Budgeting is indispensable for personal money management, yet many individuals and couples overlook its importance. Some people don’t want accountability, even to themselves, and others have never been taught how to create a budget however failing to establish and adhere to a budget can have serious consequences that impact both short-term financial stability and long-term goals. From living paycheck to paycheck to accumulating debt and lacking savings, the repercussions of not budgeting can be far-reaching. In this article, we will explore 5 consequences of neglecting proper budgeting practices and the steps that can be taken to avoid them.

5 Consequences of Not Budgeting

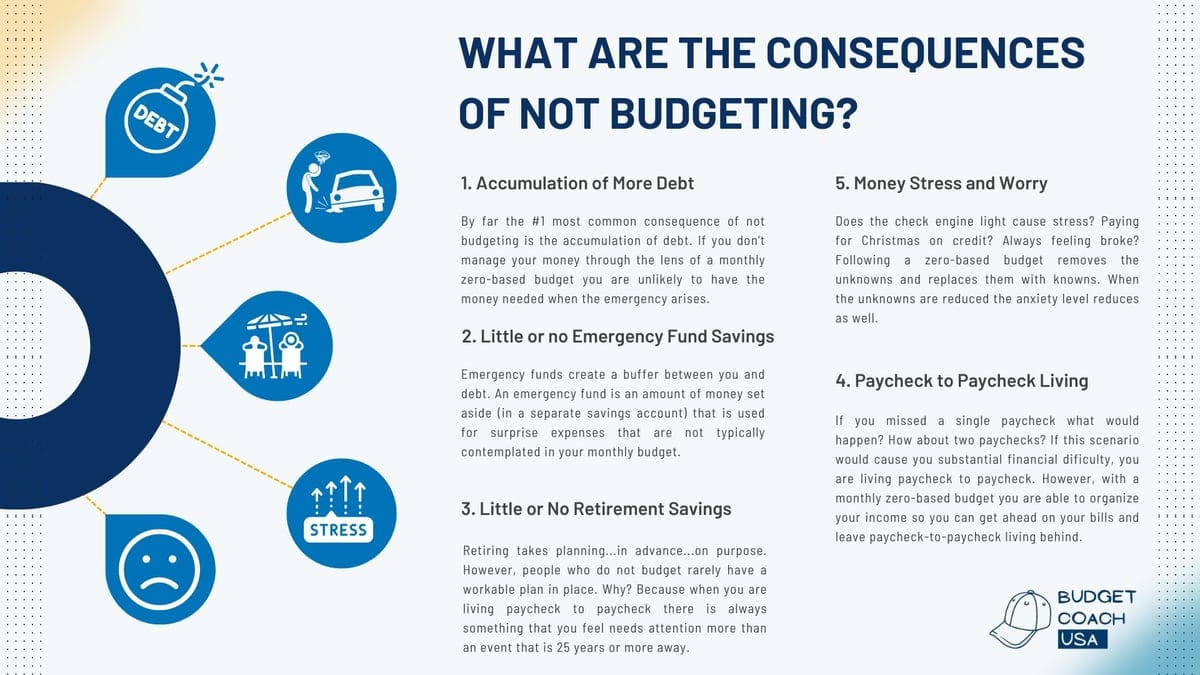

1. Accumulation of debt

By far the #1 most common consequence of not budgeting is the accumulation of debt. If you don’t manage your money through the lens of a monthly zero-based budget you are unlikely to have the money needed when the family dog needs a $3,000 surgery. When this happens, or any other similar situations occur, the credit card comes out and more debt is created. However, when you follow a carefully planned zero-based budget, you are able to create the margin needed in your finances to handle such situations.

The consequences of not budgeting include the accumulation of debt. Debt is a financial product that enriches the (lender) bank, not you. Your bank is not like your local library. They won’t let you borrow for free and bring it back whenever you feel like it. Your bank exists to make money and its primary product is debt. Their goal is to sell you as much debt as they can, for as long as they can. And it all comes at your expense. You can’t build a stable financial future playing catch up.

Learn how to create a zero-based budget or download a free zero-based budget pdf here.

2. Little or no emergency fund savings

Emergency funds create a buffer between you and debt. An emergency fund is an amount of money set aside (in a separate savings account) that is used for surprise expenses that are not typically contemplated in your monthly budget. For instance, you may include a small amount of money in your monthly budget for car maintenance such as oil changes. However, what do you do at your next oil change when the mechanic tells you you’ll need a new water pump or risk being stranded soon? This is where an emergency fund comes in. An emergency fund keeps you from using debt to pay for surprise expenses.

