Introduction to Spending Money Wisely

Spending money wisely is an important choice that most people face multiple times every day. Spending money wisely, and consistently, over time can lead to financial stability and success. In a world filled with tempting choices and constant marketing messages, it can be easy to overspend and lose sight of our financial goals. However, by understanding what it truly means to spend money wisely, individuals can make informed decisions that align with their values, priorities, and long-term objectives. This article explores the concept of wise spending, offering practical tips and insights on how to manage money effectively in order to achieve the life you want.

What does it mean to spend money wisely?

Spending money wisely means that your spending is aligned with your responsible long-term financial goals. Because spending money wisely is defined in contrast to spending that is not aligned with your goals and objectives it is impossible to know if you are spending wisely if you are not managing your money compared to your financial goals. For example: If I spend all of my extra money for the month, let’s say $1,000, on a new TV and therefore cannot contribute to my goal of saving $1,000 per month, then that TV purchase is most likely unwise spending. But the only way I know this is because I had a goal to save $1,000 to begin with. In other words, wise spending can only be evaluated through the lens of a budget that is tuned to responsible long-term financial goals. Without personal goals and a monthly zero-based budget, your financial life will be like a ship without a compass. Evaluating your spending choices is best done in the context of your monthly zero-based budget.

How do you spend money wisely?

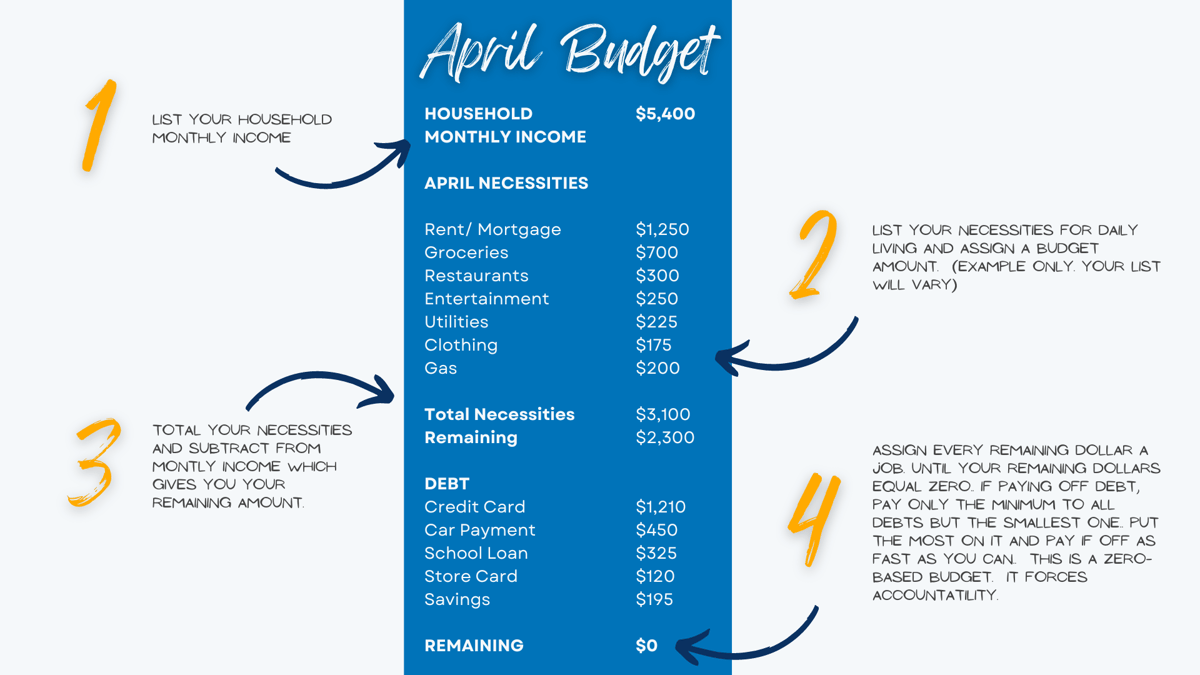

If you want to spend money wisely, you’ll need to begin with a budget that includes all of your monthly income and expenses. Carefully list all of your expenses for the month as well as any goals you have (such as saving for a new car) and apply your income to those expenses and goals. See the example below.

In the budget example above, all household expenses totaled $3,100 and the income totaled $5,400. The remaining $2,300 was assigned to debt payments and savings. This is an example of wise spending because the budget assigns every dollar of income to a specific job and no evidence of excessive spending getting in the way of household financial obligations.

How do I know if I’m spending money wisely?

Signs you are NOT spending money wisely:

- Do you have creditors calling your house about late payments?

- Are you paying for Christmas on a credit card instead of paying cash?

