Free Zero-Based Budgeting PDF and Introduction to Our Comprehensive Guide

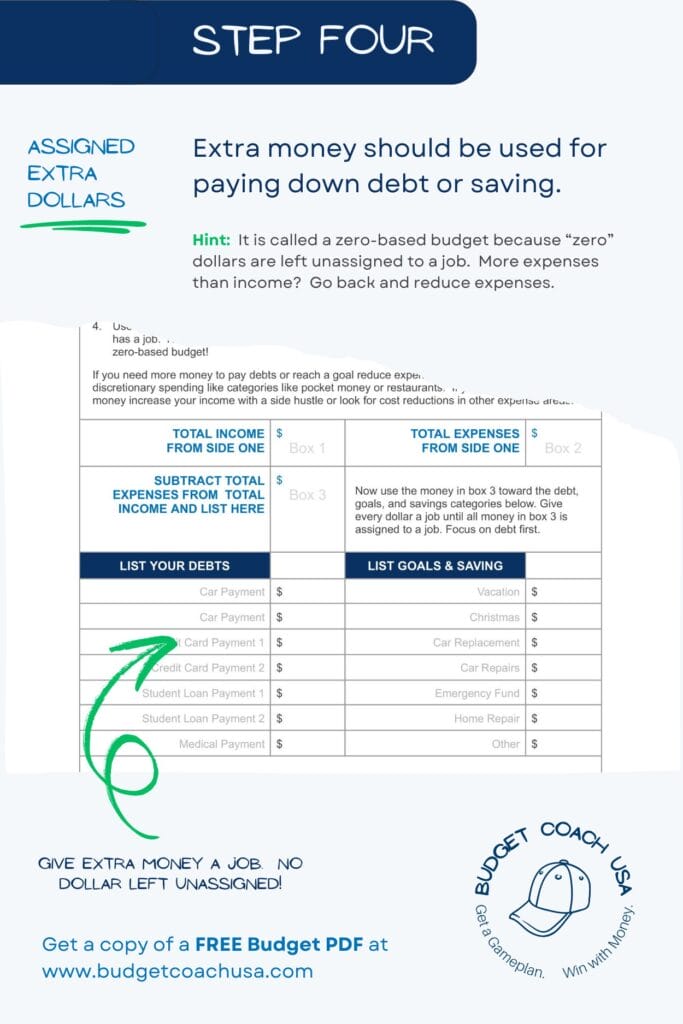

Zero-based budgeting is the pillar of financial control. Unlike other budgeting methods, zero-based budgeting requires every dollar of income is budgeted to a category. This means zero dollars left unassigned which leaves many people confused because their entire goal in previous attempts to budget was to have money “leftover” after paying their bills. Our free zero-based budgeting PDF will help you see how assigning every dollar of income to a job maximizes income, and helps reach goals faster. Get your free zero-based budget PDF here.

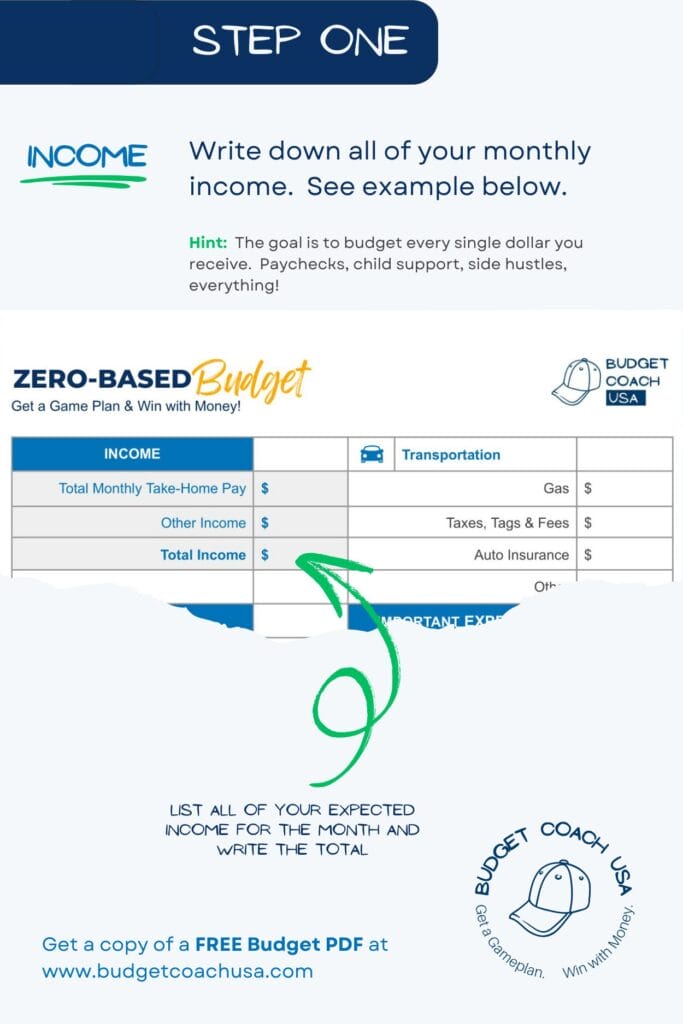

Step 1: Write down all of your income for the month.

