Introduction

Considering bankruptcy but wondering what the best alternative to bankruptcy is? You’ve come to the right place. Bankruptcy should be a last resort option and fortunately, we’ve listed not just some of the most popular alternatives, but the best alternative to bankruptcy too. If you still have time before taking the giant leap into bankruptcy, read on.

Negative Effects of Bankruptcy

Bankruptcy is a legal process that temporarily or permanently prevents creditors from collecting debts. It can be a stressful process with a lot of potential negative effects listed here. The negative effects of bankruptcy should be considered before making a final decision. The best alternative to bankruptcy (outlined at the bottom of this post) allows you to avoid these consequences and build skills so you never face it again. What are the negative effects of bankruptcy?

Employment

Bankruptcy can make it difficult to get a job, especially if you want to work with money or in a position of trust.

Property

You may lose assets like real estate, cars, boats, or investments to pay off your debts. However, you can keep some property, like your primary residence, clothing, and retirement accounts.

Insurance Premiums

Bankruptcy can increase your insurance premiums.

Renting

Bankruptcy can make it difficult to rent an apartment.

Tax refunds

You may not be able to keep your tax refund if it’s used to pay off debts.

Relationships

Bankruptcy can damage your relationships with friends and family.

Social stigma

Bankruptcy can be seen as a way to avoid financial obligations.

Popular Alternatives To Bankruptcy

Because of the risks associated with bankruptcy, many people look for alternatives. Some popular alternatives are listed below however most of these only put a bandaid on a deeper problem.

Credit Counseling

Credit Counseling is a popular alternative to bankruptcy because it is essentially, one-stop shopping. It is a service that provides financial education, credit analysis, and budget guidance to help people manage their debt. Counselors are trained professionals who can help you develop a personalized plan to address your financial situation. Sometimes credit counseling services lump in debt consolidation as a service. Other times, you may simply get guidance on how to organize your income for success and create more margin in your monthly cash flow.

Here are some things a credit counselor can help with:

- Budgeting: Create a budget that helps you manage your money

- Debt management: Develop a plan to manage your debt

- Financial education: Learn about credit and how to manage debt

Credit counseling can be a successful alternative to bankruptcy. Credit counseling organizations are usually non-profit and their counselors are certified. The first session with a credit counselor is often free. However, it is important to familiarize yourself with the exact terms and services of any credit counseling service before committing. The reputation of any service can vary. Completing your due diligence is necessary if you don’t want to end up with bigger problems in the end.

Negotiate Directly with Your Creditors

Depending on the type of debt you have, you may be able to negotiate directly with your creditor for more favorable terms. Let them know that you intend to pay back every dollar they are owed but that you need some adjustments in the payment terms to be successful. While many creditors will not be excited to hear from you directly, emphasizing that you do want to make good on your debt, may help bring them to the table. If you do strike a deal with your creditor, be sure to get the details in writing and sign accordingly.

Loan Modifications

Loan modifications are formal changes to an existing loan usually based on established lender practices. An example of a loan modification may be a reduction in interest rate or fee structure. It could also be an extension of the repayment term. Loan modifications can be an effective alternative to bankruptcy as they may result in enough margin in your monthly cash flow to make repayment of the loan possible. While loan modifications are an available tool to help you work through your troubles, they don’t necessarily address the underlying issues that led to your troubles to begin with.

Debt Consolidation

Debt consolidation is a common go-to for people seeking alternatives to bankruptcy because the lender often makes more money on an extended repayment term that results from consolidation. For this reason, debt consolidation is a pretty easy option to pursue in many circumstances. However, once again, consolidating your loans might provide temporary relief but does it really address underlying issues?

There are some circumstances in which you can consolidate your debt on your own, however most times it requires the services of a “debt relief” service that specializes in negotiation on your behalf. This is sometimes also called credit counseling. When the process is complete, you make a single monthly payment to the debt relief agency that in turn pays your bills for you at the negotiated rate. However, some debt relief services have a poor reputation that can put you in even worse shape if they fail to perform as agreed. Choose wisely.

The Best Alternative To Bankruptcy – Budgeting.

If you are not yet on the bankruptcy train and still looking for the best alternative to bankruptcy, give budgeting a try. Why is budgeting the best alternative to bankruptcy? Most people who are struggling financially really don’t have a true idea of exactly how much money they bring in, exactly where it all goes, and consequently, how much monthly margin they actually have. This is where a zero-based budget comes in. Zero-based budgets shine a light, not only on all of your expenses, but your income too. It is very possible that you can still avoid bankruptcy by simply paying more attention to every dollar you earn and spend, by learning to budget every month.

