Introduction

Financial wellness is a growing topic largely in part to America’s growing love affair with debt and the stress it is putting on households across the United States. The accessibility of loans and credit cards combined with the effectiveness of product marketing has led to a culture in the US that has adopted debt in all forms as a way of life. We see the neighbor’s shiny new car and zero-turn mower and often fall victim to the comparison game, taking out our own car loans or maxing out the credit card just to keep up. What’s more, many people never understand they are playing the game until they wake up one day drowning in monthly debt payments. Unable to see a way out, they continue the “buy now, pay later” cycle robbing themselves of the future they deserve. But there is a better way.

Let’s talk about our financial wellness checklist.

Financial Wellness Checklist Item #1.

Begin With a Budget

The beginning point of financial wellness is the Zero-Based Budget. Most people think of a budget as something that is too restrictive; almost like it is a big stop sign. They think once they are on a budget, they’ll have to say no to all the good stuff in life and kiss fun goodbye, right? Not exactly. We think of a budget as the exact opposite. A budget is freedom. Yep, you read that right. Freedom.

A budget is telling your money you are in charge. And once you are making your money behave all that worrying about loss of freedom actually turns into the control you’ve been missing. Being in charge and being in control doesn’t sound restrictive to me. It actually sounds a lot more like freedom.

A budget is the pillar of financial control. It is an indispensable part of money wisdom. According to author John Maxwell and often repeated by Dave Ramsey, “a budget is telling your money where to go before wondering where it went”.

Simply put, a budget is the assignment of your dollars before the month begins. Each dollar of income is organized on paper according to the places you plan to spend (or save) it. A budget is a written plan for your money before you receive it. It is impossible to win with money if you are not actively controlling your money with a zero-based budget.

Get your free zero-based budget PDF here. Learn how to create a budget here. Learn about what financial wellness programs should include here.

Financial Wellness Checklist Item #2

Save a Starter Emergency Fund of $1,000 as Fast as You Can.

Using your zero-based budget as your guide, as fast as you can save $1,000 for a beginner emergency fund. Sell something, sell everything, sell the dog if you have to. But save a thousand dollars so the next time you have an emergency, you don’t reach for the credit card. This is the beginning of your debt management plan. If you want to know how to pay off debt the first step is to quit using debt. And to kick things off let’s start with a thousand-dollar emergency fund. Go ahead and cut up those credit cards too. No need to transfer credit card debt anymore. Your debt repayment plan is underway the right way! Get your free zero-based budget PDF here.

