Stressing about money? You’re not alone. Many Americans are asking how to make their paychecks stretch further. While advice about saving money on groceries is a great start, not stressing about money requires more than just coupons. Take it from a former money dummy. Coupons are nice, but the secret sauce is in the monthly zero-based budget.

We learned how to not stress about money and are detailing some of our methods here for you. We are big fans of planning and using a zero-based budget. If you want to quit stressing about money read on.

Start with a game plan.

Know your “why”

Are you living paycheck to paycheck? It is a common problem for many people I’ve met especially if they lack inspiration or vision for their future. It is a vicious cycle of sorts; “I never have any money so a better future is not available to me.” “Since a better future is unavailable to me, why should I dream of anything more?”

Don’t let that negative thinking derail your dreams. There is a better future, even on a modest income, and the first step in getting there is to consider your “why”.

In his book START WITH WHY, Simon Sinek explains that individuals and organizations should first consider “why” they want something different before endeavoring to make changes. Asking “why” Sinek argues is how inspiration leads to change.

So if you are tired of stressing about money and want something better in life, start with YOUR why. Why do YOU want a better life? Is it to provide a better future for your kids? A better education? A better home? Or do you dream of retiring early? Your “why” provides motivation to accomplish difficult challenges and keeps you anchored to a future worth fighting for. Your “why” moves you from just getting through each day to living and working for a better future.

So before going any further? Think about your “why”. Ours was simple. We were sick and tired of being sick and tired. And we were ready to do anything to change the equation for ourselves and our kids. Our family was why we fought so hard to make a change. We wanted a better future for our family than the one we were facing.

Imagine where you want to be in 5, 10 or 20 years.

Now let’s add some detail to your “why”. Where would you like to be in 5, 10, and 25 years? What do you want life to look like? How much money would you want to save for retirement by then? What are your goals and dreams? Would you like to be debt-free?

Set some goals and let them sink into your day-dreams. Post a photo or image on your bathroom mirror or refrigerator to remind you of your goals. If you are married, talk together with your spouse about your shared dreams.

Knowing your “why” and establishing goals that align with your why is a powerful motivator and is absolutely necessary for long-term success.

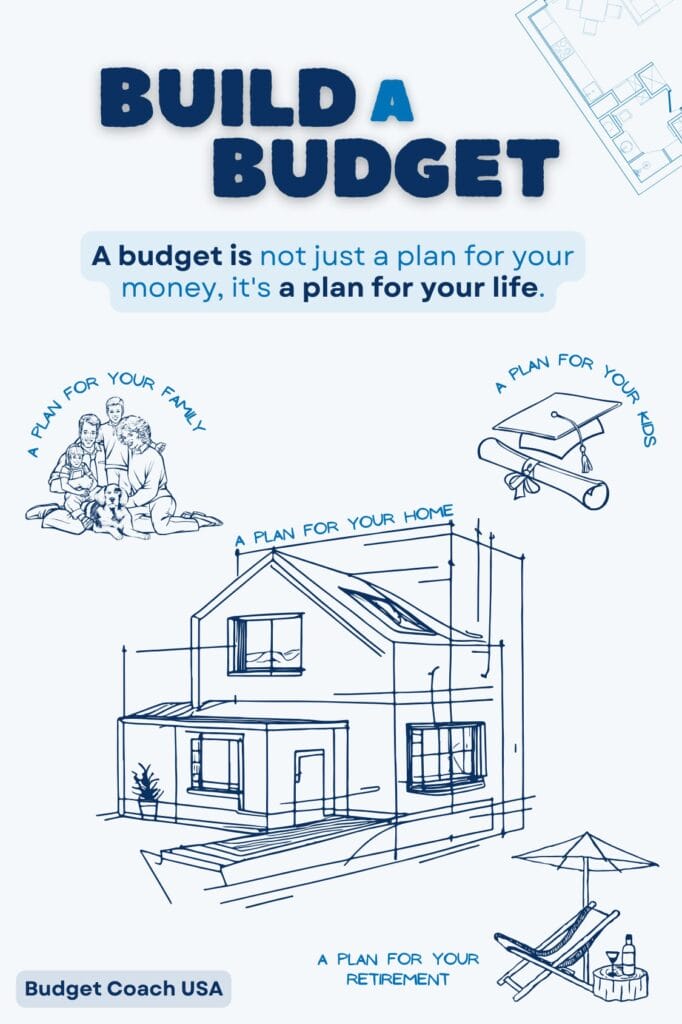

Build a budget and stress less about money

A budget is not just a plan for your money, it’s a plan for your life.

Using a zero-based budget is a great way to keep track of your money each month. In fact, it is the indispensable tool for financial freedom. But using a budget is more than just a monthly plan for your money. It is a plan for your life. Each month as you create your budget, you’ll have the opportunity to assign dollars to places other than just paying the bills. You’ll also be able to assign dollars toward paying off debt, going on vacations, saving for your children’s education, and retirement to name just a few. As you begin to see those dollars accumulating in a savings account for your various goals you begin to see a plan for your life emerge. Budgets create more certainty. Certainty creates less stress.

Listen to your budget!

Your budget is your guide. It isn’t your best guess. It’s a real plan. So as you budget each month, stay in tune with what your budget is telling you and make adjustments accordingly. Month by month you’ll see patterns emerge that you can adjust. You’ll begin to see how much control you really have vs the lack of control you used to feel. You’ll even begin to see various ways you can save even more money from your salary. Your budget is the life-blood of your financial future.

Learn how to make a monthly zero-based budget here.

Stay the course, even when it’s hard.

Challenges will come.

No matter how well you conduct your monthly budget planning, challenges will come. Cars need to go to the shop unexpectedly and medical bills can pop up quickly. School expenses for filed trips or fundraisers are sometimes a surprise. However, succeeding with money is a long-term commitment. It is about making smart choices, consistently and over time. So it is important to understand that challenges, in the grand scheme of things, are only a small blip in time. Any challenge today will be outweighed by making smart choices consistently over time. So stay the course even when it gets hard. You’ll be glad you did.

Success is a prize for those who keep going when others are quitting.

When it comes to succeeding with money, persistence is key. Success is a prize for those who keep going when others are quitting.

- Keep your dreams in full view

- Remember your “why”.

- Keep budgeting each month,

- Stay the course, even when it gets hard.

Budgeting each month is important because it removes the unknowns and replaces them with knowns. A zero-based budget brings certainty out of the unknown. It brings clarity out of confusion.

How to not stress about money.

Learning how to not stress about money requires an intentional game plan. Take time to inspire yourself by discovering what is most important to you. Discover “why” you want to make a change so you can quit stressing about money. Then consider what you would like your life to look like in 5, 10, or 20 years. Once you have a picture of what is important to you and what you would like your life to look like in the future, begin building a budget that supports your goals. (See our post on how to make a zero-based budget here.) Don’t budget each month just to pay your current monthly expenses, but also budget to pay down your debt and save for your future goals. If you need additional income to reach your goals consider a side hustle.

When challenges come, don’t get discouraged. It is just a moment in time. Winning with money is a prize for those who keep going even when it gets hard.

- Start with a game plan.

- Build a budget to support your goals.

- Stay the course, even when it gets hard.

Learn more about budgeting, paying off debt, saving, and more.