By writing down ALL of your income and ALL of your expenses at the beginning of each month you have the opportunity to adjust your behavior with money and begin aiming your income toward your most important priorities.

In addition to this, your budget helps you understand if you need to make any changes to the income side. Sometimes, increasing your income is also part of the necessary solution alongside controlling your spending.

How to Make a Zero-Based Budget.

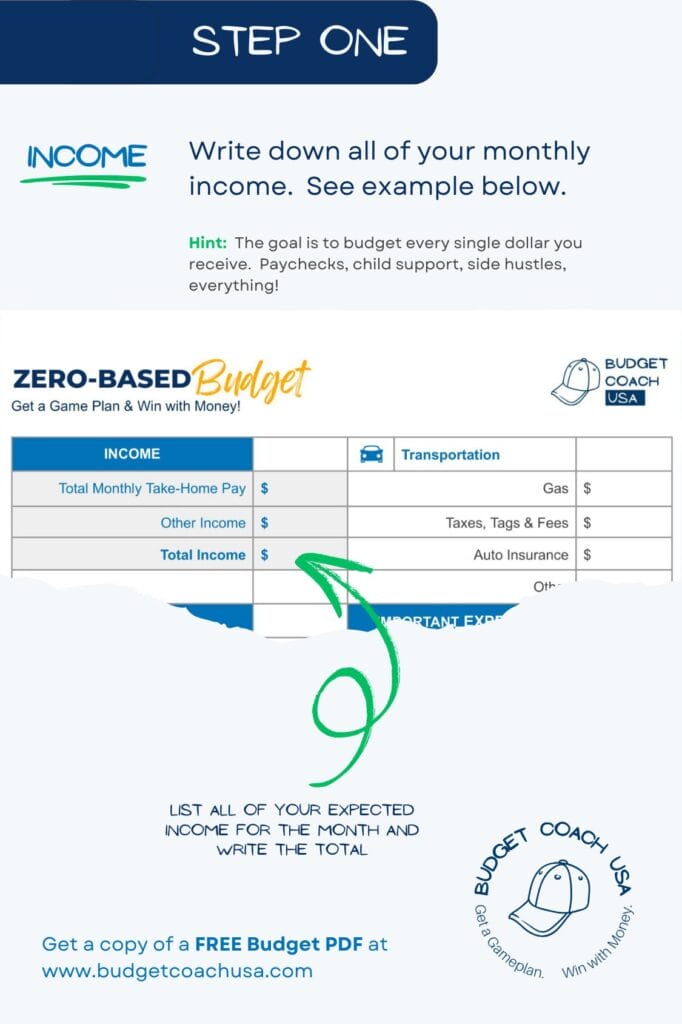

1. Begin by writing down all of your monthly income.

If you are having a hard time knowing exactly how much you earn each month, refer to your bank account statements and look at recent paychecks. Include all income from both you and your spouse, if married. Be sure to include income from alimony, child support, and any side hustles. If you are paid every other week you are usually paid twice a month. However, there will be 2 months every calendar year in which you get three paychecks. So be sure to look at your paydays and the calendar to know when those months are. See the illustration below. Download this free budget PDF here. No email is required.

Include ALL income

You may get a monthly stipend from unemployment or child support etc… Those can be so regular that they just drop into your bank account and you forget about them. Refer to your bank account statements to make sure you catch ALL of your household income. We want to acknowledge all of your income so we can budget it and put it to work.

Be honest, don’t cheat.

No hiding income from yourself and especially, not your spouse. That’s called financial infidelity. Be honest about all of it. Knowing how to make a budget means being honest about all of the numbers.

Be sure to look for 3 paycheck months if you are paid every other week.

If you get paid every other week at your work, don’t forget that there are 2 months of the year that you get 3 paychecks. Those months can sneak up on you. So look up those months now so you know when to expect that third paycheck in your budget. Who doesn’t want an extra paycheck twice a year?

