Opinion

As a parent, you’ve got a lot on your plate. From changing diapers to chauffeuring your kids around town, it seems like there’s never enough time in the day to get everything done. But when navigating all of the responsibilities of parenthood, there’s one thing you don’t want to overlook: life insurance. Yes, we know it sounds about as exciting as watching paint dry, but trust us – finding the best life insurance for parents can mean the difference between keeping your family safe and secure or leaving them high and dry if something happened to you. So shut out the distractions for the next 5 minutes and put your phone on silent. We are going to explain popular types of life insurance and share our winner for the best option if you want to protect your family and avoid a top money mistake.

Types of Life Insurance

Life insurance is an essential part of any parent’s financial plan but with so many options available, the choices can lead to more confusion than answers. We’ve broken down the types of life insurance for parents here and cut through the clutter to offer one very clear answer. There are, broadly speaking two types of life insurance: Cash-Value Life Insurance, which has a variety of names as you’ll see below, and Term Life Insurance.

1. Cash Value Life Insurance Explained

Cash Value Life Insurance is a form of permanent life insurance that allows the policyholder to withdraw cash against the policy or surrender it altogether for a payout. Proponents will point out that cash-value life insurance is best because not only does it include a death benefit in case you die, but a portion of your premium is recoverable should you want to make a withdrawal. Here is a list of cash-value life insurance policy variations and the various names that agents and companies like to sell them under.

- Indexed whole life insurance

- Permanent whole life insurance

- Universal life insurance both guaranteed and non-guaranteed.

- Guaranteed issue whole life insurance

- Limited payment whole life insurance

- Joint life insurance

- Modified whole life insurance

- Reduced paid-up whole life insurance

- Simplified issue whole life insurance

- Single-premium whole life insurance

- Variable whole life insurance

Confused? Think of cash-value life insurance plans like pizza. There are a ton of different types of pizza: New York style, Chicago style, thin and crispy crust, and thick crust or hand-tossed with endless different topping combinations. But they are all still pizza. Unless it’s pizza rolls or those bagel-bite things. Not pizza. The important thing to remember is that cash value plans may go by different names but they all share one thing in common: they combine an investment with a death benefit.

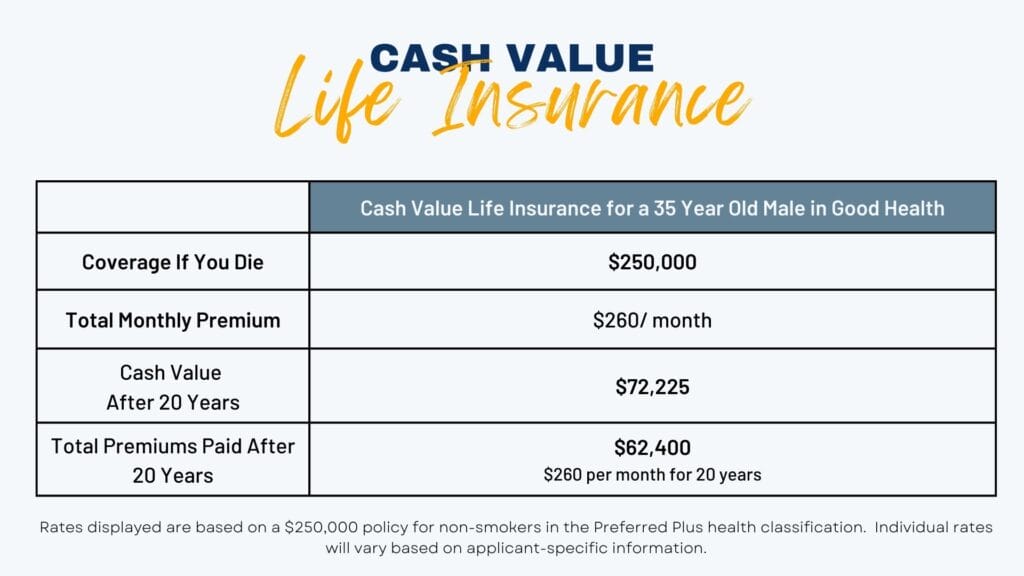

Did you say investment? That sounds good, right? Well, you decide. Take a look at the monthly premium price and the cash value in the illustration below. This graphic is based on a 35-year-old male (we’ll call him Stewart) in good health being quoted a cash-value life insurance policy.

There it is. With a cash-value life insurance plan, our 35-year-old male Stewart in good health spent a total of $62,400 over 20 years in monthly premiums for a $250,000 death benefit. That’s a lot of moola. If Stewart wanted to surrender it after 20 years they will give him $72,225 back.

