Are you tired of living paycheck to paycheck? Do you pay bills late due to a lack of organization or funds? Do you often feel like there is not enough money to cover your monthly expenses? A lot of people experiencing financial distress ask how do I make a budget? Learning how to make a budget is a skill that can help you save money, pay down debt, and get the life you want.

In this post, we’ll show you how to make a budget and offer you some tips to make it easier. After reading, take a moment to download this free budget PDF here. Using this free budget guide you’ll be able to get started on your path to less stress and more peace.

How do I make a budget that works?

My wife and I make a budget every month and I can show you how too. Take a moment to download this free budget PDF here. You’ll be able to complete each step along the way. No email is required.

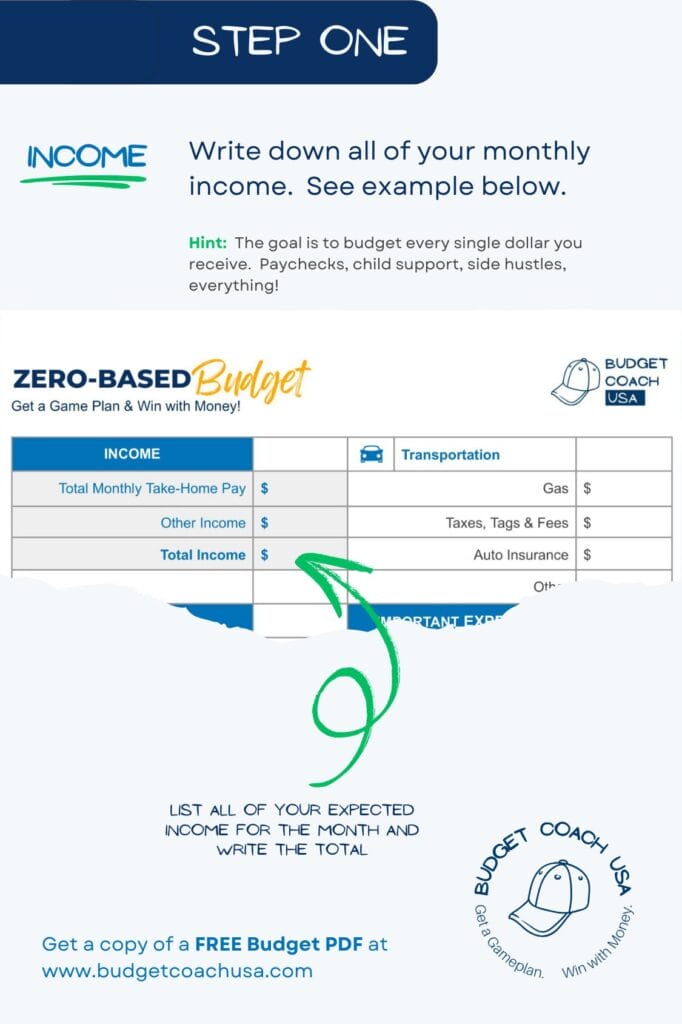

Step 1. Write down all of your monthly income.

If you are having a hard time knowing exactly how much you earn each month, refer to your bank account statements and look at recent paychecks. Include all income from both you and your spouse, if married. Be sure to include income from alimony, child support, and any side hustles. If you are paid every other week you are usually paid twice a month. However, there will be 2 months every calendar year in which you get three paychecks. So be sure to look at your paydays and the calendar to know when those months are. See the illustration below. Download this free budget PDF here. No email is required. Or, use a budgeting app.

Tips for determining your income

Include ALL income

You may get a monthly stipend from unemployment or child support etc… Those can be so regular that they just drop into your bank account and you forget about them. Refer to your bank account statements to make sure you catch ALL of your household income. We want to acknowledge all of your income so we can budget it and put it to work.

Be honest, don’t cheat.

No hiding income from yourself and especially, not your spouse. That’s called financial infidelity. Be honest about all of it. Knowing how to make a budget means being honest about all of the numbers.