Financial Wellness Checklist Item #3

Pay Off Your Debt Using the Debt Snowball

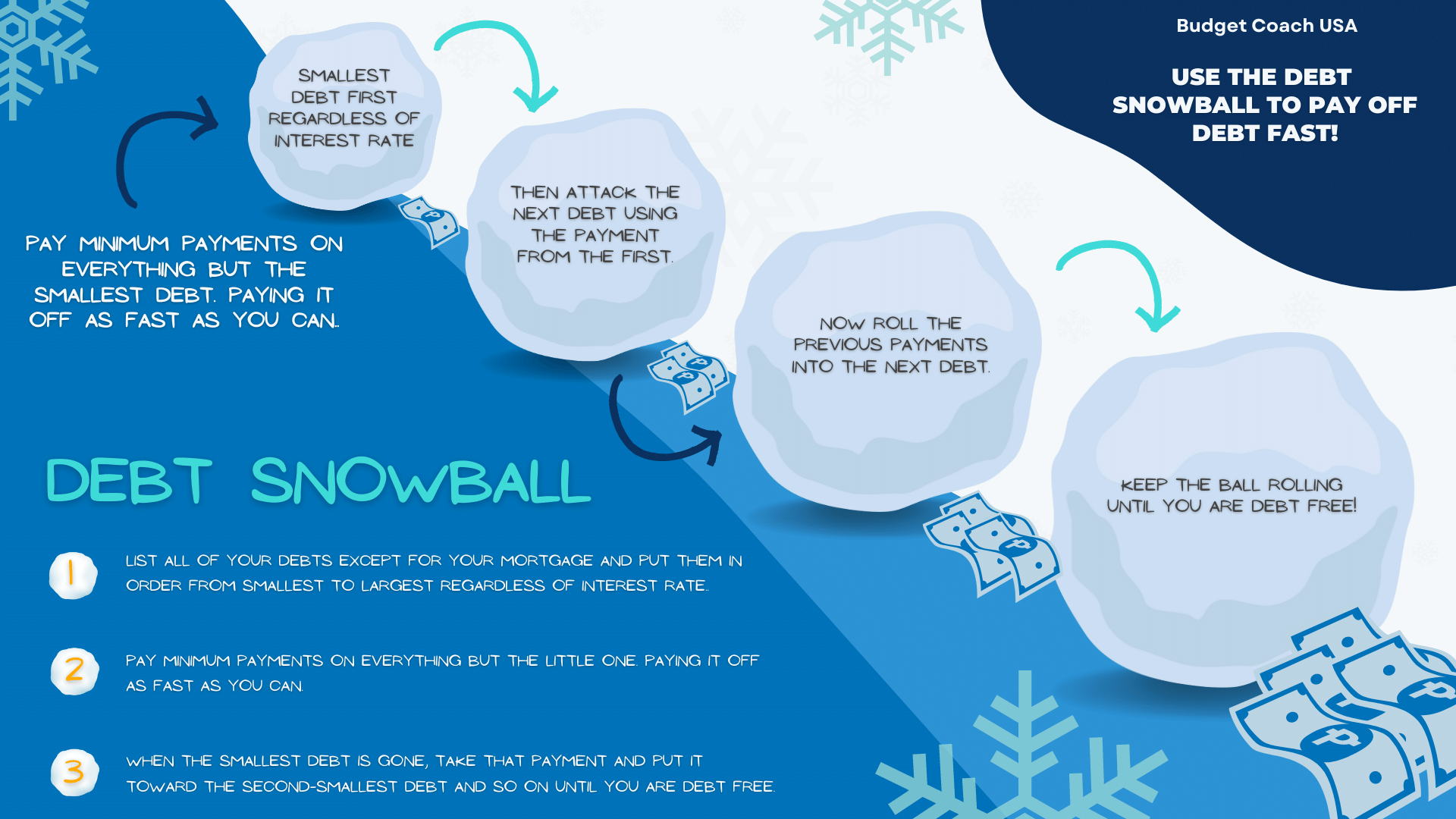

Line up all of your debts from smallest to largest and begin by attacking the smallest balance first regardless of the interest rate. No doubt you’ll have a sophisticated well-meaning relative or friend that wants to argue math and paying off the highest interest-rate debts first. They’ll be quick to point out that if you pay off the debt with the lower interest rate first it will cost a bit more vs paying off the highest interest rate first. While we will admit their math is correct they are missing one key element to your predicament. Math didn’t get you into credit card debt, your behavior did. And no one has ever corrected behavior with math. So let’s stack up a win as soon as possible and use that momentum to carry us on to the next win. Keep that $1,000 emergency fund intact and start paying off your debts from smallest to largest. And by the way, to help you get more momentum, we recommend that you stop all investing during this step. You need all of your ammo focused on getting out of debt.

Again, start by listing all of your debts except for your mortgage. Put them in order by balance from smallest to largest—regardless of interest rate. Pay minimum payments on everything but the little one. Focus on that one until it is gone. Then take that payment and put it toward the second-smallest debt, making minimum payments on the rest. That’s what’s called the debt snowball method, and you’ll use it to knock out your debts one by one until you are debt-free except for the house.

