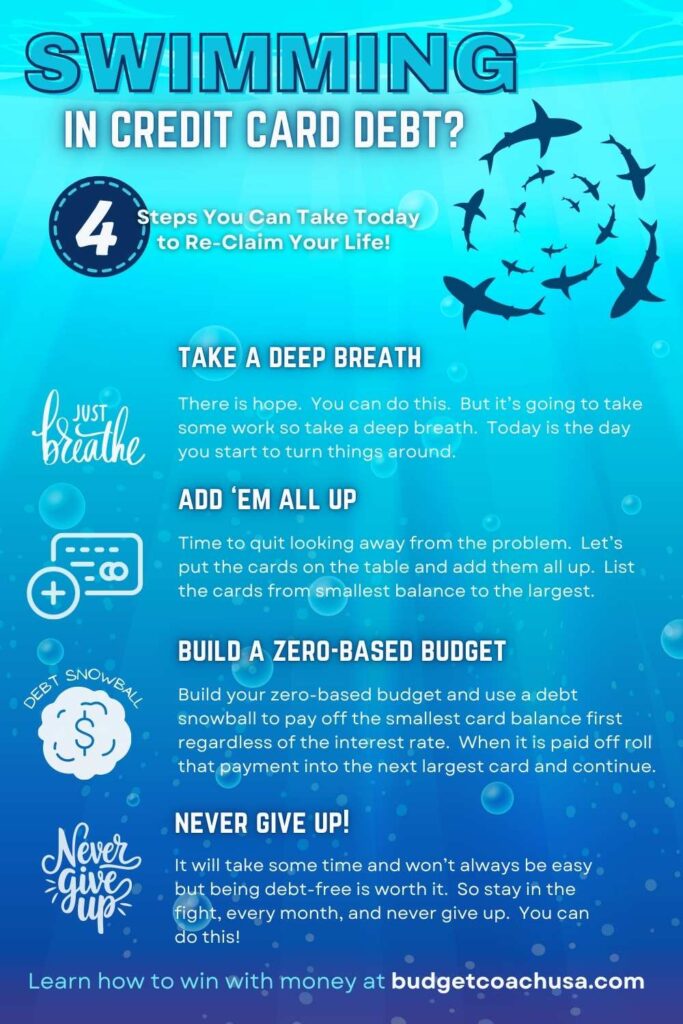

If you are Swimming in Credit card debt, there is hope! This blog is full of helpful information on how to pay off your credit card debt, manage your money better, and build the financial future you want for your life. Credit card debt steals your future and the people selling it to you are concerned with their future, not yours. So what can you do when you are swimming in credit card debt? We’ve got 4 steps you can take to re-claim your life and put that burden behind you for good.

I’ve counseled many people who were swimming in credit card debt and for those who were willing to put in the hard work, success followed. You can do it too. Let’s get started. Here are 4 steps you can take to re-claim your life if you are swimming in credit card debt.

1. Take a deep breath. There is hope.

Without a doubt, the most important thing a person needs when swimming in credit card debt is hope. Without hope, it is hard to feel like you can have any control over your financial future. So let me assure you, there is hope. Take a deep breath and decide today to make a change. Credit card debt can take a toll on your emotions but you do have control over your future. There is hope.

2. Get all of your debt out in the open.

Collect all of your credit cards and put them on a table.

Time to quit looking away and stare the ugly mess right in the face. Pull all those card statements out and put them all on the table. All of them. Don’t leave any out. Add up all the balances and look at the damage. You can’t solve the problem if you can’t look at it. So add them all up and acknowledge the mess that needs to be cleaned up.

List the balances from smallest to largest.

After you’ve got all of those credit card statements on the table arrange them from the smallest balance to the largest regardless of interest rate. Attack the smallest card balance first and aim all of your extra money at it while making only minimum payments on the rest. Once you have the smallest one paid off, roll that payment into the next one on your list. This is called a debt snowball and you can use this method until all of your cards are paid off. Learn more about how to use a debt snowball here.

If you are married, disclose the situation to your spouse.

Are you married? Be sure to disclose the entire situation to your spouse. If they have been kept in the dark, you may need to work through some issues to regain trust. However, it is important you both work together to solve this problem. Learn more about how successful married couples handle money here. Learn more about how to handle financial stress in your marriage here.

