Introduction

Having an emergency fund is crucial for financial stability and peace of mind. Unfortunately, many people struggle to establish or maintain this important savings account. Whether you’re starting from scratch or looking to boost your existing emergency fund, there are 3 reasons why creating an emergency fund should be a top priority. In this article, we share 3 reasons why creating an emergency fund should be a priority for anyone who wants to apply sound financial principles to their money life.

Top 3 Reasons Creating an Emergency Fund Should Be a Top Priority.

Reason # 1 – Emergency funds create a buffer between you and debt.

When you are on a debt-free journey the last thing you want is more debt. It deflates your progress and takes the momentum out of your progress. So the best way to prevent gathering more debt is to have an emergency fund on hand to pay cash for unexpected expenses.

The typical person without an emergency fund reaches for a credit card when unexpected expenses arise creating more debt and more stress. Be different! Create a buffer between you and more debt by making an emergency fund your top priority. It is the first step in your debt-free journey.

Reason # 2 – Paying cash for emergencies builds your financial muscles.

One of the most difficult parts of achieving a debt-free life is breaking the credit card crutch. Many people even describe their credit cards as “for emergencies only”. When a person manages their financial life this way, they cheat themselves of the opportunity to be truly free from credit dependency. Good financial habits are a muscle that you build and it takes practice. When you pay for that first emergency in cash you begin to build good financial muscles and a lot of confidence too. Does your car need a new transmission? Paying for the repair with your emergency fund, without more debt, feels great! Creating an emergency fund should be a top priority because it is an indispensable part of breaking the cycle of debt. When you pay cash for emergencies you build financial muscles that help you to create the future you want for yourself and/ or your family.

Reason # 3 – You’ll experience more peace around your finances.

Creating emergency funds is a top priority because it reduces risk and replaces it with more certainty. Most people feel the most unsettled when they cannot feel secure about their future. By making the creation of an emergency fund a top priority you are reducing the anxiety level by removing the risk of going into more debt when unexpected expenses arise. This is (financial) peace. What if I told you that you could know with almost certainty that when your car breaks down, you’ll have enough money to pay for the repairs in cash? Or that if your home’s roof springs a leak, you can handle the new roof without using credit? I bet your anxiety level would be reduced and you would feel more peace. A well-planned and executed zero-based budget with a full emergency fund allows you to know where your money is, where it is going, and how much you need to save. This equals peace.

What is an Emergency Fund?

Emergency funds create a buffer between you and debt. An emergency fund is an amount of money set aside (in a separate savings account) that is used for surprise expenses that are not typically contemplated in your monthly budget. For instance, you may include a small amount of money in your monthly budget for car maintenance such as oil changes. However, what do you do at your next oil change when the mechanic tells you you’ll need a new water pump or risk being stranded soon? This is where an emergency fund comes in. An emergency fund keeps you from using debt to pay for surprise expenses.

How Much Should You Have in an Emergency Fund?

Most experts recommend a minimum of 3 months and up to 6 months of household expenses on hand for emergencies. If your average household expenses are $5,000 per month then your 3-month emergency fund would be $15,000. Budget Coach USA recommends a 6-month emergency fund for better protection. Savings beyond a full 6-month emergency fund are generally best used toward longer-term goals such as a home downpayment, retirement, or replacing a vehicle for instance.

What is an Emergency Fund Used For?

