What is financial wellness?

We define financial wellness as the current status of one’s finances having the following characteristics:

- Able to execute daily financial obligations without delay due to a lack of funds or use of credit.

- Use a written zero-based budget monthly to guide spending and savings decisions according to overall financial goals.

- Emergency fund savings are in place to fund any known potential exposure such as replacing an automobile if needed or the HVAC system without the use of credit.

- Debt-free. No debt payments.

- At the current savings and investing pace, there will be enough money to retire with dignity as a result of advanced planning and saving.

- Plan in advance, using a zero-based budget, to be generous, even if modestly.

8 Tips for Financial Wellness

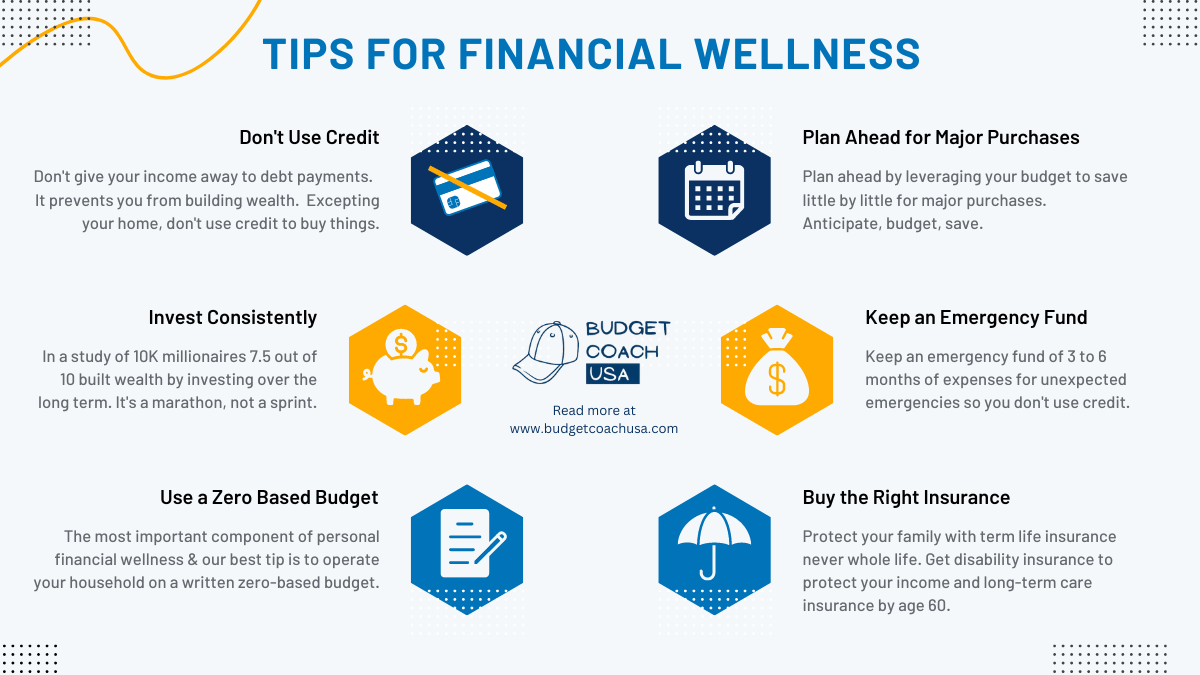

1. Don’t Use Credit – Be Debt Free

The best tips for financial wellness include not using credit and being debt free. Your number one tool for achieving financial wellness is your income and the impact of your income is lessened or even eliminated when it is sent to debt payments, credit card debt, or personal loans. Avoid using credit for any reason.

2. How to improve financial wellness? Invest Consistently Over the Long Term- Automate Your Savings

In a survey of over 10,000 millionaires in the United States Ramsey Solutions discovered that 8 of every 10 millionaires in the survey invested consistently, over the long term, in their employer’s 401K program. And 7.5 of every 10 invested additional money in their own retirement savings. And before you get to it, 8 out of every 10 received no inheritance from parents or other family members. 1 in 5 received some inheritance and only 3 in 10 received a million or more. The takeaway from this study is that, according to Ramsey, millionaires are made, not born.

Winning with money is about playing the long game. The long game involves the least risk and historically generates the best returns. If you invest consistently over the long term you can improve your financial wellness without the stress involved with get-rich-quick schemes or risky ventures. If you want to improve financial wellness begin now to put at least 15% of your income into a tax-favored retirement plan in this order: 1st toward maximizing your employer-sponsored match plan, 2nd toward a ROTH IRA, and 3rd toward any other traditional IRA available with a track record of success. Automate your contributions before they hit your paycheck. If you do, you’ll be well on your way to reaching your financial wellness and retirement goals.