Be sure to look for 3 paycheck months if you are paid every other week.

If you get paid every other week at your work, don’t forget that there are 2 months of the year that you get 3 paychecks. Those months can sneak up on you. So look up those months now so you know when to expect that third paycheck in your budget. Who doesn’t want an extra paycheck twice a year?

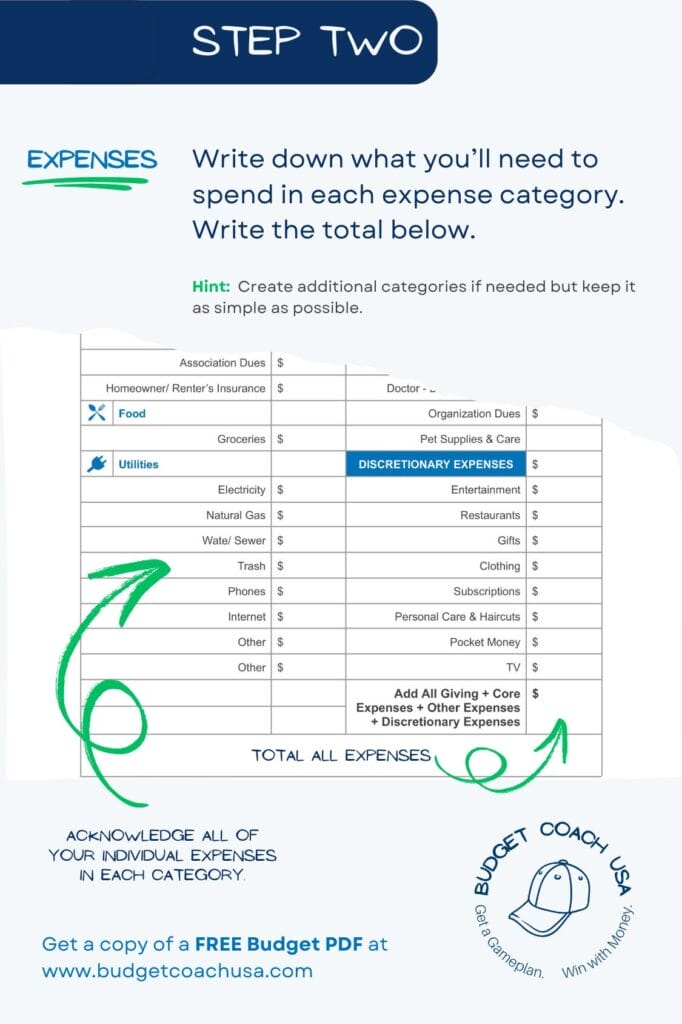

Step 2. Write down all of your monthly expenses

This step is a little more difficult. If you have never budgeted your money in the past it can be a challenge to even guess how much money you spend in certain categories such as groceries or gas. Remember that bank statement you looked at in the first step? Grab it again and use it as a guide while you are filling out your budget expenses for the month. You can add up all of the grocery store expenses as well as any restaurant or entertainment expenses. This is a lot of help when making a budget. See the illustration below. Download this free budget PDF here. No email is required. Or, use a budgeting app.

Tips for determining your monthly expenses

Use your bank statements as an initial guide.

Again, for the first couple of months, refer to your past bank statements as a guide to help you uncover your historical spending patterns.

Don’t get too specific with categories as it can be more detail than needed.

Getting too specific with your budget categories can lead to more details than is necessary. Budget categories should be specific enough to capture all of your monthly household expenses but not so specific that it creates extra work. For instance, a category for “gas” is usually enough. There is no need, in most cases, for a separate gas category for each vehicle. Keep it as simple as possible while capturing each distinctive different category.