How does that sound to you? Before you decide let’s take a look at Term Life Insurance costs and coverage and see what the same total investment looks like for Stewart after the same 20 years. Remember, Stewart, spent a staggering $62,400 over 20 years on his premiums to protect his family with $250,000.

2. Term Life Insurance

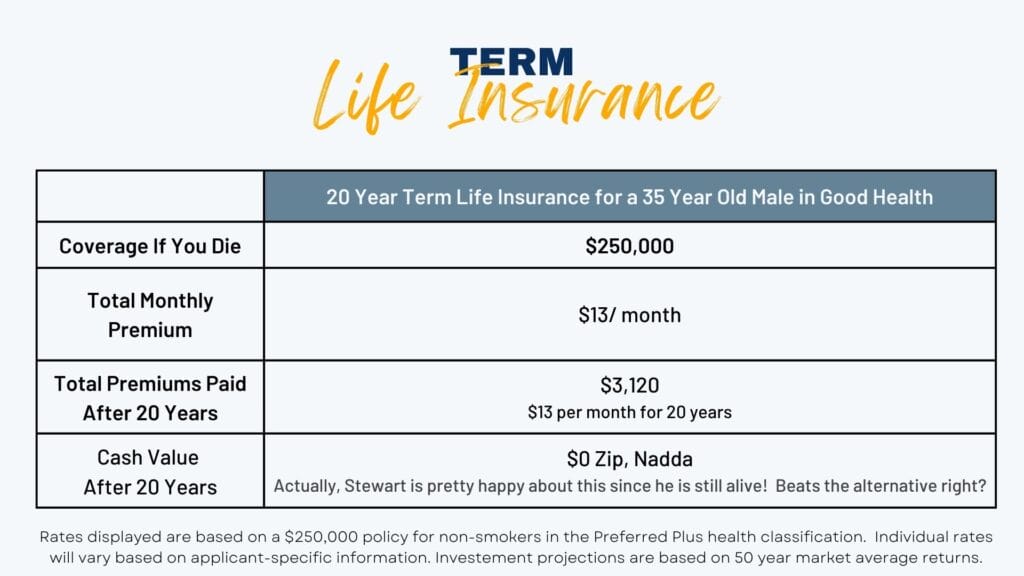

Term life insurance only pays a benefit if you die. At the end of a 20-year term life insurance policy, they don’t give you a single penny if you are still alive. That is it. Term life is pretty simple. Let’s take a look at the graphic below and see how a Term Life Insurance Policy is priced. (Spoiler alert. Term life policies are a lot cheaper than cash-value plans.) Let’s look at what the numbers look like if Stewart buys a 20-year term life policy instead of a cash-value policy.

Well, there it is. At the end of 20 years, Stewart was covered for $250,000 for just $13 per month. The total he paid into his premiums over those 20 years was grand total of $3,120. However, he won’t get a penny in the end if he is not deceased. And happily so for Stewart since he is still alive!

But the cash value policy gives Stewart $72,000 back at the end of 20 years, right? Yep, but let’s look at the numbers compared before we draw a final conclusion for the best life insurance for parents.

So What Is the Best Life Insurance for Parents? Cash-Value Life Insurance or Term Life Insurance?