A very common consequence of not budgeting is the lack of emergency fund savings. Budgeting creates peace of mind so when life’s inevitible curve balls come, you are prepared to respond. Budgeting helps you create and sustain emergency funds. When you have emergency funds in the bank, most emergencies become more of an inconvenience than an emergency. It is a great feeling.

3. Little or no retirement savings

Retiring takes planning…in advance…on purpose. However, people who do not budget rarely have a workable plan in place. Why? Because when you are living paycheck to paycheck there is always something that you feel needs attention more than an event that is 25 years or more away. At least that is the story you tell yourself. As with anything personal finance, it all begins and is maintained with a budget and by knowing your numbers.

Retiring with a seven-figure retirement account is possible through wise and diligent financial management throughout a person’s working life. In other words by budgeting your income! (See this article on saving money from your salary for more information.)

To avoice the consequense of not budgeting, begin today with your first zero-based budget. Start a budget today and learn how to win with money.

4. Money stress & anxiety

Does the check engine light cause stress? Paying for Christmas on credit? Always feeling broke? These are tale-tale signs that you are failing to budget.

Following a zero-based budget removes the unknowns and replaces them with knowns. When the unknowns are reduced the anxiety level reduces as well. Most people experience anxiety around money because they don’t really know where their money is going or if they’ll have enough when they need it. What if I told you that you could know with almost certainty that when your car breaks down, you’ll have enough money to pay for the repairs in cash? Or that if your home’s roof springs a leak, you can handle the new roof without using credit? I bet your anxiety level would be reduced. A well-planned and executed zero-based budget allows you to know where your money is, where it is going, and how much you need to save to keep “Murphy’s law” from your front door.

A monthly zero-based budget brings clarity out of confusion. Consequences of not budgeting don’t have to be a part of your life. Start a budget today and learn how to win with money.

5. Paycheck-to-paycheck living

If you missed a single paycheck what would happen? How about two paychecks? If this scenario would cause you substantial financial difficulties, you are living paycheck to paycheck. However, with a monthly zero-based budget you are able to organize your income so you can get ahead on your bills and leave paycheck-to-paycheck living behind. Learn more about how to get ahead on your bills here.

Living paycheck to paycheck is not fun. It is full of anxiety and for good reason. When you live paycheck to paycheck you are one missed payday away from having significant financial stress. To eliminate this consequence of not budgeting you’ll need to begin by making a monthly zero-based budget and let that budget guide your money choices moving forward.

Consequences of not budgeting: What to do now.

A monthly zero-based budget is the pillar of financial control. If you want to avoid the consequences of not budgeting you’ll need to begin by creating a zero-based budget so that you can generate the financial margin needed to get ahead. The signs are simple to see if you look. Instead of living paycheck to paycheck or lacking emergency savings you can use a zero-based budget to make a plan for your money before the month begins. Doing so will help you save for retirement, plan ahead for inevitable emergencies, and most importantly, avoid debt!

- Begin by making a zero-based budget for your monthly income and expenses. Get a free zero-based budget pdf here.

- Follow that budget so that all of the money you earn is pointed toward your goals and dreams.

- If you do not have any extra money in your budget then you’ll need to look at each expense category for ways to cut expenses so that you can avoid the consequences of not budgeting.

- Plan a budget for each month, year after year and you’ll soon begin to see the benefits of budgeting and being in control of your money.

Bonus: 7 Steps to Financial Wellness

- Save a starter emergency fund of $1,000 as fast as you can.

- Pay off your debt. Start by listing all of your debts except for your mortgage. Put them in order by balance from smallest to largest—regardless of interest rate. Pay minimum payments on everything but the little one. Focus on that one until it is gone. Then take that payment and put it toward the second-smallest debt, making minimum payments on the rest. That’s what’s called the debt snowball method, and you’ll use it to knock out your debts one by one until you are debt-free except for the house.

- Save a full emergency fund of 3 to 6 months of household expenses

- INVEST 15% of your gross income toward retirement.

- CONTRIBUTE to children’s college education fund.

- PAY off the house early.

- Build wealth and be generous.

Note: Steps 4,5 & 6 are worked on at the same time.