- Does the check engine light cause you stress?

- Are you arguing about money with your spouse?

- Are you consistently wishing you had more money?

- You are not achieving your financial goals, if any.

- You have no plan for retirement.

- Your debt balances are increasing.

How to tell if you ARE spending money wisely:

Spending money wisely is easy to spot if you are willing to look for it. People who spend their money wisely are most often at peace with their financial life because they have a compass for their financial ship! And it is evidenced by several clues.

- You create and stick to a monthly zero-based budget that reflects your goals.

- You have financial goals and dreams and evaluate your spending thru that lens.

- You have an emergency fund of 3 to 6 months of household expenses saved instead of using that money for a new toy.

- You are investing 15% of your total household income toward retirement.

- You pay cash for things like vacations instead of using debt.

- Emergency expenditures such as car repairs are more inconvenient than an emergency.

What if I’ve not spent money wisely and now I have a money mess?

If you need to clean up a money mess have no fear! You can do it, I promise. The first step to spending money wisely is to create a zero-based budget. You can start with our free zero-based budget pdf download here. List all of your income and all of your expenses. Don’t fudge or leave things out. Everything matters so be honest. Budgets are very important because they help you track your income and expenses but also enable you to prioritize your spending and savings to meet your goals. Once you have created your budget stick to it. You’ll need to create your budget monthly and adjust each month to new expenses and new income. Every dollar matters. A budget is freedom and it is the pillar of financial control.

Once you have your budget you’ll need to develop the discipline to stick to it.

Tips for Sticking to a Budget

Spending is an appetite! And left unchecked, appetites only grow. So if you are going to spend money wisely you’ll need to learn how to control your appetite. Here are some tips for sticking to a budget and controlling your appetite.

1. Have a Realistic Goal

Don’t try to do too much in the first month. Is your heart set on getting out of debt or taking charge of your money? That’s awesome! Just remember that you are learning a new skill and just like taking on a new exercise routine or hobby you are best served to leave yourself room to learn. So if the first couple of months is not perfect that’s okay. Learn and keep moving forward. You’ll be a budgeting pro in no time.

2. Plan Your Meals

For many people, the single biggest driver of discretionary spending is food. Yep. Food. By that, we mean groceries and restaurants. So if you don’t keep a close eye on the grocery and restaurant budget it can get out of hand fast. So plan those meals. Not every night can be seafood. A good old-fashioned taco Tuesday never hurt anyone. If you plan your meals BEFORE you go to the store, you’ll be able to fill up your cart with groceries that are more likely to be on budget.

3. Check Your Budget Frequently

By frequently we mean daily. If you want to be successful you have to know your numbers! That means checking in daily or at minimum 4 times a week on your spending. Record those expenses, see how much money is left in your budget, and behave accordingly. Doing this little by little will help you from overspending your budget categories.

4. Consider Your Social Calendar

Peer pressure is the enemy of diets and budgets. Are co-workers going out to eat? Do friends want to meet for drinks? That’s all fine if you have the money in your budget but what if you don’t? How about asking them to come to your house for a game night and grill out instead?

5. Choose What You Want Most Over What You Want Now

Choose what you want most over what you want now. If you are like me what you want now is to go out to eat. But what I want most is to be debt free and have financial peace. So, I evaluate what I want now with my budget. If it doesn’t fit, I choose what I want most instead. Choose what you want most over what you want now.

Wrap-Up: Spending Money Wisely

It is easy to get distracted with money and spend unwisely. But if you are going to win with money you must begin with creating a zero-based budget which serves as a guide and compass to your spending decisions. A zero-based budget is the pillar of financial control and helps you spend money wisely.

If your first month of budgeting is a little rocky, don’t give up. It takes most people at least 3 months of budgeting to learn how to tune their budget and flush out all of the income and expenses in your household. So start with your first budget now and download your free zero-based budget pdf today. You’ll be spending money wisely and making progress toward the life you want.

7 Steps to Financial Wellness

- Save a starter emergency fund of $1,000 as fast as you can.

- Pay off your debt. Start by listing all of your debts except for your mortgage. Put them in order by balance from smallest to largest—regardless of interest rate. Pay minimum payments on everything but the little one. Focus on that one until it is gone. Then take that payment and put it toward the second-smallest debt, making minimum payments on the rest. That’s what’s called the debt snowball method, and you’ll use it to knock out your debts one by one until you are debt-free except for the house.

- Save a full emergency fund of 3 to 6 months of household expenses

- INVEST 15% of your gross income toward retirement.

- CONTRIBUTE to children’s college education fund.

- PAY off the house early.

- Build wealth and be generous.

Note: Steps 4,5 & 6 are worked on at the same time.