Introduction

Habits are a funny thing. They don’t seem very bad in the moment, but they have an outsized effect over time. That is because habits are something that add up. Anything persistent usually wins.

So with that in mind let’s take a look at these 7 money habits that will keep you poor. And three ways to fix it.

7 Money Habits That Will Keep You Poor

1. Eating at restaurants too much will keep you poor.

We all love a good meal out but what if the tab doesn’t fit your budget? Well, doing this on the regular can make you poorer. Eating just one meal out for a family of 4 can easily reach $100 after tax and tip. What would happen if you opted instead to invest that $100 in a good mutual fund? The habit of investing could turn that $100 per month into over $1,000,000 by age 65. Yes, you read that correctly. Investing one hundred dollars per month from age 25 to 65 earning 10% will yield over one million dollars at retirement. (Based on 75-year historical returns in the US)

Eating at restaurants fits into a budget category we call “discretionary spending”. That means restaurants are not a necessity but rather a luxury. Habits matter. And the habit of eating out while ignoring more important financial priorities will keep you poor. Instead of restaurants, eat at home and learn to save more money at the grocery store.

2. Buying daily fufu coffee can keep you poor.

Besides being calorie bombs, those daily/ weekly fufu coffees are adding up to the tune of $303,000 in lifetime losses. According to the folks at the Motley Fool, the average Starbucks order is $12 per person. Do this weekly and you’ll spend better than $48 per month on overpriced coffee. Once again, what would happen if you opted instead to invest that $48 in a good mutual fund? The habit of investing from age 25 to 65 could turn that $48 per month into over $303,000 by age 65 based on 10% annualized returns. (Based on 75-year historical returns in the US)

Habits matter and the coffee habit, while ignoring more important financial priorities, will keep you poor. There is nothing wrong with an expensive cup of coffee as long as the purchase is not displacing more important priorities such as getting out of debt, saving for retirement, or funding your children’s education.

3. Gambling

They don’t call Las Vegas, “lost wages” for nothing. Honestly; if this one isn’t obvious to you call 1 800 GAMBLER. This is a legit gambling helpline and there are folks standing by to help. Or you can visit their website here.

4. Buying the latest phone each year

Most people don’t consider that when you bundle your new phone and cell service together in one payment you are financing your phone. Instead, opt for a cut-rate carrier and pay cash for a phone that is a couple of years old. A decent 2nd generation phone can be had for about $250. Combine that with a discount cell carrier and your total phone bill for 1 line can easily be as little as $25 per month, even less sometimes. My phone plan (with Cricket) costs $100 per month for 4 lines and unlimited data. And that includes all taxes and fees. With a BYOP (Bring Your Own Phone) strategy you can cut your phone plan from $75 to $25 per month and save thousands over the course of 5 to 10 years even after factoring in the cost of your 2nd or 3rd generation phone.

The point here is that trading your phone in each year on the newest model keeps you in a cycle of payments and (essentially) debt…for a phone! Call me weird if you want but I’d rather retire with dignity and save that money toward a better result.

