Is being debt-free worth it? The burden of debt weighs heavily on countless lives, and some people question whether the pursuit of debt-free living is truly worth it. Others question if the goal is even attainable. Is it possible to live without owing anyone? Yes, it is and in this post, we’ll share 3 simple reasons why being debt free is most definitely worth it and the path out of debt for anyone who wants to achieve it.

Top 3 Reasons Being Debt-Free Worth It.

Our top 3 reasons being debt free is worth the journey.

1. You’ll gain financial peace of mind

Being debt free is worth it because it gives you financial peace of mind. Debt equals risk and when risks are reduced the anxiety level reduces as well. Most people experience anxiety around money because they don’t really know where their money is going or if they’ll have enough when they need it. What if I told you that you could know with almost certainty that when your car breaks down, you’ll have enough money to pay for the repairs in cash? Or that if your home’s roof springs a leak, you can handle the new roof without using credit? A well-planned and executed zero-based budget allows you to know where your money is, where it is going, and how much you need to save to keep “Murphy’s law” from your front door.

2. You’ll get control over your future

It is hard to think about a future that you control if you are always giving away your hard-earned money for debt payments. When you organize your money ahead of time and on purpose (using a budget), you can save for the future and for short-term goals like that new outdoor patio set. Debt equals risk and is the opposite of financial freedom. Using a budget helps you pay off debt and have the things you want from life and financial freedom as well. It is the best of both worlds!

3. It is a priceless gift for your children

You already know the impact that debt is having on you. It squeezes you emotionally and financially. And your kids see this. Especially as they get older. Being debt free is worth it because once you are debt free you begin to change the narrative (and the expectation) that debt is unavoidable. You can live a debt-free life and your kids will thank you for the gift of showing them how. Imagine their future beginning without the burden of debt. Showing them how to be debt free and avoid common money mistakes is a priceless gift to give your children.

