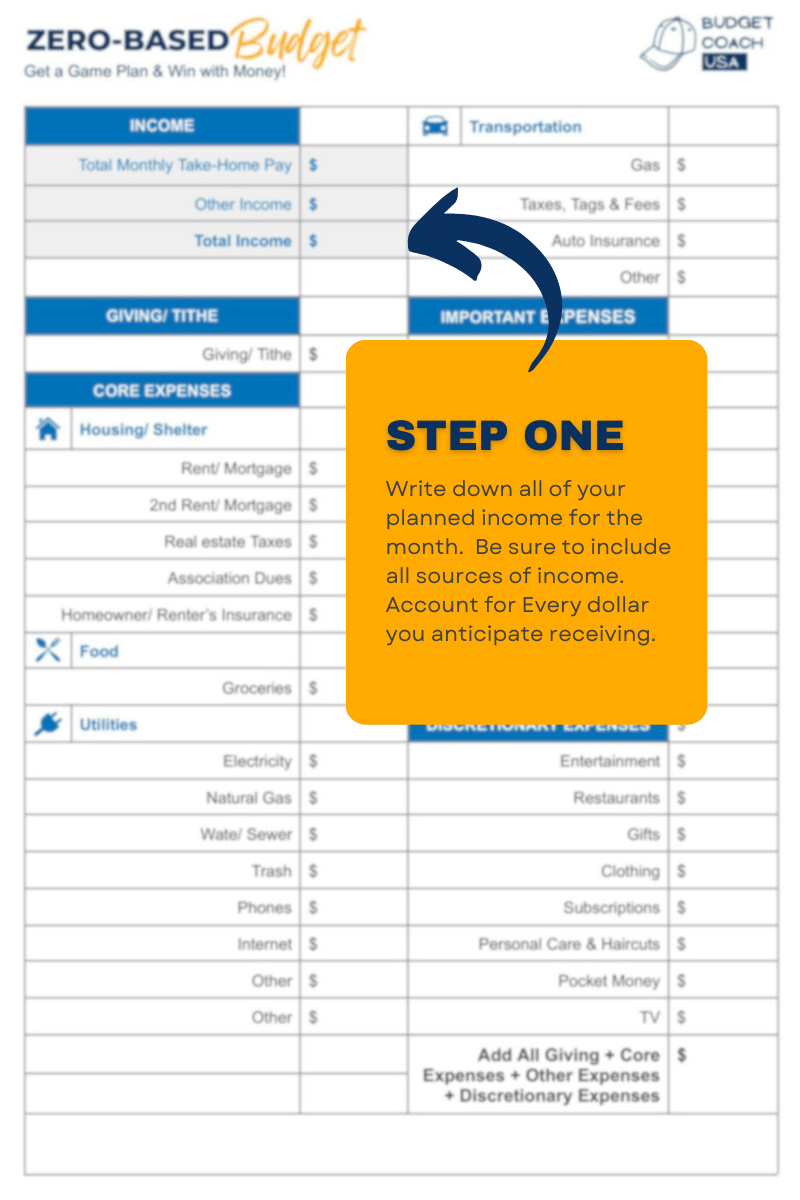

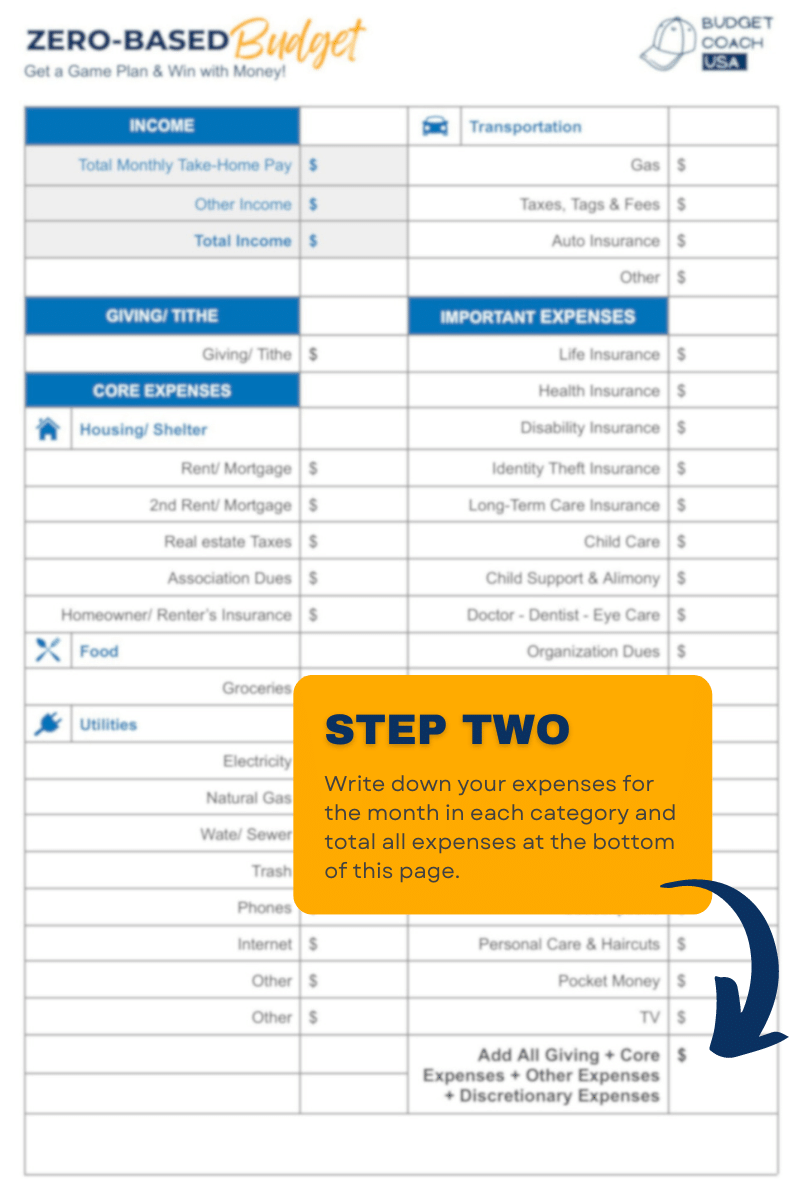

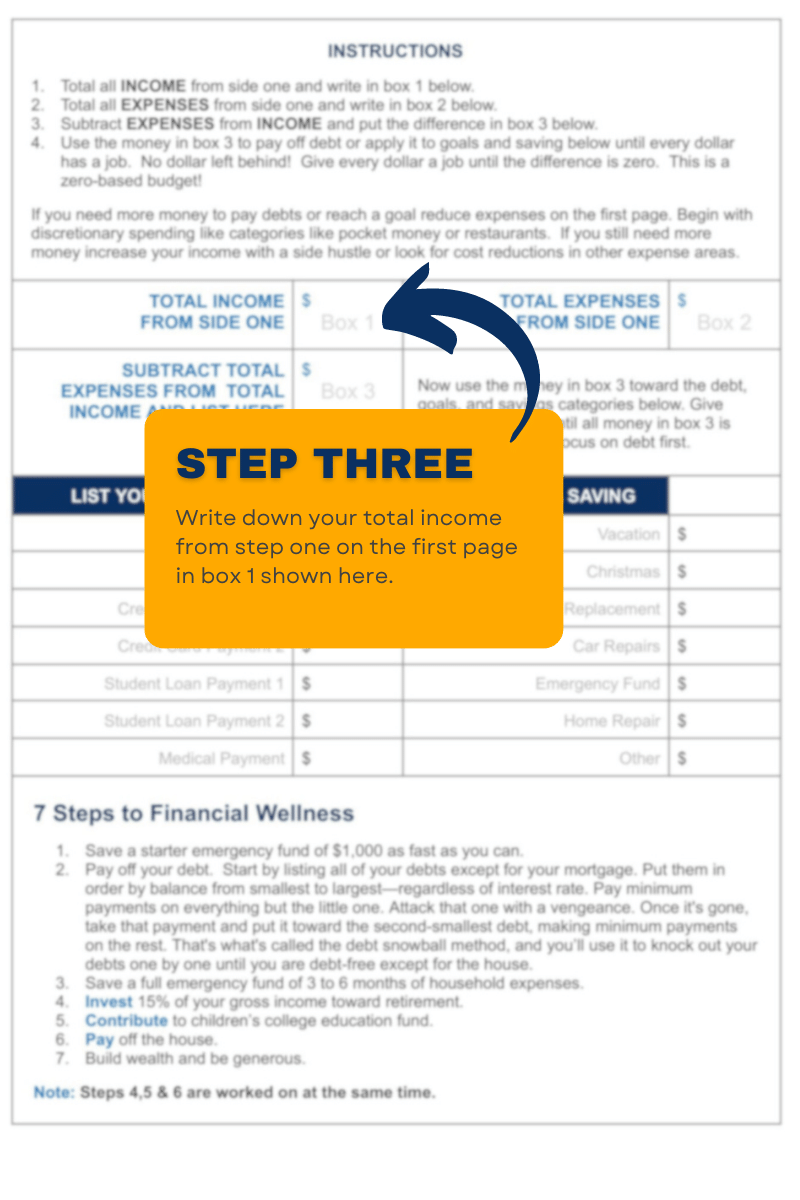

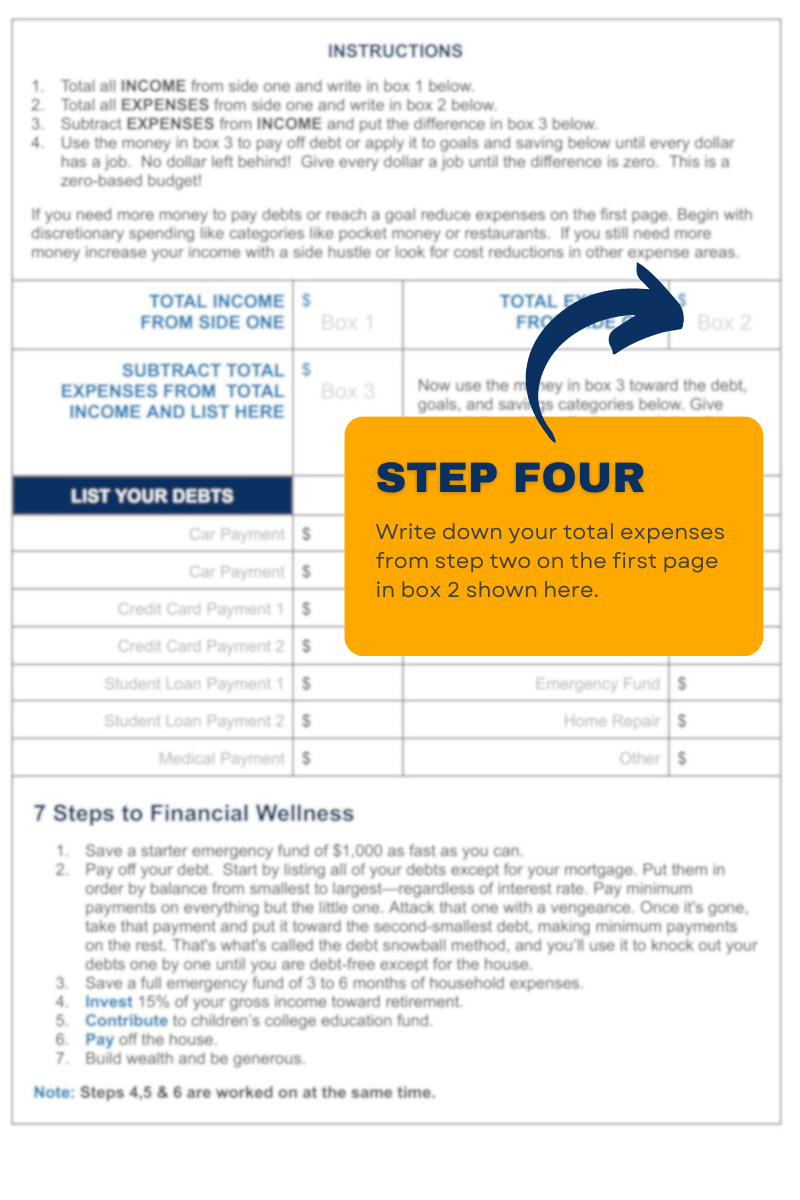

Use a Monthly Zero-Based Budget

Not all budgeting tools are created equal. Use a zero-based budget. A zero-based budgeting approach is the best solution to help newlywed couples gain control over their spending habits. This method requires every dollar earned or spent to be accounted for creating opportunities to reach your goals. Following a zero-based budget is important because it removes the unknowns and replaces them with knowns. When the unknowns are reduced the anxiety level reduces as well.