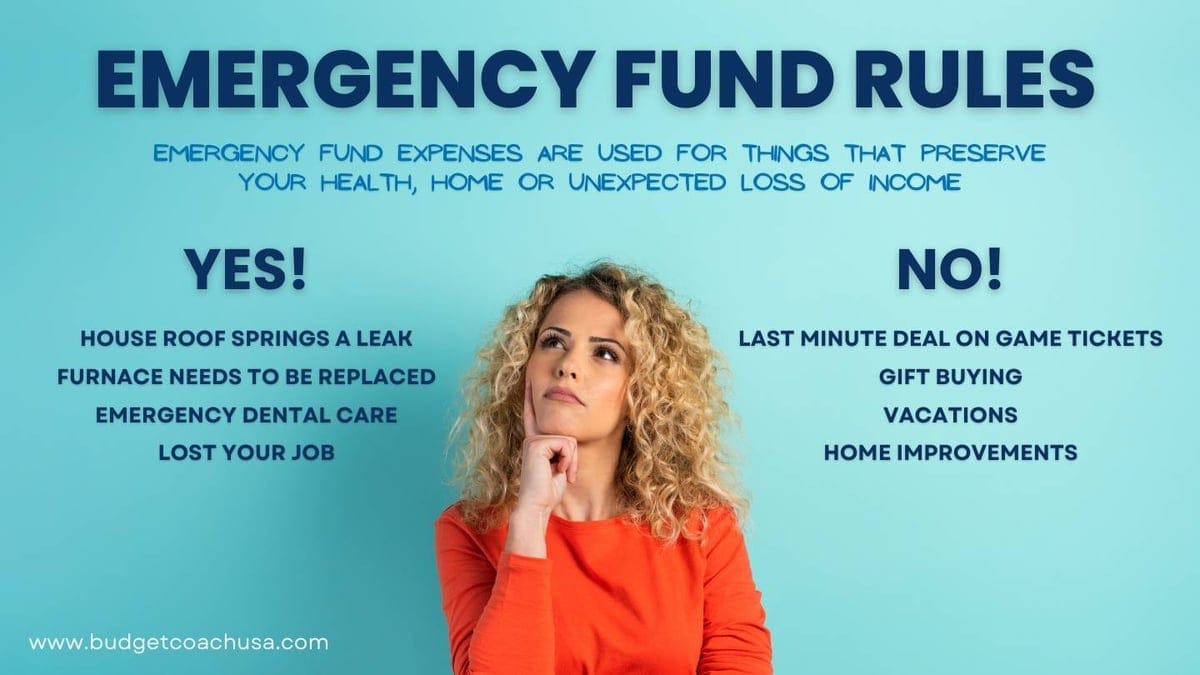

Emergency funds are used for unexpected expenses not able to be paid for through your monthly household budget. So any surprise expense that is necessary for your household to function.

Emergency funds are used for unexpected expenses not able to be paid for through your monthly household budget. So any surprise expense that is necessary for your household to function.

How Can I Save for an Emergency Fund?

Get on a budget! Telling your money where to go is the first step to taking control of your financial life. A zero-based budget is important because it forces accountability over how you choose to spend or save every single dollar. You may have tried in the past to write down how much you are going to spend in certain categories for a month, however, if the budget you are creating is only a loose collection of how much you plan to spend it misses a key element: You haven’t weighted your spending against your income and assigned every dollar of income to a job. Further, the dollars of income that are not assigned to a job are likely to walk away, or at minimum, they’ll be directed toward the wrong target. You know that you have assigned every dollar a job when your income minus your expenses equals zero. Zero does not mean that you have no money left, it means that you have given every dollar (even the extra ones) a job to do. There is a big difference. It means that all of the money you earn is pointed toward a goal such as saving, investing, paying down debt, or in this case, saving for an emergency fund.

Creating an Emergency Fund Should be a Top Priority.

Without an emergency fund, you are living on the edge of accumulating more debt every day. Problems with the house, health, or your car are just a few ways that life creates challenges. However when you have an emergency fund what used to be an “emergency” really becomes more of an inconvenience. Emergency funds create a buffer between you and more debt. They create peace of mind. Creating an emergency fund is a top priority because it is an indispensable part of sound personal finance. Learn more about how to kickstart your emergency fund!

7 Steps to Financial Wellness

- Save a starter emergency fund of $1,000 as fast as you can.

- Pay off your debt. Start by listing all of your debts except for your mortgage. Put them in order by balance from smallest to largest—regardless of interest rate. Pay minimum payments on everything but the little one. Focus on that one until it is gone. Then take that payment and put it toward the second-smallest debt, making minimum payments on the rest. That’s what’s called the debt snowball method, and you’ll use it to knock out your debts one by one until you are debt-free except for the house.

- Save a full emergency fund of 3 to 6 months of household expenses

- INVEST 15% of your gross income toward retirement.

- CONTRIBUTE to children’s college education fund.

- PAY off the house early.

- Build wealth and be generous.

Note: Steps 4,5 & 6 are worked on at the same time.