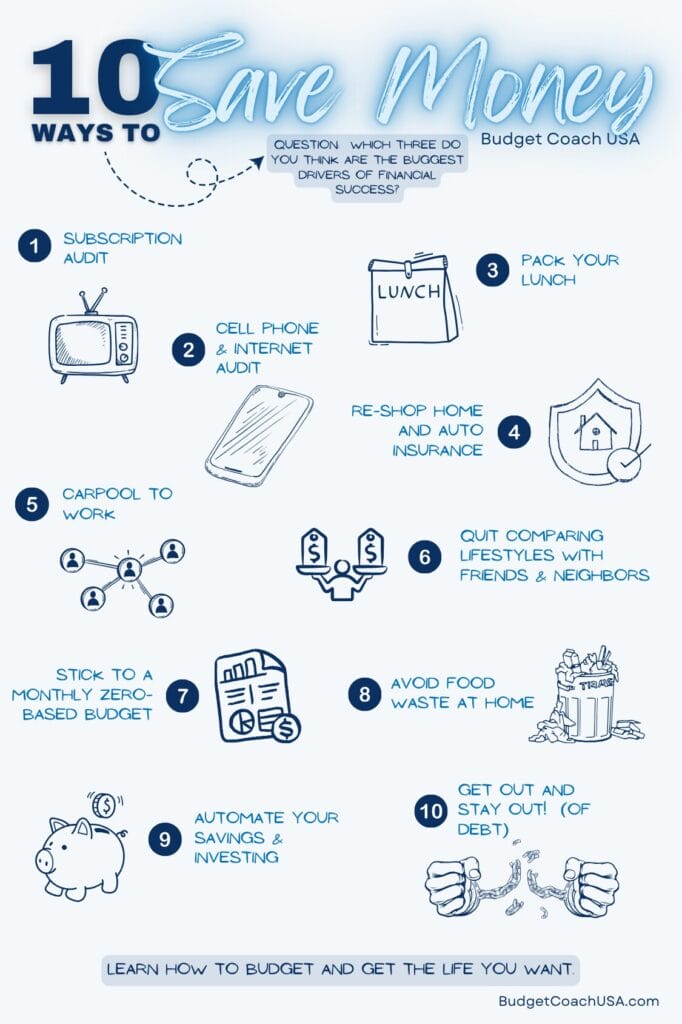

Are you feeling a financial pinch? I don’t blame you. It is hard not to notice the increased cost of almost everything in the last few years. Fortunately, there are some ways to curb the challenges of inflation. We’ve put together 10 ways to save money and the great thing is you can do them now! With a little work and the willingness to make a few lifestyle changes, you can see annual savings in the thousands in just one month.

10 ways to save money now.

We do all of these regularly (except carpooling) in our family and I can personally say they help save a lot of money from year to year. Here are 10 ways to save money and boost your bank account.

1. Subscription audit

First on our list of 10 ways to save money is to complete a subscription audit. You should do this annually. From Walmart to Amazon Prime to music, subscriptions are the new profit center for many businesses. If you have not taken a fresh look at your subscription commitments you should. A great way to save money is completing a subscription audit. Just checking your streaming subscriptions might uncover some services you haven’t used in a while. Grab your last 3 bank statements and audit them carefully. Look for all of your subscriptions and make a list. Then decide which ones you can let go of. While you are at it, get on a zero-based budget so you have your current month’s expenses named and accounted for. That way you can always know what you are making, and spending, and where your money is going.

2. Re-shop your auto and home insurance

Second on our list of 10 ways to save money is re-shop your auto and home insurance every 3 years. Your current insurer may not be passing down savings to you because you are already a customer. As your life and family situation changes, you can become a different risk profile for insurers without even knowing it. For instance, if you were renting but bought a home in the last couple of years you’ll be a more attractive customer for many insurers and could qualify for lower rates. The market is always changing. So a great way to save money is to re-shop your home and Auto insurance every 3 years. To do this, call a local insurance agent who quotes for multiple insurers. Don’t call the agents who are “captive”. They’ll only quote you the single insurer they represent. Call an agent who can quote multiple insurers at the same time.