Make Decisions Together About Your Goals and Dreams

Once again, you free spirits need to join with your “nerd” spouses and discuss your goals and dreams together. The famous motivational speaker and author Zig Zigler once said, “If you aim at nothing, you’ll hit it every time”. When you have common, agreed-upon goals and dreams your everyday money decisions tend to wrap themselves around those goals and dreams. But without goals, you are “aiming at nothing”, and you’ll find yourself living a very inefficient financial life. Want to retire with dignity and leave a legacy for your children’s children? Discuss your goals and dreams and agree together on what you’ll pursue.

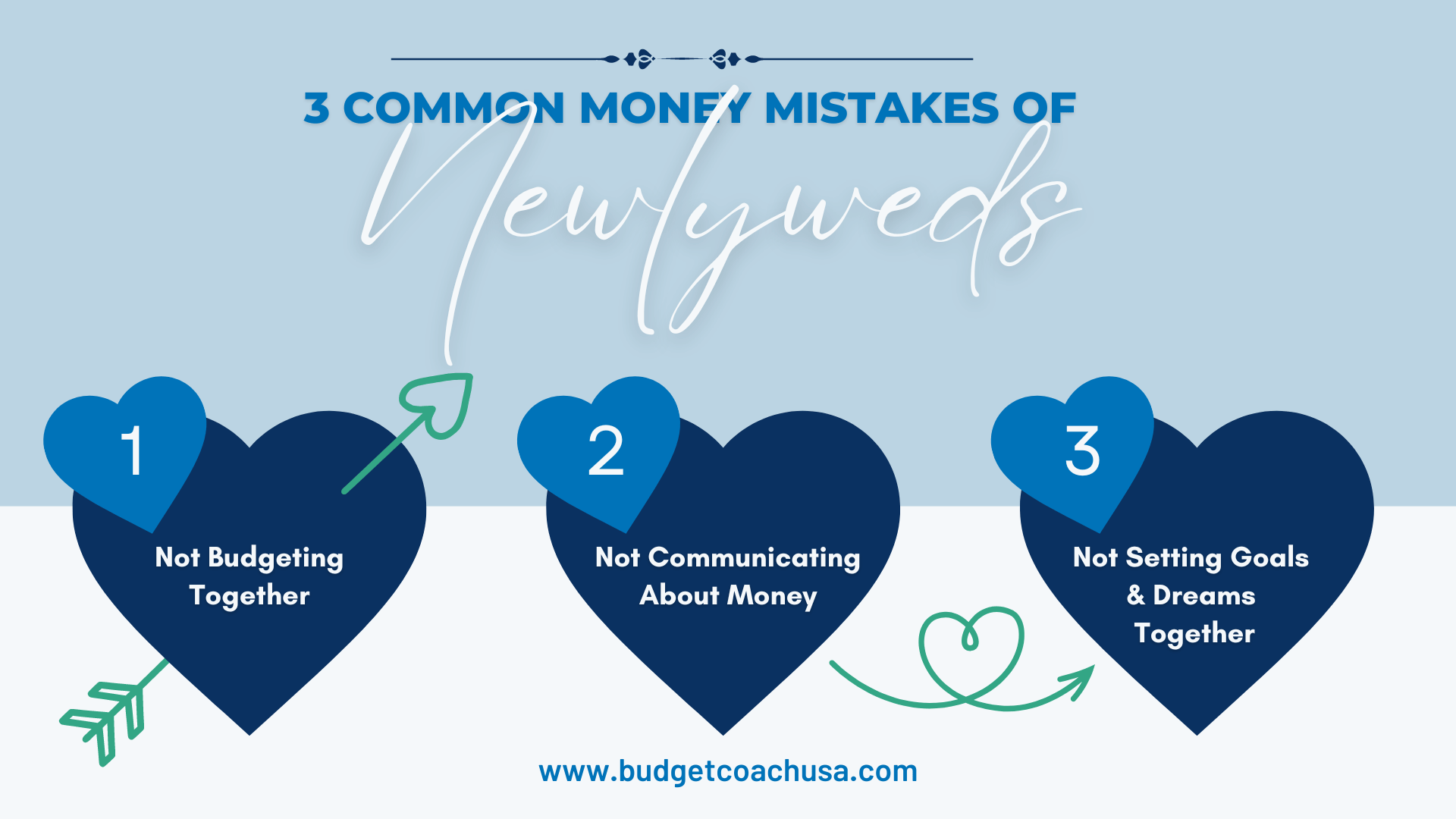

What are The Most Common Mistakes Newlywed Couples Make with Money?

Not Budgeting

Failing to use a zero-based budget together is the most common and consequential money mistake that newlywed couples can make. Without a budget zero-based budget your dollars are at high risk of being lost to poor decisions and regret. A budget tells your money where to go instead of wondering where it went.

Not Communicating

Failing to communicate together is another significant and costly money mistake newlywed couples make. This leads to hiding expenditures and income which is not only counter-productive to healthy finances, it is a dangerous mistake to make for the marriage as well. Communicate with each other and keep your money in the open.

Not Setting Goals Together

The famous motivational speaker and author Zig Zigler once said, “If you aim at nothing, you’ll hit it every time”. When you have common, agreed-upon goals and dreams your everyday money decisions tend to wrap themselves around those goals and dreams. But without goals you are “aiming at nothing” and, you’ll find yourself living a very inefficient financial life. Want to retire with dignity and leave a legacy for your children’s children? Discuss your goals and dreams and agree together on what you’ll pursue.

What is The Best Budget Tool for Newlywed Couples?

Every Dollar App by Ramsey Solutions

The best zero-based budgeting app available for newlyweds is Every Dollar by Ramsey Solutions. It is free to use the basic version, free of ads, and easy to use.

Why is a Budget Important and How do you Create One?

It forces accountability over your money and promotes transparency

Writing it down makes it harder to ingor.

You may have tried in the past to write down how much you are going to spend in certain categories for a month, however, if the budget you are creating is only a loose collection of how much you plan to spend it misses a key element: You haven’t weighted it against your income and assigned every dollar of income a job. Further, the dollars of income that are not assigned to a job are likely to walk away, or at minimum, they’ll be directed toward the wrong target. Y

