Creating and sticking to a zero-based budget is the most effective way to achieve financial stability and reach your long-term goals. Many people believe that they don’t need a budget because they are able to make ends meet without one, however making “ends meet” is a poor goal for our finances. Having a clear understanding of your income, and expenses, and the personal discipline to make your money work toward specific ends will help you grow wealth and retire with dignity. In this article, we’ll explore 6 reasons why you need a budget, regardless of your financial position.

6 Reasons Why You Need a Budget

1. If You Want Something to Change, Then Change Something.

If your finances are less than ideal as you read this you are probably beginning to acknowledge that what you have been doing in the past isn’t working for you now. “Making ends meet”, and “getting by” are the hallmarks of managing money without a plan. So, if this describes your current situation it is not a surprise you are reading this now. If you want something to change, then change something. If you don’t make a substantive change and point your efforts in a new direction you’ll be in the same place a year from now. What can you change to make your finances better? Learn how to make a zero-based budget and discipline yourself to stick to it.

If you don’t feel like you are on the right financial track, start with a budget. It will help right away. Then check out this article on how to further organize your money for success.

2. A Budget Leads to Financial Peace of Mind

Anxiety comes from the unknown. Stressing about money comes from the same place. If you are operating your finances without a budget you have a lot of unknowns whether you want to believe it or not. Budgets change your unknowns to knowns and offer you the ability to predict with much better certainty what your future will look like and that leads to financial peace of mind. A budget is a plan for your money. It is telling your money what to do before wondering where it went. A budget coupled with your commitment to sticking to it, will give you the peace of mind you are looking for. When the numbers are in the open, and you are acknowledging them without excuses, you are able to make decisions that move you forward in your financial journey. This is financial peace of mind.

3. A Budget is How to Get What You Want Without Using Debt

Want that new pair of shoes or that new 72-inch TV without the next-day guilt? Budgets help you prioritize your money so that you can have the things you want without using debt. When you organize your money ahead of time and on purpose, you can save for the future and for short-term goals like that new outdoor patio set. Debt equals risk and is the opposite of financial freedom. Using a budget helps you pay off debt and have the things you want from life and financial freedom as well. It is the best of both worlds!

4. Retire With Dignity

Youth doesn’t last forever and the day that you would like to be able to retire will arrive sooner than you think. When you use a monthly zero-based budget to organize your finances you are able to make room for consistent investment and planning over the long term. Investing and saving small amounts over the long term leads to good results. A monthly zero-based budget helps to make this possible by properly organizing your income. Retiring with dignity is possible when using a zero-based budget even if you are starting over later in life.

5. A Budget Tells You the Truth About Yourself and Your Money

If you are having trouble making the kind of financial progress you would like or if you are living paycheck to paycheck without much to show for it chances are you are not using your current income to your fullest advantage. A monthly zero-based budget is important because it will shed light on your spending habits and reveal the truth behind your struggles. Remember, if you want something to change, then change something. A budget reveals more about your money and your values which provides a useful vantage point for change.

6. A Budget is the Path to the Freedom You Really Want

- Using a monthly zero-based budget helps you live free of anxiety caused by financial unknowns because you are prepared and have plans.

- Using a monthly zero-based budget helps you create the margin you need to give to causes you care about and help others.

- Using a monthly zero-based budget helps you live the life you want on your terms.

- When you use a monthly zero-based budget you control your money, instead of your money controlling you.

How Can I Make a Budget?

Get our Free Zero-Based Budget PDF Planner Here. Download now.