How to Become Debt-Free

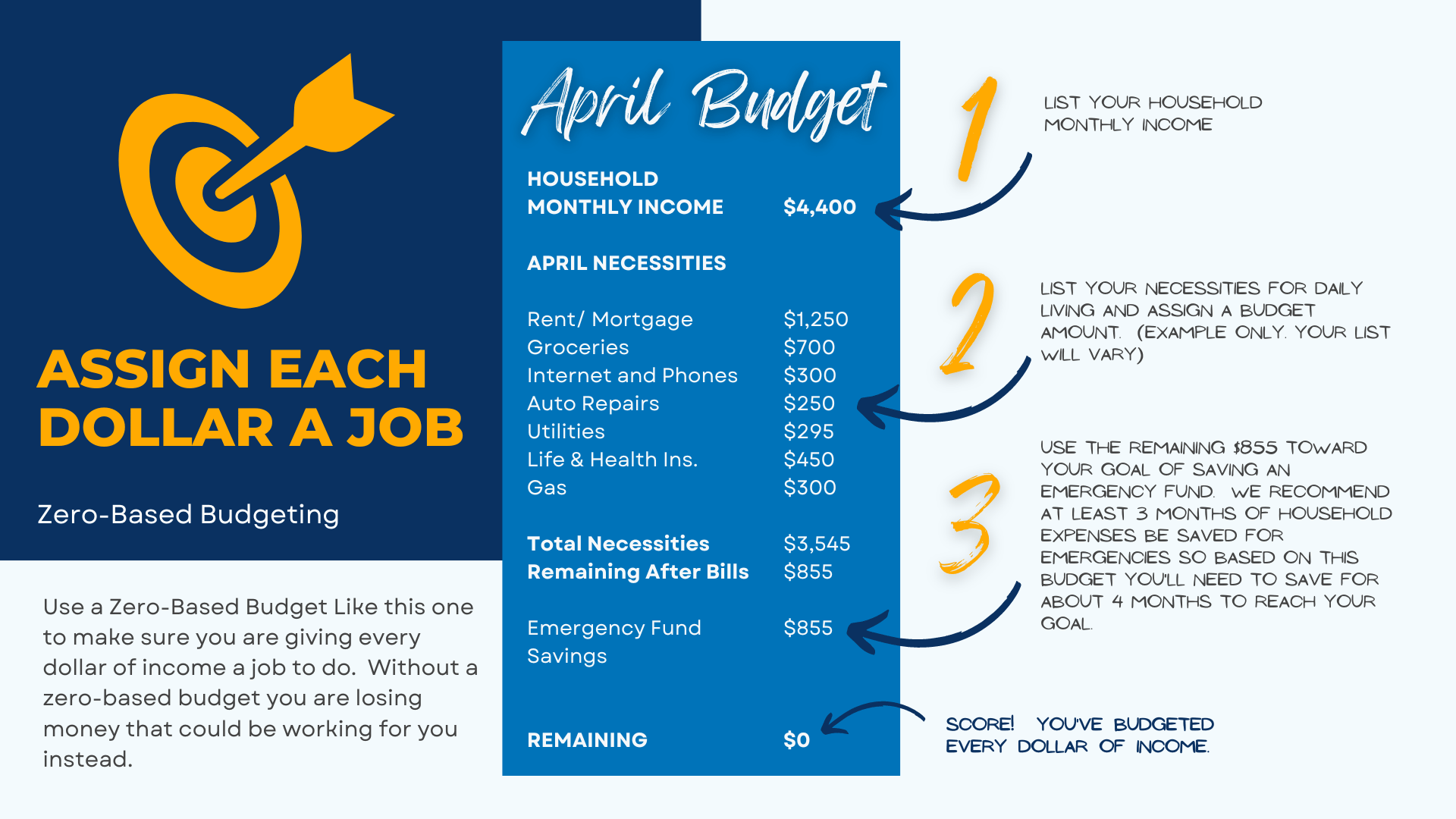

1. Start with a monthly zero-based budget.

Get our Free Zero-Based Budget PDF Planner Here. Download now.

Step 1. Acknowledge and write down all of your monthly income.

Step 2. Next, let’s list out every category that you spend money on during any given month. Include everything you spend money on.

Step 3. Now let’s enter how much money we expect to spend in each category for the month.

Step 4. Almost done. Next step; fine-tune it. The moment of truth. Add up your expenses and let’s compare them to your income. If you have more expenses than you do income, you’ll need to reduce expenses until your income is equal to your expenses. If you don’t you are just racking up debt and we don’t want that. More income than you do expenses? Kudos! But go ahead and assign those leftover dollars to a job. For instance, take the extra income and use it to pay down debt.

Our goal here is to give every dollar a job so we want a big fat “0” dollars left unassigned. This is called zero-based budgeting. Every dollar of income is allocated to a budget category so that no money is left unassigned at the end of the month. That way every dollar you earn has a purpose.

Step 5. Final and most important step. Track your spending and record each dollar spent in the appropriate budget category. You can only be successful if you say no to discretionary expenses if you don’t have the money left in that budget category. You have to control impulses to be successful.

2. Save a starter emergency fund of $1,000 as fast as you can.

Using your budget, build in a category to save a starter emergency fund. This helps you quit your dependency on debt. With a starter emergency fund of $1,000, you can pay cash for life’s inevitable curve balls and avoid pulling out the credit card. Later, when your debt is fully paid off, you’ll save a full emergency fund of 3 to 6 months of household expenses.