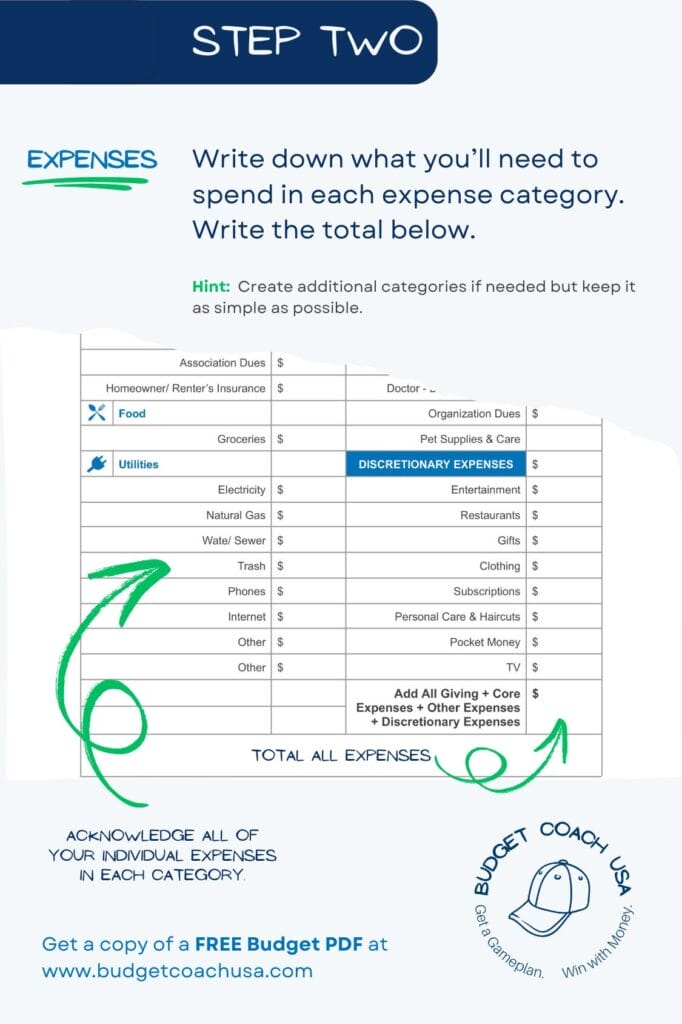

2. Next, write down all of your monthly expenses.

This step is a little more difficult. If you have never budgeted your money in the past it can be a challenge to even guess how much money you spend in certain categories such as groceries or gas. Remember that bank statement you looked at in the first step? Grab it again and use it as a guide while you are filling out your budget expenses for the month. You can add up all of the grocery store expenses as well as any restaurant or entertainment expenses. This is a lot of help when making a budget. See the illustration below. Download this free budget PDF here. No email is required.

Use your bank statements as an initial guide.

Again, for the first couple of months, refer to your past bank statements as a guide to help you uncover your historical spending patterns.

Don’t get too specific with categories as it can be more detail than needed.

Getting too specific with your budget categories can lead to more details than is necessary. Budget categories should be specific enough to capture all of your monthly household expenses but not so specific that it creates extra work. For instance, a category for “gas” is usually enough. There is no need, in most cases, for a separate gas category for each vehicle. Keep it as simple as possible while capturing each distinctive different category.