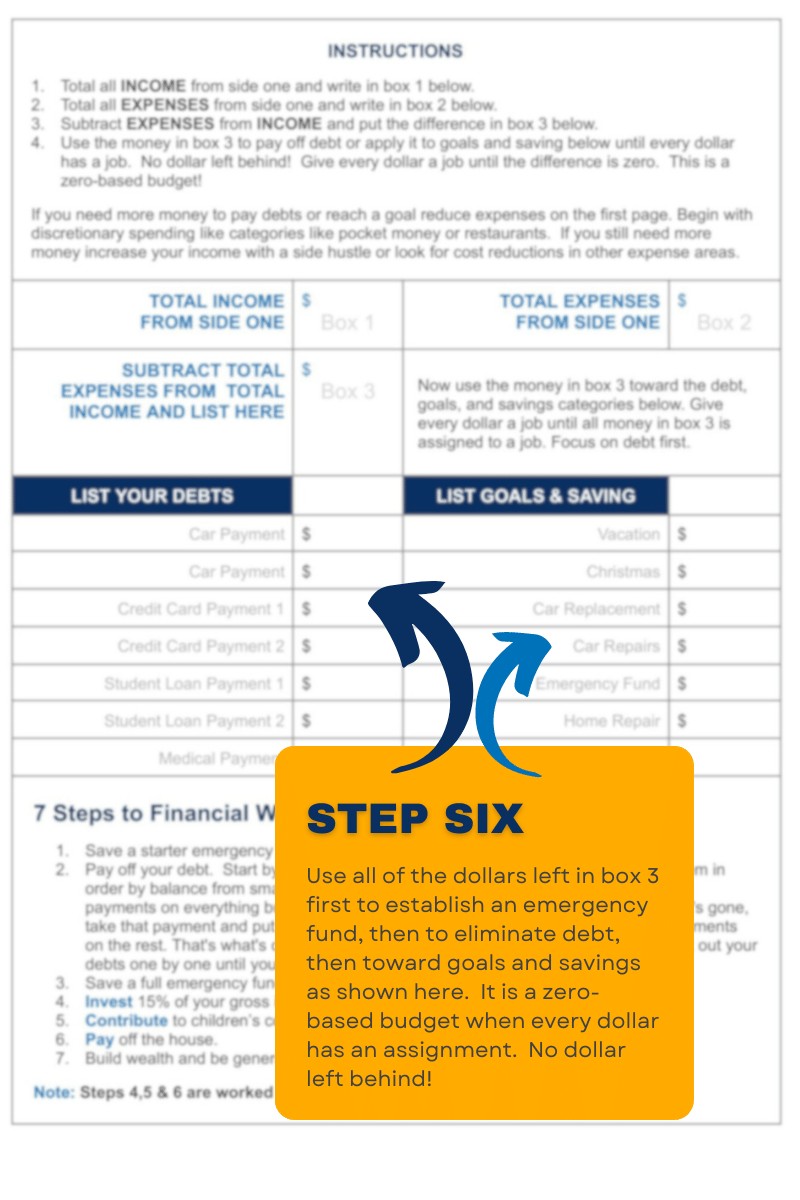

Every dollar gets a job.

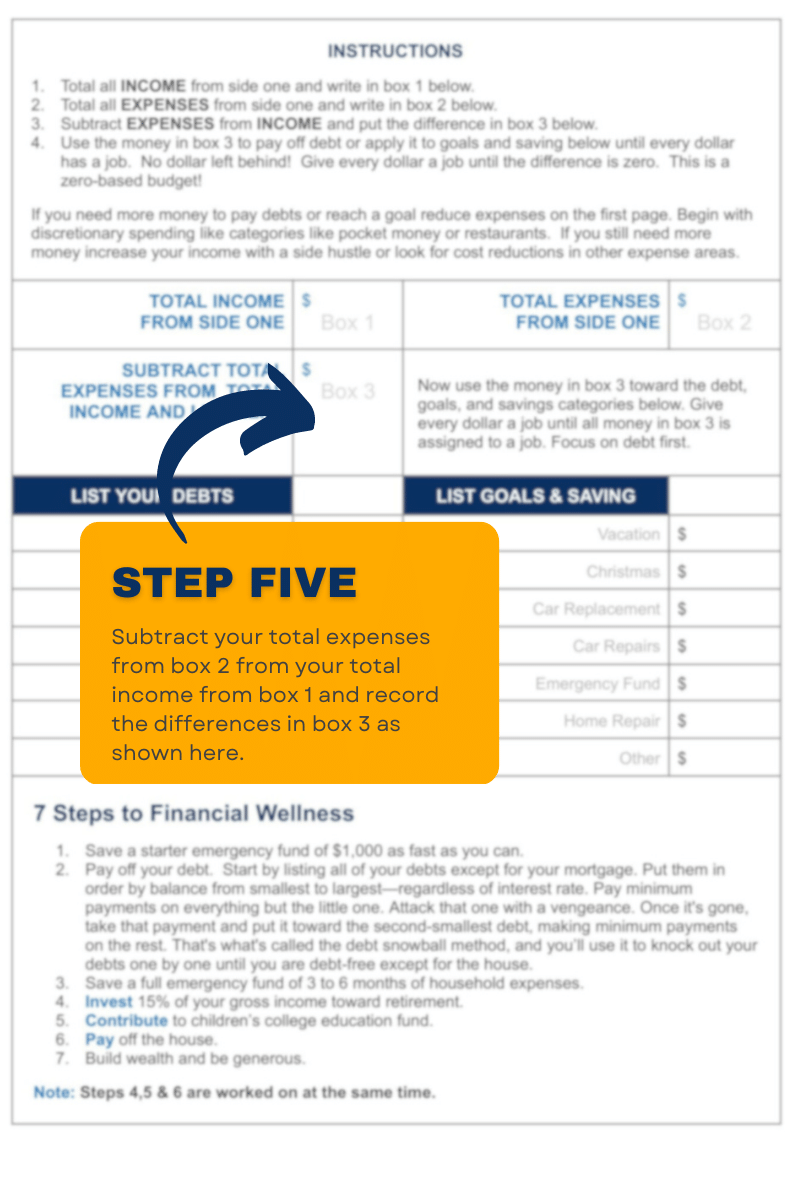

You know that you have assigned every dollar a job when your income minus your expenses equals zero. Zero does not mean that you have no money left, it means that you have no money unassigned to a job. There is a big difference. It means that all of the money you earned is pointed toward a goal such as saving, investing, or paying down debt. When you have assigned a job to every dollar of income, you have forced yourself to put those dollars where you have pre-determined they should go. This is accountability.