Financial Wellness Checklist Item #3

Save a Full Emergency Fund of 3 to 6 Months of Household Expenses

Now that you have kicked payments out of your life we are ready to make sure that we don’t end up there ever again. Our next financial wellness checklist item is to save 3 to 6 months of household expenses as a full emergency fund so that when life’s inevitable surprises occur, you have the money set aside to pay for them. When you have an emergency fund you mostly stop having emergencies. What we used to call emergencies are now more like an inconvenience. With a full emergency fund in place, you won’t need personal loans and you’ll soon find out that your credit score doesn’t matter anymore. No more need to make a balance transfer either.

Financial Wellness Checklist Item #4 (Do these 3 things at the same time.)

INVEST 15% of Your Gross Income Toward Retirement.

With debt out of your life, no more credit card balances, and a full emergency fund protecting us from a debt relapse, it is time to pick investing back up. Up until now, we paused investing until we had our debts paid off and our full emergency fund in place. Not it is time to pick it back up. Start contributing 15% of your household income into a retirement plan. Are you a bit older? You can do more if needed to catch up. Just don’t do less than 15%.

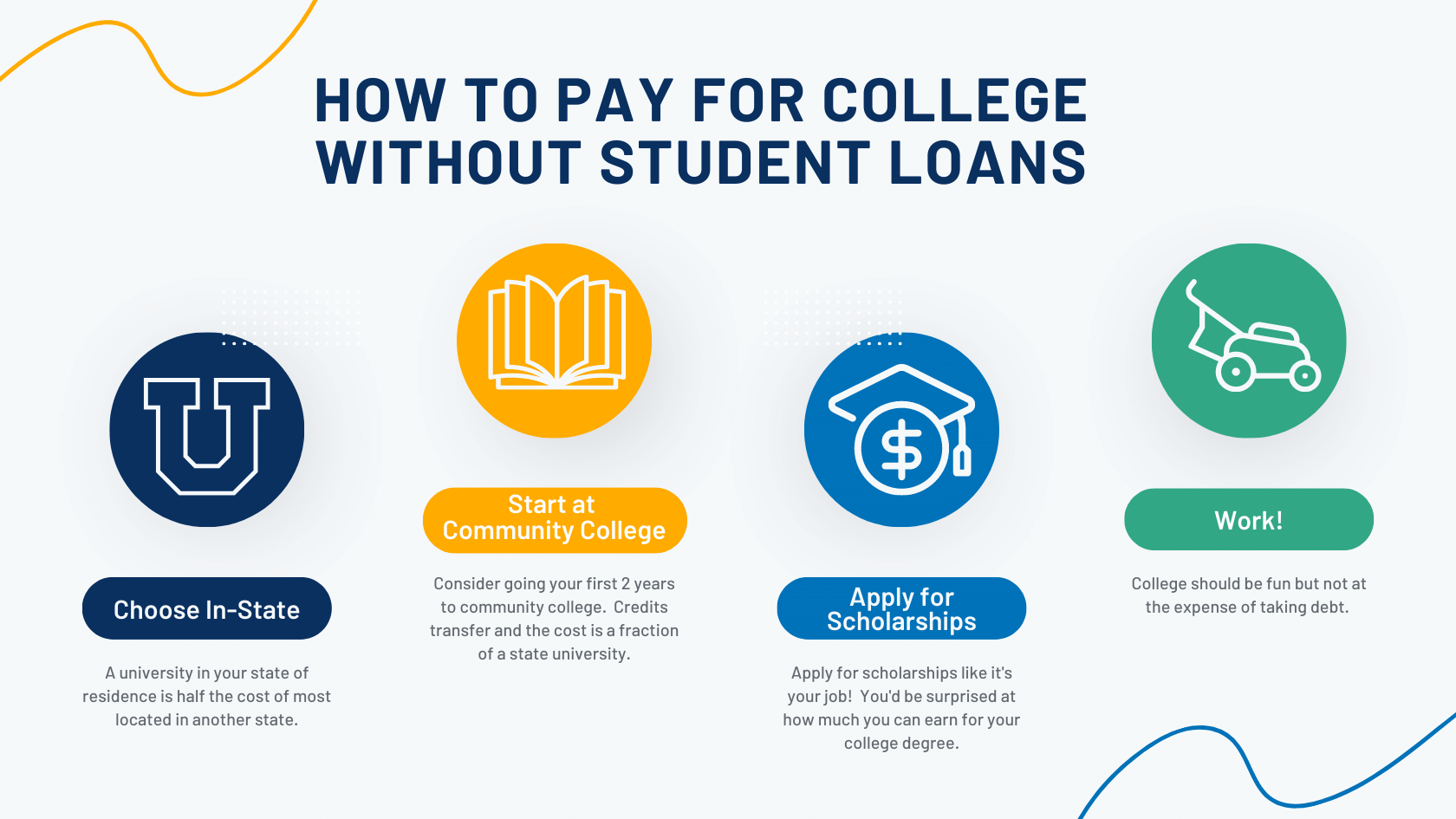

CONTRIBUTE to Children’s College Education Fund.

Okay. While we are investing 15% of our income in a retirement plan, let’s also start to save for our kid’s college education. A 529 college savings plan for your state is a great idea. You can find more creative ways to pay for college here.

PAY Off the House Early.

Now for the big kahuna. Anything extra you can come up with after steps 4 and 5 should be directed to your home mortgage. Pay it off early and as fast as you can. Life without a house payment is worth the effort. Can you imagine the extra money you’ll have each month to use for additional retirement, education, or vacations? Pay off the house early. No more home equity line. No more home equity loans!

Financial Wellness Checklist Item #5

Build Wealth and Be Generous.