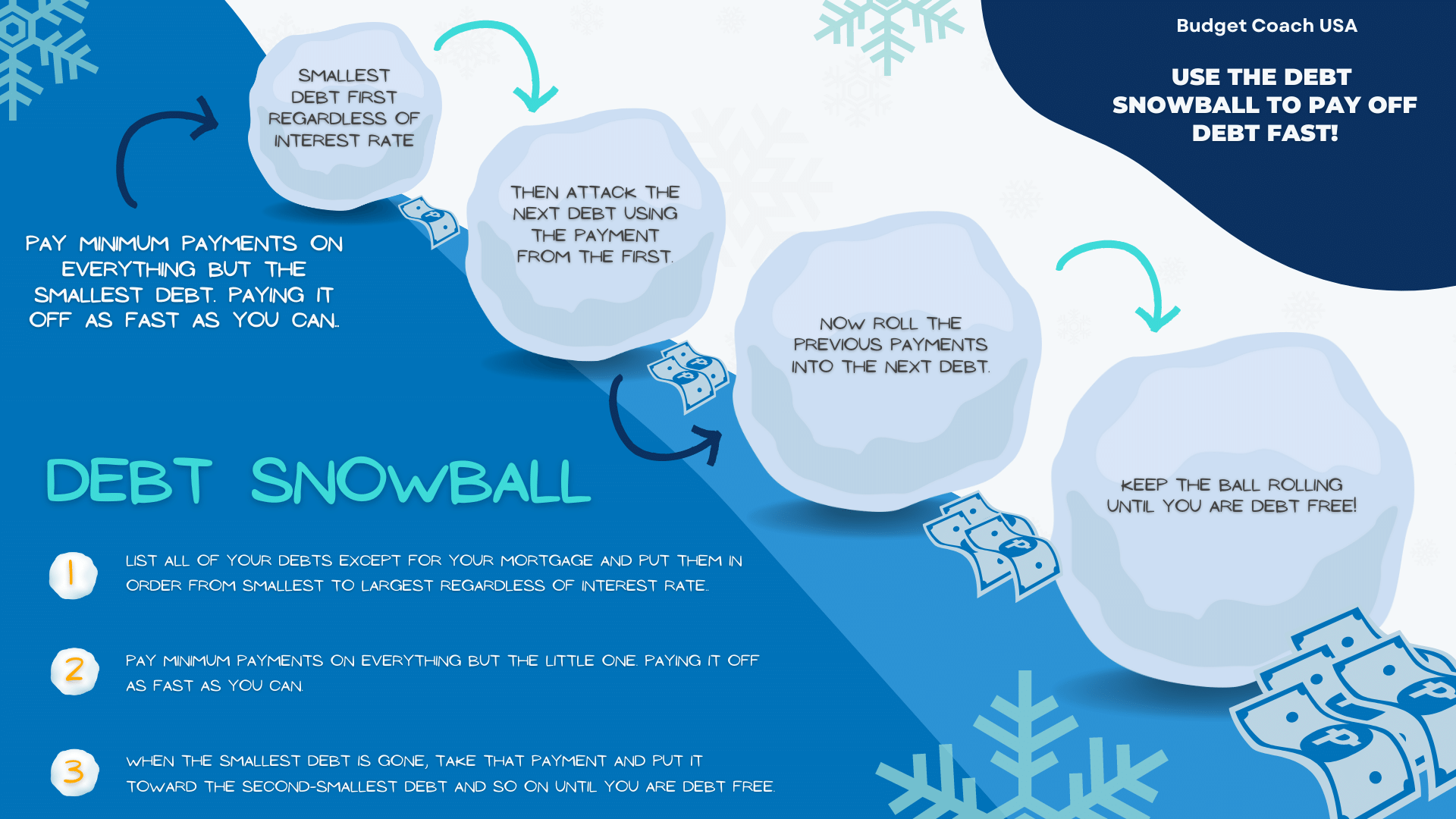

3. Use the Debt Snowball to pay off all of your debt.

Start by listing all of your debts except for your mortgage. Put them in order by balance from smallest to largest—regardless of interest rate. Pay minimum payments on everything but the little one. Focus on that one until it is gone. Then take that payment and put it toward the second-smallest debt, making minimum payments on the rest. That’s what’s called the debt snowball method, and you’ll use it to knock out your debts one by one until you are debt-free except for the house.