Be sure to include your paychecks, alimony, child support, and any other sources of income for the month you are zero-based budgeting. Get your free zero-based budget PDF here.

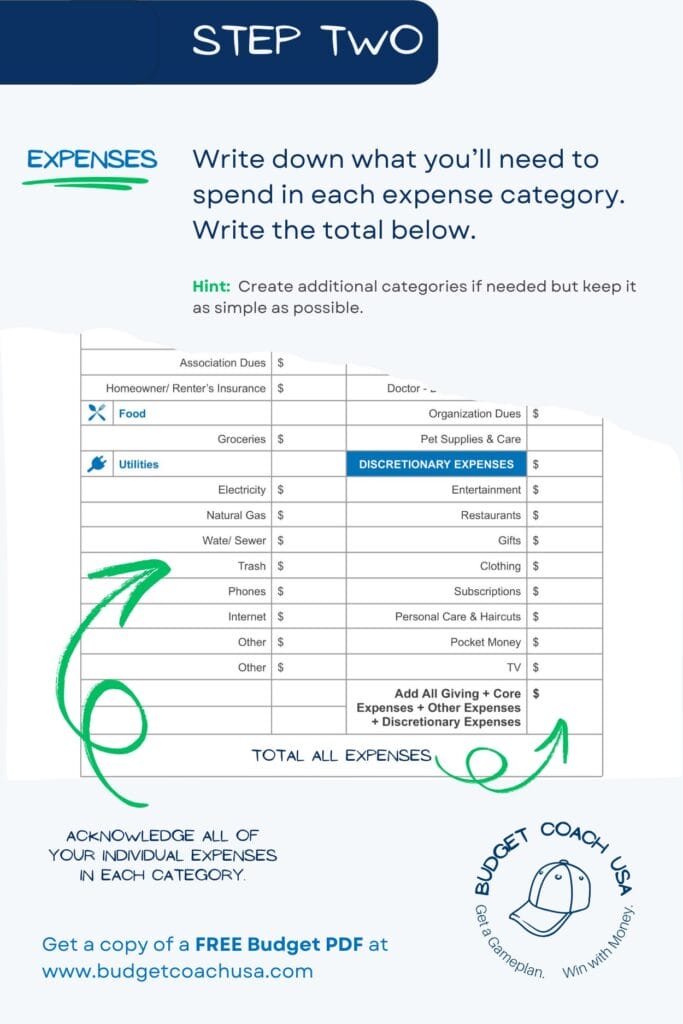

Step 2: Write down your expenses for the month.

Carefully consider each expense category and assign a dollar amount you plan to spend in that category for the month. We have broken expenses down into three categories in order of importance. When you are looking to cut costs consider cutting your discretionary expenses first. Get your free zero-based budget PDF here.

Core Expenses

These expenses are necessary to live. They keep a roof over your head, meals for your family, transportation for work, and health care if needed. Think of your core expenses as anything that assures your home, food, transportation, and health are funded.

Important Expenses

These expenses also include health care costs and insurance that are required or that protect your family, your home, and your autos. This category may also include alimony payments or child support payments. Think of your important expenses as necessary but do not threaten your ability to live in your home or eat food on a day-to-day basis.

Discretionary Expenses

These expenses you can live without for short to long periods of time.