It maximizes every dollar you spend and earn

A zero-based budget is important because it maximizes every dollar you spend and earn through advanced planning and disciplined execution. A zero-based budget accounts for all income and assigns it a job. When all income is assigned to a job, on purpose, it assures you that you are maximizing its potential.

Many people like to have a “buffer” in their budget for emergencies. They feel if they assign every dollar of income to an expense category they won’t have any money left for unexpected wants or needs. We encourage you to plan for emergencies by budgeting specifically for an emergency fund. A buffer is only needed when you don’t have full control. When you aim generically for a few leftover dollars at the end of the month as a buffer what you have really done is admit that you don’t have control over where every dollar is being spent and you need a buffer “just in case”. A zero-based budget forces those dollars to be assigned to a job and maximizes their value.

It creates better spending decisions and a clear way to focus on your priorities

Why a zero-based budget is important is, at its core, rooted in how you prioritize your money. A zero-based budget puts all the cards on the table and reveals your hand. There is nowhere to hide. As such the weaknesses in the decisions you make with your money are revealed. For instance, if you are following a zero-based budget faithfully you will soon see if you are overspending on groceries or another category. Once you have that knowledge you only have a couple of choices: Keep overspending or adjust your habits to meet your goals. A zero-based budget is important because it shines a light on your spending decisions and creates opportunities for you to make choices that align with your goals.

It helps remove anxiety around money

Following a zero-based budget is important because it removes the unknowns and replaces them with knowns. When the unknowns are reduced the anxiety level reduces as well. Most people experience anxiety around money because they don’t really know where their money is going or if they’ll have enough when they need it. What if I told you that you could know with almost certainty that when your car breaks down, you’ll have enough money to pay for the repairs in cash? Or that if your home’s roof springs a leak, you can handle the new roof without using credit? I bet your anxiety level would be reduced. A well-planned and executed zero-based budget allows you to know where your money is, where it is going, and how much you need to save to keep “Murphy’s law” from your front door.

A zero-based budget is important because it brings certainty out of the unknown. It brings clarity out of confusion. However, even the best-planned zero-based budget is no match for a spender that cannot control their impulses. Ultimately, a person has to choose what they want most over what they want now.

Tips for Budgeting as Newlyweds

Budget every month.

A budget is not a set-it-and-forget-it job. You must create a zero-based budget every month that reflects the income and expenses you expect for that month.

Don’t hide expenditures or keep money from your spouse.

If you have agreed upon a budget and set your goals and dreams together it is expected that you’ll always keep all of your income and expenses in the open. If you don’t, this is called financial infidelity and leads to a very dangerous place. Don’t hide income or expenditures for your spouse.

Make your decisions together and agree on your priorities together.

The key is “together”. When both partners are actively involved in budgeting their finances they can accomplish a lot. But two people rowing in separate directions will sink the boat.

Say no to debt.

Debt is not a tool for building wealth. It is not a requirement for living. Debt is a financial product that lenders spend billions marketing to you every year. Debt is your admission that you did not plan ahead, save money, and pay cash for the thing you bought. Your path to financial contentment is blocked by debt. Say no to it. Plan, work together, and invest. You’ll be glad you did.

Newlywed Budget Planning Worksheet

Get your free newlywed zero-based budget planning worksheet here.

Final Thoughts on Budgeting for Newlyweds

Budgeting for newlyweds is an important first step toward building the future you want for your family. When you create together a zero-based budget each month that addresses your shared goals and dreams you will find that your everyday decisions begin to wrap themselves around your shared goals. Budgeting for newlyweds helps you keep all of your income and expenses in the open and promotes healthy communication within your new marriage.