3. Best Tip for Financial Wellness: Live on a Written Budget, Every Month

The most important component of personal financial wellness and our best tip for financial wellness is to operate your household on a written budget monthly. A budget is the cornerstone of personal financial wellness and the basis from which everything is accomplished. How do you plan ahead for major purchases? With a budget. How do you get debt free? It begins with the use of a budget. A budget tells every dollar where to go so that at the end of the month you’ve used all of them to maximum efficiency. When you tell every dollar where to go you are assured that the dollars you need to go toward retirement will be there when you need them. Learn more about how to budge here.

4. Plan Ahead for Major Purchases

It should come as a surprise that the car you are driving today, probably won’t last forever. Or that the heat pump for your house won’t last past 20 years on average. Or that the family will want to take a vacation this year or the truck will need new tires. Major purchases should never come as a surprise. Those who achieve financial wellness have learned to budget and anticipate major purchases. They account for these purchases by saving a little each month and setting it aside for that purpose. Will you need another car in 5 years? If so, begin now to save $200 per month for the car. In 5 years you’ll have $12,000 for the purchase. This is what financial wellness looks like.

Tips for financial wellness from Budget Coach USA including steps to improve financial wellness.

5. Keep an Emergency Fund of 3 to 6 Months of Household Expenses

Next on our list of financial wellness tips is emergency funds. To improve your financial wellness build and keep an emergency fund of 3 to 6 months of expenses. To do this, leverage your zero-based budget. When life’s inevitable surprises come your way you’ll be prepared because you have an emergency fund to handle the expense. In fact, your emergency really becomes a simple inconvenience when you have an emergency fund in place. Having an emergency fund prevents you from taking on debt to cover unexpected expenses. And when you are able to pay cash for unexpected expenses your stress level stays low. This is what financial wellness looks like.

6. Payoff Your Home as Soon as Possible

If you are debt free, have 3 to 6 months of emergency funds in place, and are contributing to your retirement at least 15% of your income, the next priority is to throw as much money at your home as you can until it is paid off. Want to know what a person can do when they have no debt including their home? What can a person do when every dollar they earn stays in their bank account and doesn’t go out to a debt payment? Anything they want! That’s what. Your home loan isn’t a pet. You don’t have begrudgingly keep it around. What we know about people who experience financial wellness is that they pay off their home mortgage as soon as possible. They don’t treat their mortgage as a fact of life they have no control over. They treat it like an unwanted guest and kick it out! This is what financial wellness looks like.

7. Actions That Could Improve Your Financial Well-Being: Keep the Right Insurance in Place

Got a friend or insurance “professional” trying to sell you whole life insurance? They are either very confused or cannot be trusted to give you financial or insurance advice. It is a terrible product. Buy Term Life Insurance instead. It is 1/5 the cost or less for the same death benefit. Take the premium savings when you buy term life insurance vs whole life insurance and invest it into your retirement accounts yourself. You’ll be further ahead. I promise. Next, make sure you have disability insurance in place in case of a disability. Disabilities take away your ability to earn an income so you’ll need to pay your bills somehow. This is where disability insurance kicks in. It will pay you a pre-determined amount according to the policy so you can pay your bills and buy food while you are not able to work. It is bad enough that you are dealing with a negative health event, you don’t need money stress on top of it. Get disability insurance to protect your income. Lastly, make sure you have long-term care insurance in place by age 60. The right insurance protects your overall financial health.

8. Be a Lifelong Learner

People who are financially well tend to stay up to date on current financial trends such as changes in the law or tax changes. This doesn’t mean you have to be the sophisticated type and speak in lofty terms. Quite the contrary actually. Be yourself, but be aware so that you can protect your hard work. There are always changes in the landscape that can affect your money. Keep your ear tuned to things that could adversely impact your future or things that could help you. For instance, the ROTH IRA is relatively new but it is a terrific option to help you save for retirement on a tax-favored basis. Being a lifelong learner helps you protect your hard work and leverage the money you have been able to save for better results. Caring for your financial wellness is not a set-it-and-forget-it proposition. Stay in the game and look for the signs that may impact you. This is what financial wellness looks like.

There you have it. Our 8 tips for financial wellness. Do you have others? Let us know in the comments below.