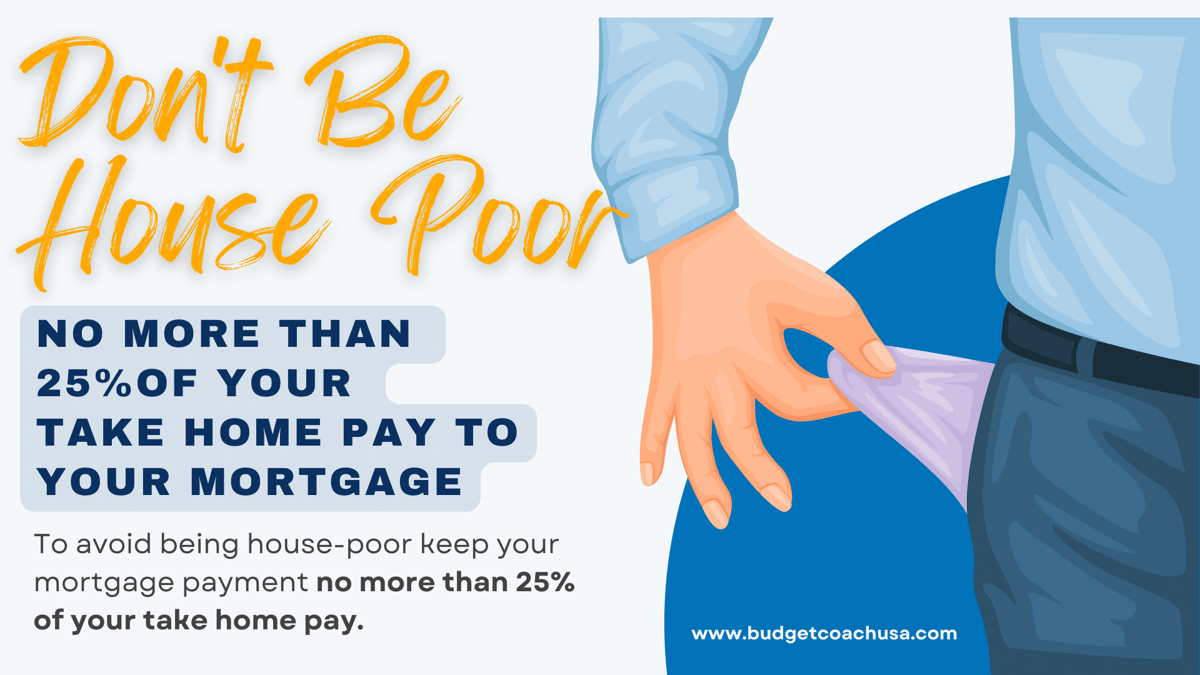

5. Buying too much house (or renting too much apartment)

We all want the house of our dreams, but we don’t want that dream to turn into a nightmare because we can’t afford the payment. This money habit will keep you poor. There is a simple formula that works for most people; keep your house payment, or rent payment, to 25% or less of your monthly take-home pay. If your house payment is above 30% of your monthly take-home pay you’ll begin to feel “house-poor”. If it gets higher than that you’ll find yourself gasping for margin in your checking account. This means that your house payment is putting too much stress on other financial obligations such as saving for retirement. If you want to stay poor, buy too much house. It’ll do it every time.

6. Using credit cards

Credit cards are a tool that banks use to keep you producing income for them. It is as simple as that. Wouldn’t it be nice instead of paying interest, if you were earning interest instead? Credit cards are a habit that will keep you poor, keep you paying interest, and keep you from earning interest. Instead of using credit cards, learn to make a monthly zero-based budget, pay off your debt, and begin putting your money to work for you by saving and investing. Using credit cards is a habit that will keep you poor, and the banks wealthy.

7. Making car payments (worse, leasing a car)

I can hear you now. Who can pay cash for a car? Answer: The people who have consistently, over time, avoided the previous 6 bad money habits that’s who! I know it seems difficult now, but using a zero-based budget to decide where you’ll spend your income each month will over time, yield the results you want. Making payments on things for the rest of your life will only keep you poorer than you could have been otherwise.

How to Stop the 7 Money Habits that Keep You Poor.