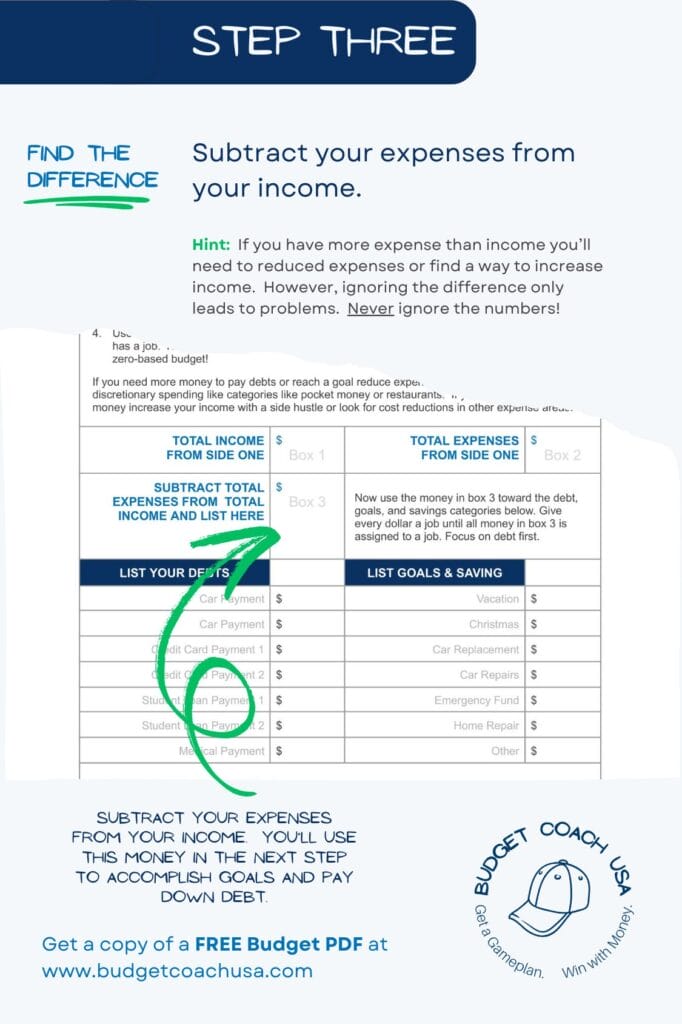

Step 3. Subtract your expenses from your income.

Once you have your total income (from step, one) and your total monthly household expenses (from step, two) let’s do some quick math. Subtract your total expenses from your total income. See the illustration below. Download this free budget PDF here. No email is required. Or, use a budgeting app.

Tips for step, three

Extra money left over?

If you have extra money left over move on to step 4 below. And congratulations! That’s awesome.

Are you in the red? Too many expenses and not enough income?

If your expenses are more than your income, you have two choices. You can go back and reduce expenses. When reducing expenses focus on discretionary expenses first. Discretionary expenses are expenses that are not absolutely necessary such as “fun money” or “restaurants”. The second thing you can do is increase your income. Doing nothing will lead to debt over time and we don’t want that!