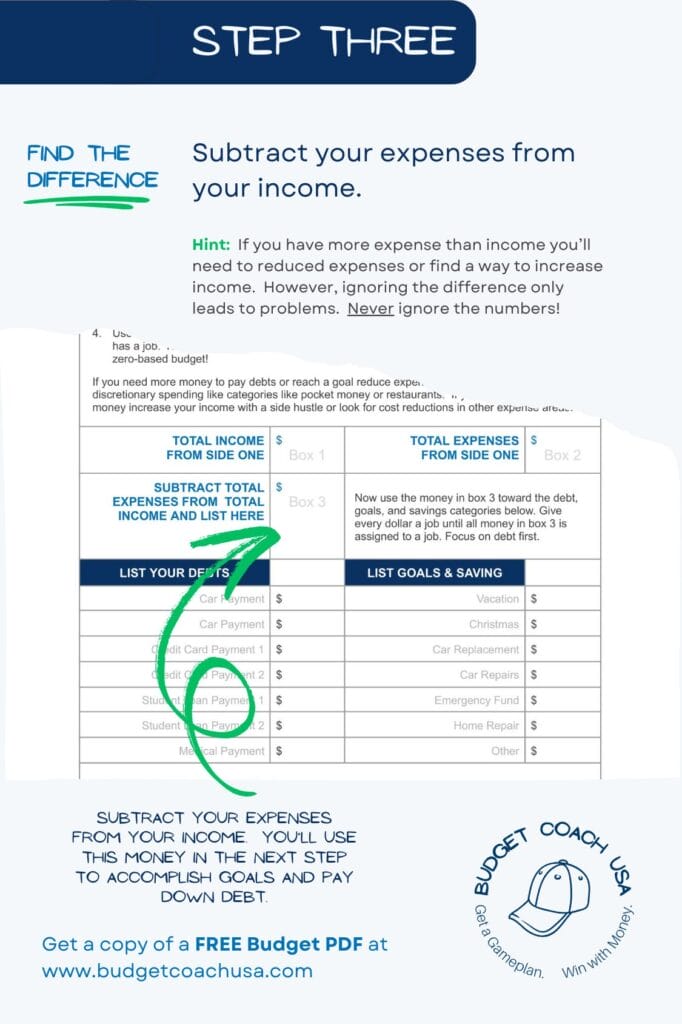

3. Now, subtract your expenses from your income.

Once you have your total income (from step, one) and your total monthly household expenses (from step, two) let’s do some quick math. Subtract your total expenses from your total income. See the illustration below. Download this free budget PDF here. No email is required.

Extra money left over?

If you have extra money left over use it to pay off your smallest credit card balance first regardless of interest rate.

Are you in the red? Too many expenses and not enough income?

If your expenses are more than your income, you have two choices. You can go back and reduce expenses. When reducing expenses focus on discretionary expenses first. Discretionary expenses are expenses that are not really necessary such as “fun money” or “restaurants”. The second thing you can do is increase your income.

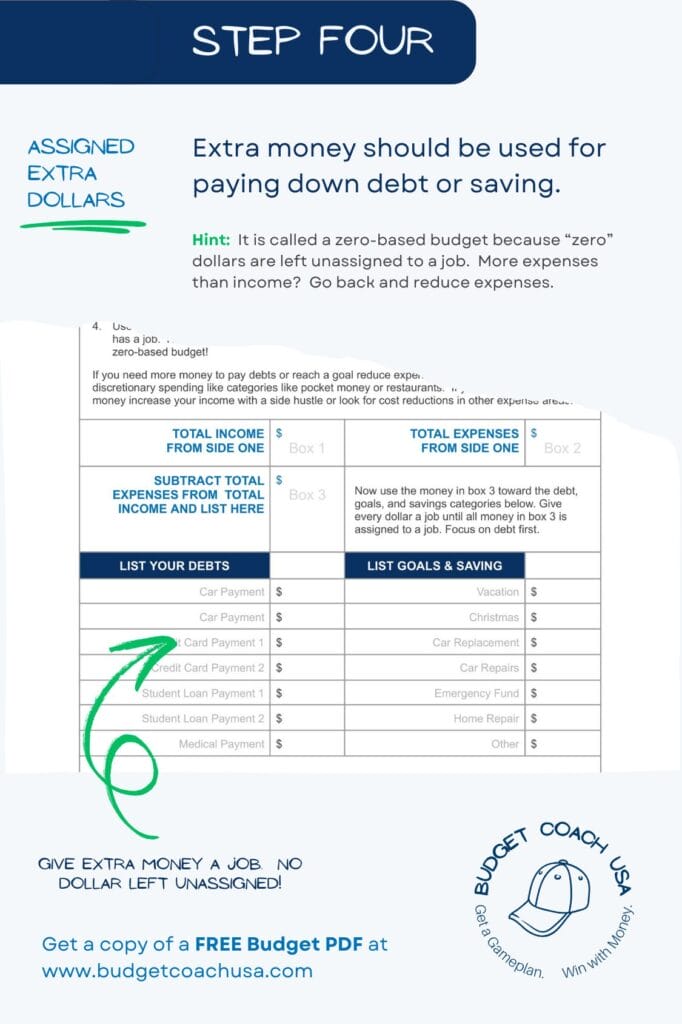

4. Budget all extra money toward paying off credit cards.

Now it is time to give that extra money a job. Use it to pay off your credit card debts beginning with the smallest card balance first.

An Ounce Of Prevention is Worth a Pound of Cure.

Bankruptcy is not a fast or easy process and should not be entered into without exhausting available alternatives first. Moreover, while bankruptcy may provide the financial relief you are seeking, the emotional toll and reputation damages linger for years. On top of that, certain types of debt are not bankruptable such as federally insured student loans, secured debts (like cars and homes), and most tax debt. So what alternative to bankruptcy is best?

The best alternative to bankruptcy if you still have time, is to learn how to budget your money every month, say “no” to unbudgeted expenses, and if necessary, find ways to increase your income. This will help you build new skills to make sure that you don’t find yourself in the same place in the future.

The alternatives to bankruptcy, even the best ones are not easy. But then, neither is bankruptcy! So if you are going to have to invest your time and engergy into a difficult endeavor, why not make it one that allows you to avoid the negative effects of bankruptcy and instead focus on a solution that allows you to build lifelong skills for the future? Learn how to build a better financial future through the skill of zero-based budgeting today.