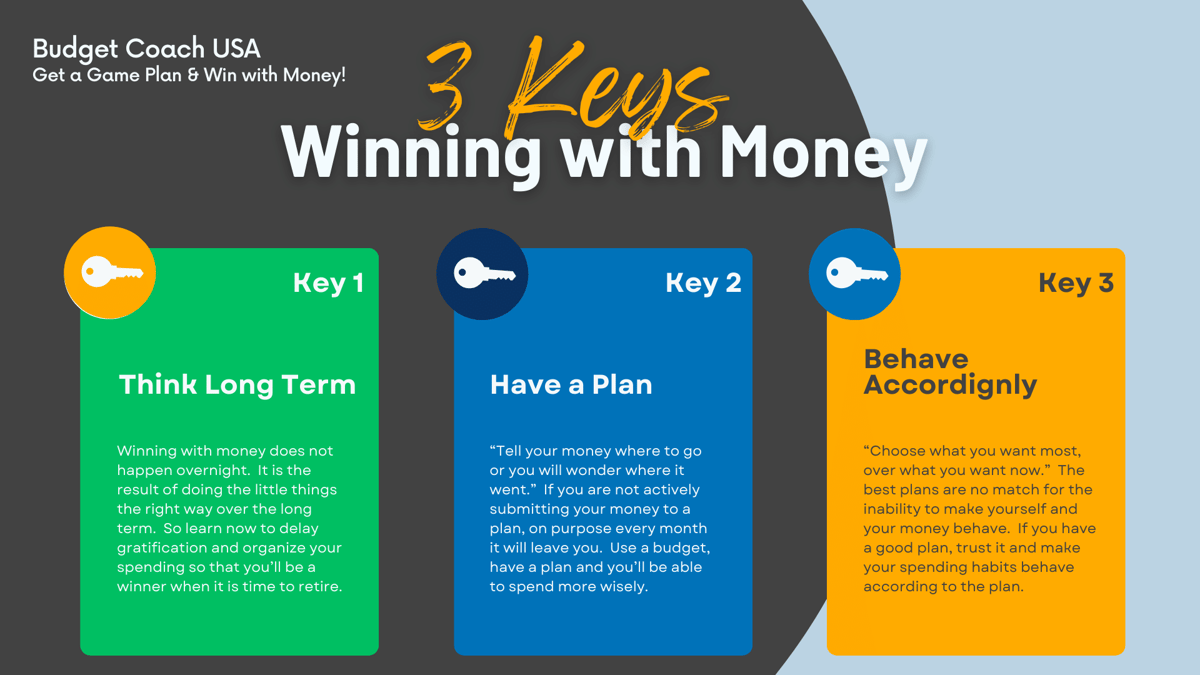

1. Think long-term when it comes to your money

Winning with money does not happen overnight. It is the result of doing the little things the right way over the long term. So learn how to delay gratification and organize your spending so you’ll be a winner when it is time to retire.

Living only for today won’t end well.

We all want to have fun and enjoy our lives but living entirely for now without planning for the long term won’t end well. If you don’t want to live in your kids’ basement one day, you’ll need to live for more than just now.

- Make and use a zero-based budget that includes room for paying off your debt and saving for the future.

- Begin investing and saving for retirement today. It is never too late. The old Chinese proverb says “The best time to plant a tree was 20 years ago. The second best time is now.” Begin investing now.

Consider future responsibilities.

You’ll be able to spend money wisely when you are leaving room for your future responsibilities in your spending decisions.

- Spending money wisely means always keeping your eye on the future. What we want now and what we need long term are very different things. So submit your spending decisions to a budget that is pre-planned and considers both here and now as well as the future.

- Spending money wisely means using personal discipline to make smart choices. If you always feel broke, it is because you are not organizing your money in a way that acknowledges reality. Leaving your future responsibilities out of your spending is not a wise thing to do and will leave you broke when it is time to retire.

2. Create a monthly zero-based budget that aligns with your long-term goals

A budget is a plan for your money before the month begins. It helps you assign your income to a job according to your plan and your long-term goals. Without a budget, you will spend money like a ship drifting in the ocean without a rudder. Your money won’t have a direction and your financial life will be lost at sea. A budget is a plan for your money and a habit that will keep you from being poor.

3. Choose what you want most over what you want now.

“Choose what you want most, over what you want now.” Make your spending habits behave according to the plan.

Evaluate all of your decisions through the lens of your plan.

Plans without execution are useless. So even the best plan without any personal discipline is likely to fail. Evaluate all of your spending decisions through the lens of your plan and your budget.

Choose what you want most over what you want now.

Example: What I want now is a new phone and dinner out. But what I want most is to be able to care for my family and retire with dignity. So, I’ll choose to say no to the phone and dinner out so I can continue to save for retirement instead.

Ultimately, how you spend your money is a choice. If you are unable to choose what you want most over what you want now, you’ll struggle to achieve any goal and your plans will be wasted. Being able to regulate our behavior means more than our diet and exercise. It extends to our financial lives as well. If you want to win with money, you’ll have to behave according to your plan.

Conclusion

Winning with money takes planning and discipline. Financing your phone, making care payments for life, and buying too much house are just a few of the money habits that will keep you poor. However, if you’ll pay attention to your spending, stay out of debt, and use a monthly zero-based budget you’ll be well on your way to living a dignified financial life.

Life will always have its share of problems, but by avoiding the money habits that keep you poor, money does not have to be one of them.

Bonus: 7 Steps to Financial Wellness

- Save a starter emergency fund of $1,000 as fast as you can.

- Pay off your debt. Start by listing all of your debts except for your mortgage. Put them in order by balance from smallest to largest—regardless of interest rate. Pay minimum payments on everything but the little one. Focus on that one until it is gone. Then take that payment and put it toward the second-smallest debt, making minimum payments on the rest. That’s what’s called the debt snowball method, and you’ll use it to knock out your debts one by one until you are debt-free except for the house.

- Save a full emergency fund of 3 to 6 months of household expenses

- INVEST 15% of your gross income toward retirement.

- CONTRIBUTE to children’s college education fund.

- PAY off the house early.

- Build wealth and be generous.

Note: Steps 4,5 & 6 are worked on at the same time.