Debt-free including your home. Sounds satisfying just to say it. What a great feeling. You learned how to pay off debt. Do you know what you can do with you don’t have a house payment or any other debt? Well, about anything you want. And here at Budget Coach USA we recommend that once you reach this stage you focus your extra income above your expenses toward generosity. I once heard Dave Ramsey say that the most fun you can have with money is giving it away. And I think he may be right. Can you imagine leaving a $100 tip for a server at dinner just because you got the feeling they need it? That is a fun way to use money and you can when you are debt-free and know how to win with money.

Additional Financial Wellness Checklist Items

Term Life Insurance

If you have little ones at home and or a spouse counting on you and your income always keep term life insurance in an amount of about 10X your annual income. Insurance term life is cheaper than you think and if anything ever happened to you they’ll be protected. Read about term life insurance vs. whole life insurance here.

Long-Term Disability Insurance

Long-term disability insurance protects you in the event you are unable to work. This is an important part of your financial wellness checklist. Read more about long-term disability insurance here.

Financial Coaching/ Budget Coaching

Financial coaching (sometimes called a budget coach or personal financial coach) is a trained coach who helps you identify opportunities and errors in your money habits. Coaches help you develop a game plan and build confidence so that you can win with money. They help you learn how to pay off credit card debt, build an emergency fund, save for retirement, and achieve the financial future you want. Financial coaches are sometimes referred to as Financial Literacy Coach or Budget Coach.

7 Steps to Financial Wellness

- Save a starter emergency fund of $1,000 as fast as you can.

- Pay off your debt. Start by listing all of your debts except for your mortgage. Put them in order by balance from smallest to largest—regardless of interest rate. Pay minimum payments on everything but the little one. Focus on that one until it is gone. Then take that payment and put it toward the second-smallest debt, making minimum payments on the rest. That’s what’s called the debt snowball method, and you’ll use it to knock out your debts one by one until you are debt-free except for the house.

- Save a full emergency fund of 3 to 6 months of household expenses

- INVEST 15% of your gross income toward retirement.

- CONTRIBUTE to children’s college education fund.

- PAY off the house early.

- Build wealth and be generous.

Note: Steps 4,5 & 6 are worked on at the same time.