3. Make a zero-based budget to begin attacking the problem.

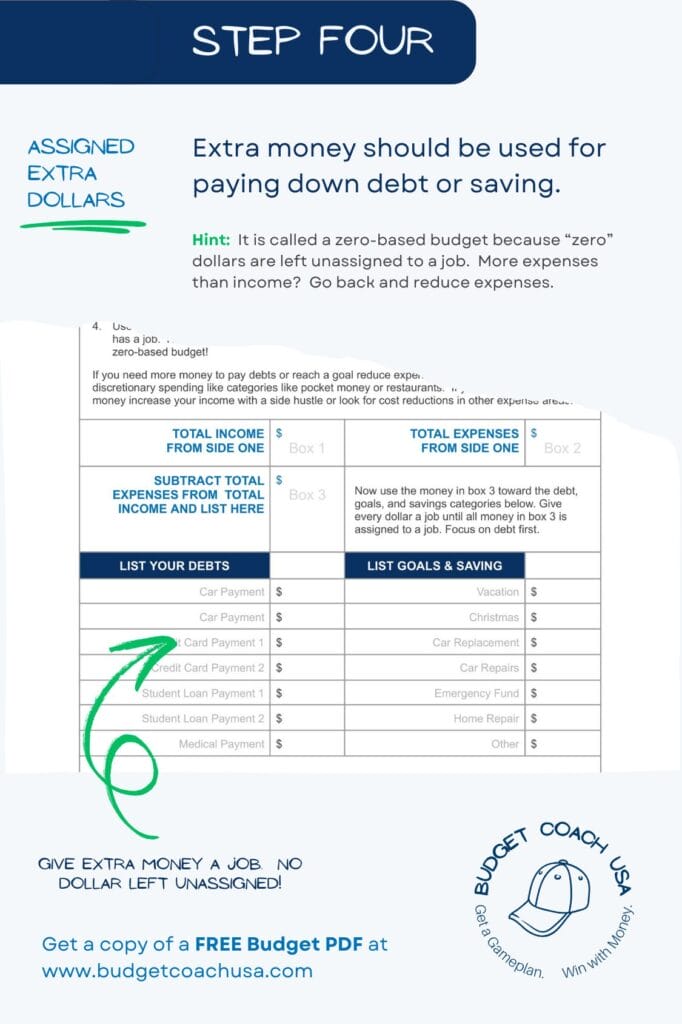

A zero-based budget is designed to make sure that every dollar of income you bring home is assigned to a job and that no dollar is ever wasted. A zero-based budget is always completed before every month begins. If you are going to free up enough money to pay off those credit card balances you are swimming in, you’ll need to maximize every dollar you earn. Follow these steps. You can learn more about zero-based budgeting here.

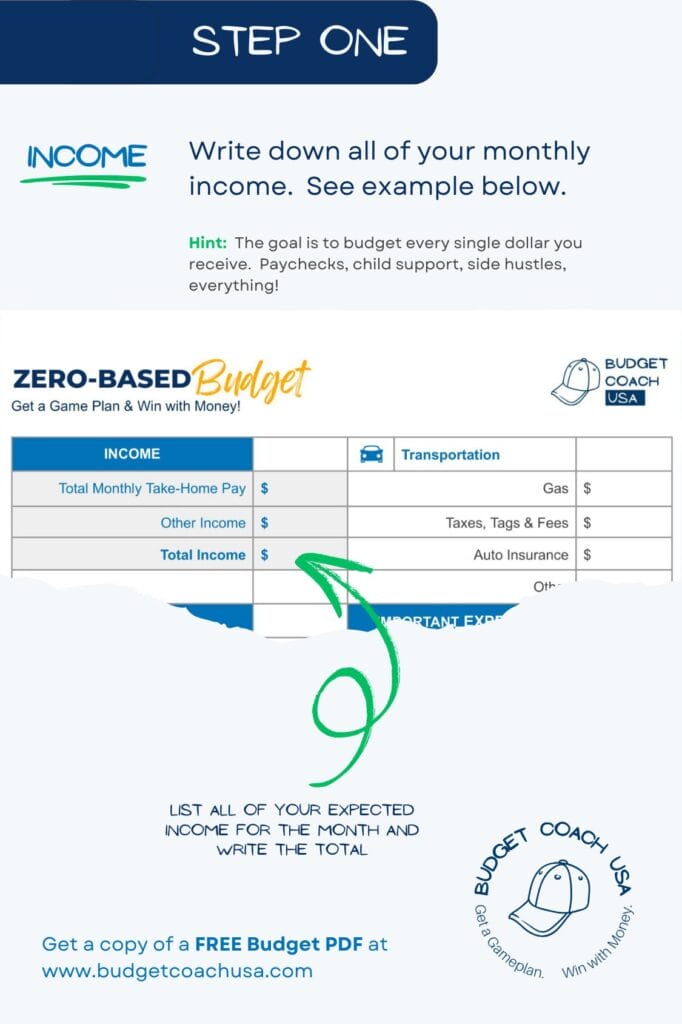

Begin by writing down all of your monthly income.