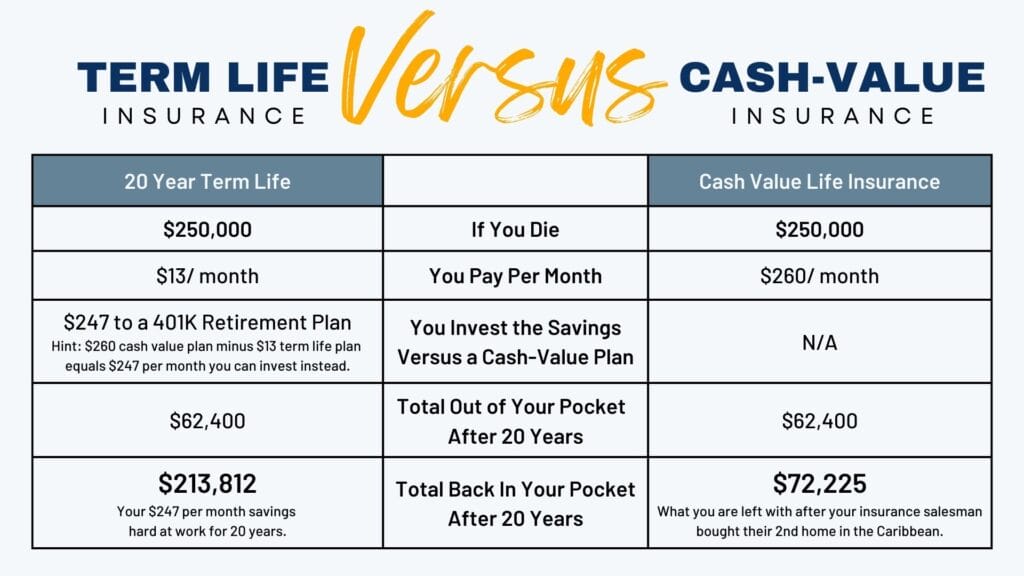

Well, if we are going to answer this question we need to compare the insurance types apples-to-apples. Stewart’s cash value plan is going to cost him $260 per month and last until he dies. The Term Life Policy is just $13 per month and ends at 20 years. To do this we’ll compare what it looks like for Stewart to buy the cash-value policy for $260 per month compared to buying the Term Life policy for $13 and adding an additional $247 per month to a 401K retirement plan to make things even. It is $260 per month either way.

Cash Value Life Insurance Vs. Term Life Insurance – A Comparison

Here comes the payoff pitch. Let’s compare a cash-value life insurance plan with a term life insurance plan apples-to-apples and see which one gives us the best value at the end of 20 years.

Ouch! That cash-value plan that sounded so sophisticated bit you in the rear end to the tune of $141,587 that you could have had in your pocket after 20 years. Good thing we didn’t run the calculations for 40 years because that would have been a loss to you (and another Caribbean beach house for your insurance salesman) of $1,940,064. Yeah, you read that right. Almost two million dollars were lost after 40 years for that sophisticated cash-value policy. That is what compound interest does and your insurance salesperson knows it. And it is what they are trying to sell you.

What is the Best Life Insurance for Parents?

The winner is clear. A term life insurance policy offers you the same death benefit as a cash-value policy and provides more money in your pocket at the end of the term versus cash-value life insurance when the difference is invested. No question about it. Unless you just like buying beach houses for insurance salespeople, we recommend that you stay away from any life insurance that offers a cash value. Remember, they go by a lot of different names, but they are all the same. We recommend term life insurance to protect your family and invest the difference in your own 401K retirement plan.

Comparison Questions & Answers

What if I Need 30 Years of Coverage instead of 20?

We hate to say it, actually, we like to say it. If you need 30 years of coverage instead of 20 the difference only grows. That means another beach house for your insurance salesperson and a whole lot of nothing for you! That is why some people call it Whole Life. There is a whole lot of profit for the salesperson and a whole lot of nothing for you.

I See Your Point, But What Happens if I Die After 23 Years? My 20-Year Term Policy Is Expired.

Well, for starters you have $213,812 to provide to your family if you invested the difference as opposed to the cash-value plan you are still paying $260 per month. If by the time our 35-year-old male Stewart is 58, he still isn’t financially solvent, he can buy a term life insurance policy for the $37,000 difference for about $20 a month. In fact, his employer is probably already carrying that much or more on his behalf as a benefit anyway.

But the Cash Value Policy is Permanent. What is the Maximum Length of Term Life Policy I Can Buy?

Most insurance companies will offer plans for up to 30 years. So if you start your family around 25, you be 55 by the time your 30-year policy expires. Remember, when you invest the savings in a 401K retirement plan versus a cash-value policy you will be building value in your own retirement account. Using our example of $247 per month saved (term life vs. cash-value) invested, after 30 years you would have in the neighborhood of $692,000 of retirement savings as protection for your family. We are using an average market return of 11% for this calculation.

Who Should Have Life Insurance?

Anyone who has a dependent to protect. If you are married without kids and your spouse would count on your income to survive if you were deceased, then you need life insurance. If you have children who are dependent on you, you need life insurance. Think of it this way. If you were to pass away is anyone else who depends on you going to be able to provide for themselves and maintain their lifestyle after you are gone? If they cannot, you need life insurance to protect them.

How Much Life Insurance Do I Need If I’m a Parent?

It is recommended that you carry 8-10 times your annual income in life insurance to protect your children and spouse. If you make $80,000 per year that your family is dependent on, you should carry between $640,000 and $800,000 in term-life coverage.

Final Thoughts

If you hold a cash-value policy now you would be money ahead to stop the bleeding now and switch to a term life policy. However, never never never cancel any life insurance policy until a new one is in place. Did you hear that? Don’t cancel until a new policy is in place.

Life has a lot of twists and turns and the longer you go the more you realize just how many people are after your money. Cash-value life insurance and the salespeople who peddle it are no different. Remember, they sometimes call it whole life because the salesperson gets a whole lot of commission and you get a whole lot less than if you had kept your life insurance and investment strategies separate.

These are the opinions of Budget Coach USA. The reader should complete their own due diligence and decide what is most important to them when selecting a life insurance plan to protect their dependents.