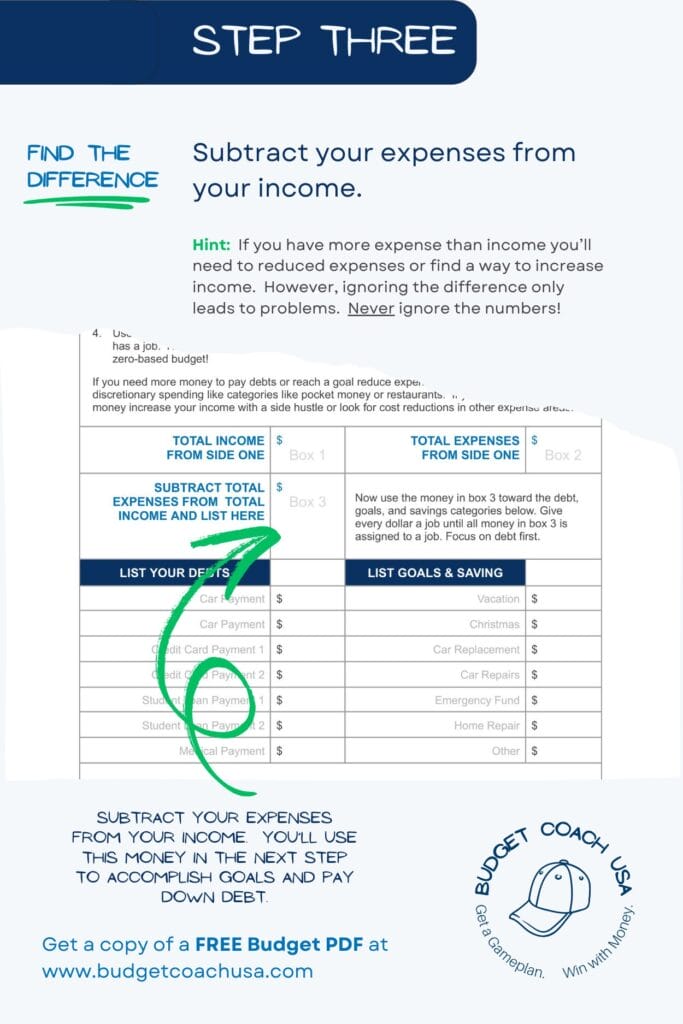

Step 3: Subtract your expenses from your income.

If you have more expenses than income you’ll need to reduce expenses or find a way to increase income. However, ignoring the difference only leads to problems. Never ignore the numbers! Get your free zero-based budget PDF here.

Step 4: Give Extra Money a Job

Extra money should be used for paying down debt or saving for future expenses such as Christmas or emergencies. Get your free zero-based budget PDF here.

Step 5: Track your expenses for the month.

If this month was a little bumpy that is okay. You can make adjustments for the next month. It usually takes about 3 months to get your budget “dialed” in. Disciplined spending will always be required. Get your free zero-based budget PDF here.

Tips for Using our Free Zero-Based Budgeting PDF

Make Your First Goal to Save a $1,000 Emergency Fund

Quitting dependency on debt means having an emergency fund in a savings account so the next time you need a car repair or have an unexpected medical bill you are not using debt to cover the expense. We recommend saving a $1,000 beginner emergency fund as your first goal. Get your free zero-based budget PDF here.

Cut Discretionary Expenses First If You Need More Money for Debt or Goals

Eliminating debt and saving for major purchases and life events is a necessary part of healthy personal finance. However, sometimes our wants get in the way of saving or paying off debt. When don’t have enough income to pay off debt (or save for a major purchase) as fast as you want look to your discretionary expenses category for savings first. Chances are, there are opportunities in your discretionary expenses category to redirect money to your debt snowball or savings goals.

Focus on Debt Before Retirement or Long Term Savings

We believe at Budget Coach USA, that a debt-free lifestyle is the quickest route to financial peace in your life. Before you save for long-term goals such as retirement, we recommend that you eliminate all debt (except your home) first. When you are debt-free you will be able to save quickly for any goal such as a new car or retirement.

Be Honest

Be honest with yourself. After all, you are budgeting because you want more control over your money. Don’t fudge or pretend that certain income or expenses “don’t count”. They all count. So write it all down, account for it all, and make your money behave. Get your free zero-based budget PDF here. Keep budgeting every month, even when it is hard.

7 Steps to Financial Wellness

- Save a starter emergency fund of $1,000 as fast as you can.

- Pay off your debt using a zero-based budget. Start by listing all of your debts except for your mortgage. Put them in order by balance from smallest to largest—regardless of interest rate. Pay minimum payments on everything but the little one. Attack that one with a vengeance. Once it’s gone, take that payment and put it toward the second-smallest debt, making minimum payments on the rest. That’s what’s called the debt snowball method, and you’ll use it to knock out your debts one by one until you are debt-free except for the house.

- Save a full emergency fund of 3 to 6 months of household expenses.

- Begin investing 15% of your gross income toward retirement.

- Contribute to children’s college education fund.

- Pay off the house.

- Build wealth and be generous.

Note: Steps 4,5 & 6 are worked on at the same time.Get Your

Final Thoughts on Our Free Zero-Based Budgeting PDF

Budgeting takes practice. So don’t give up if the first month is difficult. You will begin to win with money when you learn to perfect a zero-based budget and learn to make your money go where you tell it to go.

The more you budget, the better you will get. Within about 3-4 months, you will have flushed out all of the unknowns and will be making progress toward the financial future you want.