If you are having a hard time knowing exactly how much you earn each month, refer to your bank account statements and look at recent paychecks. Include all income from both you and your spouse, if married. Be sure to include income from alimony, child support, and any side hustles. If you are paid every other week you are usually paid twice a month. However, there will be 2 months every calendar year in which you get three paychecks. So be sure to look at your paydays and the calendar to know when those months are. See the illustration below. Download this free budget PDF here. No email is required.

Include ALL income

You may get a monthly stipend from unemployment or child support etc… Those can be so regular that they just drop into your bank account and you forget about them. Refer to your bank account statements to make sure you catch ALL of your household income. We want to acknowledge all of your income so we can budget it and put it to work.

Be honest, don’t cheat.

No hiding income from yourself and especially, not your spouse. That’s called financial infidelity. Be honest about all of it. Knowing how to make a budget means being honest about all of the numbers.

Be sure to look for 3 paycheck months if you are paid every other week.

If you get paid every other week at your work, don’t forget that there are 2 months of the year that you get 3 paychecks. Those months can sneak up on you. So look up those months now so you know when to expect that third paycheck in your budget. Who doesn’t want an extra paycheck twice a year?

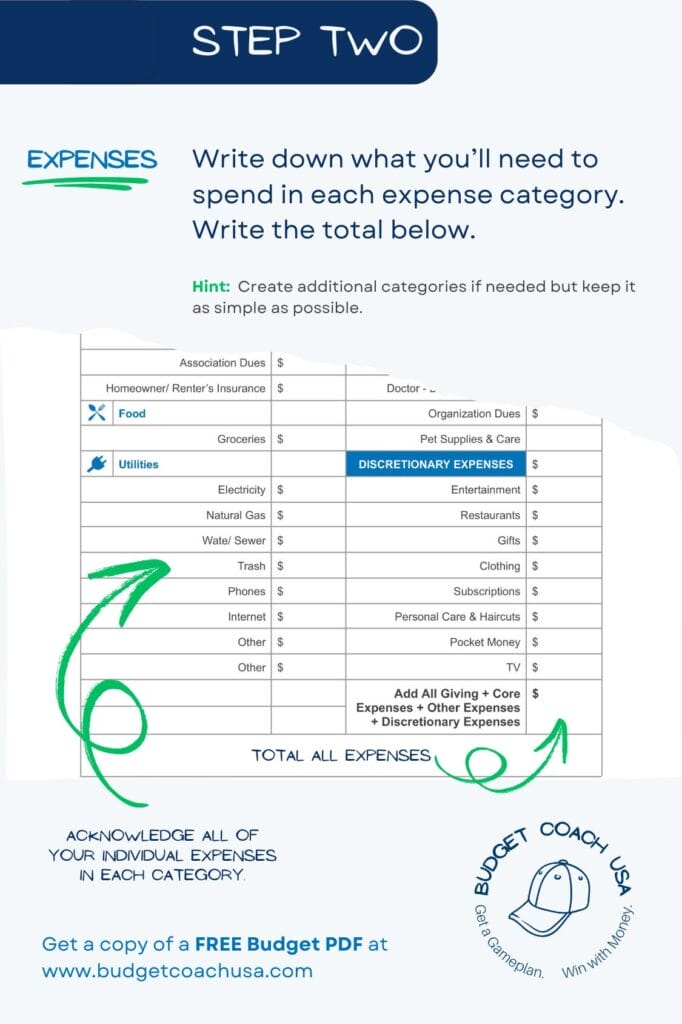

Next, write down all of your monthly expenses.

This step is a little more difficult. If you have never budgeted your money in the past it can be a challenge to even guess how much money you spend in certain categories such as groceries or gas. Remember that bank statement you looked at in the first step? Grab it again and use it as a guide while you are filling out your budget expenses for the month. You can add up all of the grocery store expenses as well as any restaurant or entertainment expenses. This is a lot of help when making a budget. See the illustration below. Download this free budget PDF here. No email is required.

Use your bank statements as an initial guide.

Again, for the first couple of months, refer to your past bank statements as a guide to help you uncover your historical spending patterns.

Don’t get too specific with categories as it can be more detail than needed.

Getting too specific with your budget categories can lead to more details than is necessary. Budget categories should be specific enough to capture all of your monthly household expenses but not so specific that it creates extra work. For instance, a category for “gas” is usually enough. There is no need, in most cases, for a separate gas category for each vehicle. Keep it as simple as possible while capturing each distinctive different category.