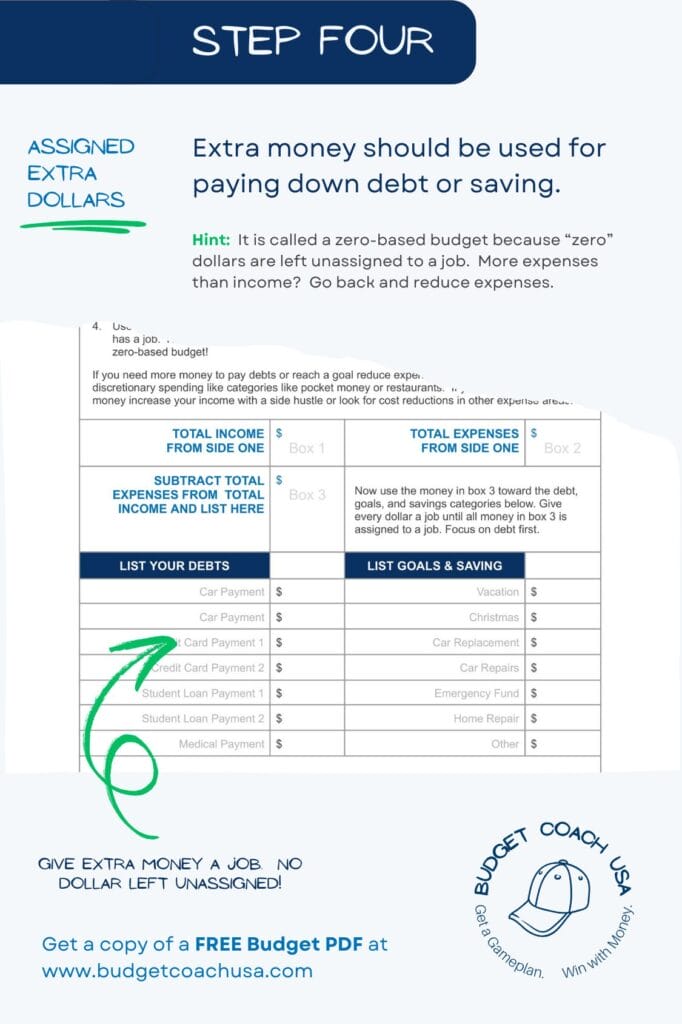

Step 4. Budget extra money toward goals or savings.

If you had additional money left over after subtracting your expenses from your income congratulations! Now it is time to give that extra money a job. Most people like to keep that extra money as a “buffer” in case they need it. Don’t fall for this trap. You want to use that extra money to pay down debt, save for a goal, or invest in retirement. This is what people who win with money do. If you don’t assign that extra money to a savings or investing category, it will leave you. I promise. Every single dollar must be accounted for in your budget. See the illustration below. Download this free budget PDF here. No email is required. Or, use a budgeting app.

Step 5. Track your budget all month long.

Budgets don’t work unless you follow them. They don’t magically work on their own. You have to be engaged each month in making your money behave and do the job you’ve assigned it to do in your budget. Budgets are done every month. A budget is not a set-it, and forget-it job. Your income and your expenses will vary at least a little every month so you need to make a budget every month to reflect those realities.

Tips for tracking your income and expenses

Check your budget frequently.

A lot can happen in a month. Sometimes an unexpected expense can come up. But that doesn’t mean you can overspend your budget. So you need to check your budget frequently over the course of the month so that you can make adjustments along the way. Occasionally you may need to reduce some spending on entertainment to cover that unexpected expense. It’s all part of budgeting but once you get the hang of it, the benefits are less stress and more peace.

Adjust as needed.

What do you do when the kids pop a field trip on you at the last minute that costs $100? Well, if you have a budget you just go back to a discretionary category and move some money out of it and into your kid’s school fund. That adjustment allows you to handle the expense while not overspending your total money for the month.

Use what you learn for the next month’s budget.

The more you budget the better you get. You start to know your family patterns and each month you can make future budgets more accurate and easier to do. For instance, we know based on years of experience that we need about $550 per month for groceries. And that gas runs us about $400 a month. We know this because we’ve learned over the years what our patterns are. The better you know your numbers the more effective you’ll be at getting the future you want.

Conclusion: How do I make a budget?

The hardest part of budgeting your money is at the beginning. Budgeting requires you to face the facts and your true numbers and it can be challenging to set spending limits, especially if you are not used to it. However, a monthly zero-based budget is the pillar of financial control. It helps you reach your goals, buy a home, and send your kids to college. Any serious effort to win with money must begin with a monthly zero-based budget.

Have you tried to budget before and failed? Don’t get discouraged. It can take several months to get your budget “dialed” in. If you have not paid enough attention to your income and spending in the past it can take some time to become familiar with the true numbers. But for those who keep budgeting, month after month, a great reward can be earned. You’ll begin to see debt reduced, savings increased, and much of the stress you’ve been dealing with begins to go away.

See the illustration below. Download this free budget PDF here. Or, use a budgeting app.