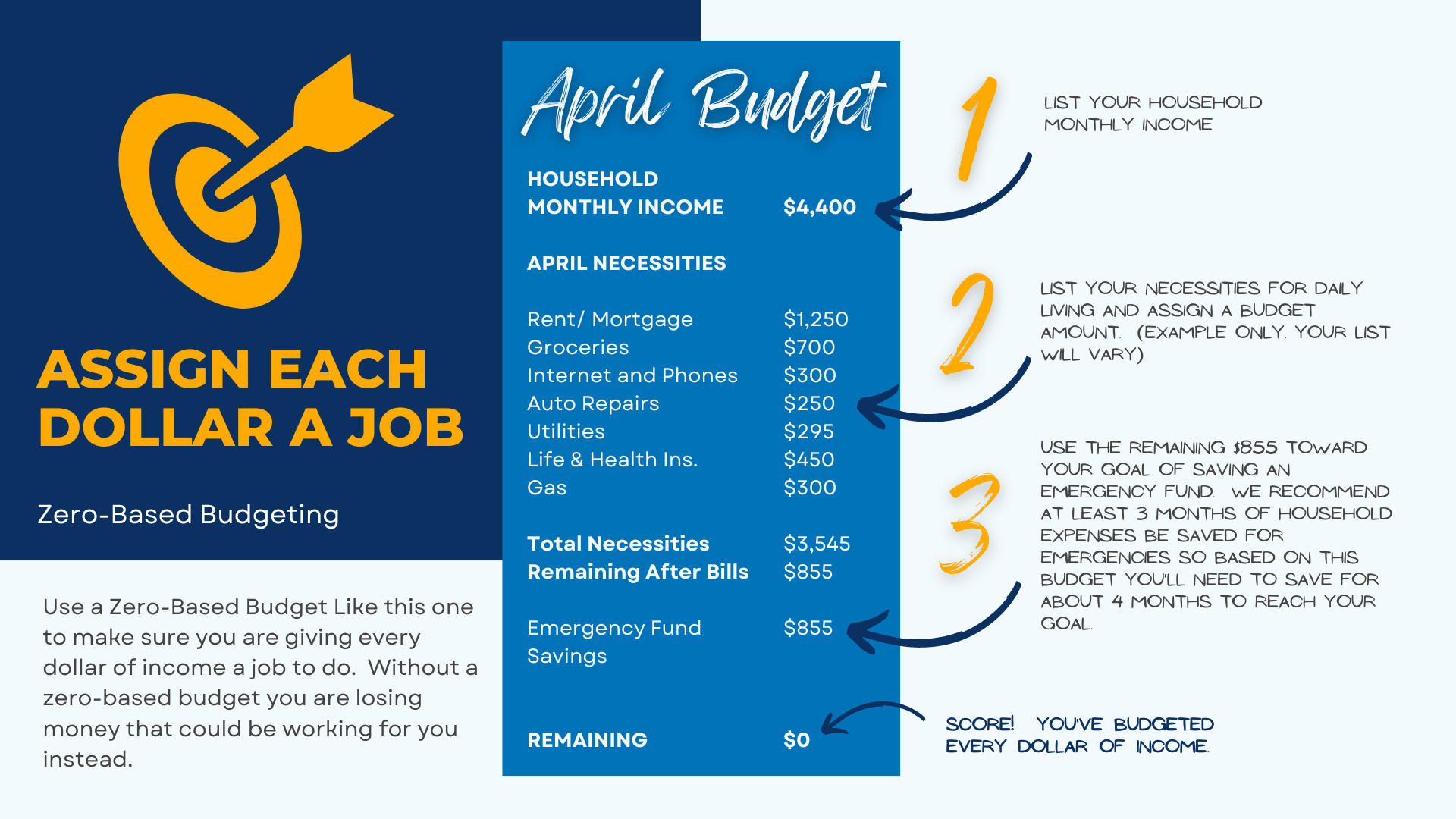

Step 1. Acknowledge and write down all of your monthly income.

Step 2. Next, let’s list out every category that you spend money on during any given month. Include everything you spend money on.

Step 3. Got your list completed? Now let’s enter how much money we expect to spend in each category for the month.

Step 4. Almost done. Next step; fine-tune it. The moment of truth. Add up your expenses and let’s compare them to your income. If you have more expenses than you do income, you’ll need to reduce expenses until your income is equal to your expenses. If you don’t you are just racking up debt and we don’t want that. More income than you do expenses? Kudos! But go ahead and assign those leftover dollars to a job. For instance, take the extra income and use it to pay down debt.

Our goal here is to give every dollar a job so we want a big fat “0” dollars left unassigned. This is called zero-based budgeting. Every dollar of income is allocated to a budget category so that no money is left unassigned at the end of the month. That way every dollar you earn has a purpose.

Step 5. Final and most important step. Track your spending and record each dollar spent in the appropriate budget category. You can only be successful if you say no to discretionary expenses if you don’t have the money left in that budget category. You have to control impulses to be successful.

How Often Should I Make a Budget?

Every month is the gold standard for zero-based budgeting. Before each month begins, create a budget for that month that reflects each dollar of income and each dollar of expected expenses. Don’t forget that each month is unique so you have to plan for holidays and birthdays and other occasions each month in your expenses. And, if you get paid every other week, you’ll need to remember there are 2 months of the year that you get 3 paychecks! So budget each month and take into account how that month is different from the previous. The important thing is to keep budgeting every month, even on the months it’s hard. Your commitment will pay off!

What is a Zero-Based Budget?

Free Zero-Based Budget PDF Download

A budget is the pillar of financial control. It is an indispensable part of money wisdom. If your spending is out of control, you need a budget. In fact, you need a budget regardless. According to author John Maxwell and often repeated by Dave Ramsey, “a budget is telling your money where to go before wondering where it went”.

Simply put, a budget is the assignment of your dollars before the month begins. Each dollar of income is organized on paper according to the places you plan to spend (or save) it. A budget is a written plan for your money before you receive it.

In Closing: 6 Reasons Why You Need a Budget

- If you are struggling with money and something needs to change…then change something by using a monthly zero-based budget.

- When you have your money and yourself under control, it leads to peace of mind. Peace, especially financial peace of mind is a wonderful thing.

- A monthly zero-based budget is how you get the things you want from life without using debt.

- You can retire with dignity.

- A budget tells you the truth about your habits and your money.

- Using a monthly zero-based budget organizes your money and your habits so you can have the life you really want.