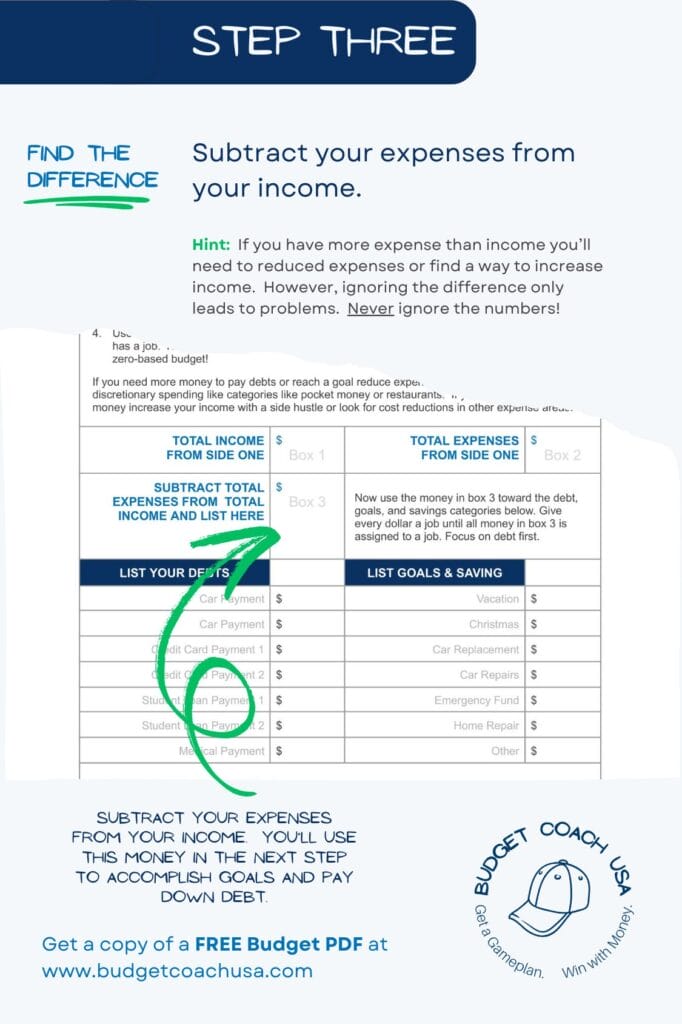

Now, subtract your expenses from your income.

Once you have your total income (from step, one) and your total monthly household expenses (from step, two) let’s do some quick math. Subtract your total expenses from your total income. See the illustration below. Download this free budget PDF here. No email is required.

Extra money left over?

If you have extra money left over use it to pay off your smallest credit card balance first regardless of interest rate.

Are you in the red? Too many expenses and not enough income?

If your expenses are more than your income, you have two choices. You can go back and reduce expenses. When reducing expenses focus on discretionary expenses first. Discretionary expenses are expenses that are not really necessary such as “fun money” or “restaurants”. The second thing you can do is increase your income.

Budget all extra money toward paying off credit cards.

Now it is time to give that extra money a job. Use it to pay off your credit card debts beginning with the smallest card balance first.

4. Never give up!

“Why” do you want to quit swimming in credit card debt? Is it stealing from your life and creating stress? Wanting more peace and less stress is a great reason to kick those card balances out of your life and knowing your “why” will help you stay the course, even when it gets hard. Some years ago our family was on a journey to pay off all of our debts. We were sick and tired of living paycheck to paycheck and having little to show for it. We wanted a better life and more personal peace. And it worked. Knowing our “why” helped us aim our income and our choices toward our goal even when temptations were present.

We wanted financial peace of mind in the present, protection from future emergency expenses, and the ability to fund important priorities such as education, paying off our home, and saving for retirement. This was our “why”. Once we had these goals and priorities in focus, we simply pointed our money and efforts in that direction. And when things got hard, we simply refused to give up.

Final thoughts if you are Swimming in Credit Card Debt.

Success is a prize for those who keep going when others are quitting. It is about making smart choices, consistently and over time. So it is important to understand that challenges, in the grand scheme of things, are only a small blip in time. Any challenge today will be outweighed by making smart choices consistently over time.

If you are swimming in credit card debt, begin by taking a deep breath. You can do this. You didn’t get into debt overnight and it is going to take some time to work your way out of it but it is possible. I promise.

Line up those credit cards on the table from the smallest balance to the largest. Don’t look away from the mess any longer. Begin your debt snowball by paying all extra money on the smallest balance card first making only minimum payments on the rest. When that card is paid off, roll its payment into the next largest card.

Never give up. It will take time but for those that are willing to put in the hard work, success follows. It’s worth it. Financial peace of mind is worth it.