3. Get out and stay out! (of debt)

When you pay cash for purchases you avoid paying interest rates on a loan. If you borrow $10,000 for a car. Over the next 4 years, you will pay back the original $10,000 plus $1,000 in interest. When you took the bank loan, you had $10,000. When you finished paying the bank loan off you paid a total of $11,000. So after 4 years, you had lost $1,000. A benefit of being debt-free is having more money to point toward your goals and dreams instead of giving it away to a banker. It is a myth that debt helps you build wealth. Debt prevents you from building wealth.

The best way to pay off debt is by using the debt snowball method. Start by listing all of your debts except for your mortgage. Put them in order by balance from smallest to largest—regardless of interest rate. Pay minimum payments on everything but the little one. Focus on that one until it is gone. Then take that payment and put it toward the second-smallest debt, making minimum payments on the rest. That’s what’s called the debt snowball method, and you’ll use it to knock out your debts one by one until you are debt-free except for the house.

4. Take a break from lunch out

It’s a “go-to” for saving money for a reason…it saves money! Do the math. Every time you brown bag your lunch vs. eating out will save you at least $10 on the conservative side. That is $200 a month! And that is just for lunch for one person. Imagine if you and your spouse are both buying lunch out almost every day. If you took $300 per month from age 30 to age 65 and invested it into your retirement you’d have an additional $688,000 in retirement savings. I hope lunch tasted good because Chipotle (or wherever else) has your retirement funds now. That makes this one great way to save money!

5. Phone and internet audit

Fifth on our list of 10 ways to save money is a phone and internet audit. As businesses and technology evolve new and more competitive phone and internet plans become available. Some new businesses are in the customer acquisition phase and offering great new rates for a few years. Some more established businesses are re-packaging their plans to meet new customer needs. All that to say, a great way to save money is to audit your internet and cell phone plans once per year.

Big-name brand carriers have to pay for all of that advertising and those fancy stores on prime real estate somehow. And they do that by selling you an image more than delivering a discernable difference in service. The facts are that cut-rate carriers are way less expensive and provide the same cell towers and coverage. So what is the difference? A little less speed sometimes, but not always. And if you want them to provide you with a phone, it won’t be the latest version. I ran an entire business across my state on a Chromebook and a second-generation Android phone while using the Cricket mobile network. The network and my phone provided directions for 15 stops a day and were used for each customer to sign. Neither I nor the business ever suffered a bit. I currently get 4 lines with unlimited data (including 5G) for $100 per month.

6. Stop comparing

An interesting thing happens when you achieve a debt-free life. The very journey to debt-free living establishes a willingness to live, financially at least, counter-culturally. When this happens you tend to quit comparing yourself to others. More than 70% of US households are living paycheck to paycheck. Understanding this fact you begin to realize that the shiny outer shell of new cars and big houses is many times supported on the back of risky debt. Once you arrive in this place, comparison gives way to confidence. The neighbor’s cars and house may look nice but it is built on a shaky foundation. A benefit of being debt-free is no more need to compare!

Comparing yourself to your neighbors or co-workers temps you to live their financial life. Don’t do this. Live your life. If you are trying to keep up with others, start a budget plan this month and you’ll soon learn how much money you can save.

7. Start budgeting

Our best way to save money is to get yourself on a zero-based budget. I know it doesn’t sound as fun as other things and you are probably looking for fixes that you feel are quicker. But that is the thing about a zero-based budget, it fixes things faster than all of the other ideas we have listed combined. When you tell every single dollar you earn where to go your savings will pile up fast. Check out this article on why a zero-based budget is important then start one today.

8. Avoid food waste at home

Number eight on our list of 10 ways to save money, and perhaps the fastest way to see quick results, is to eliminate food waste. Stop and think for a moment about the amount of food you toss from your refrigerator because it has spoiled before being consumed or from your freezer because it has freezer burn. When you toss that food and replace it you have literally bought those meals twice! Don’t buy your food twice. Focus on the food already in your refrigerator or freezer and eat it before it goes bad. If you do this for a couple of months you will be shocked at how much your grocery bill is reduced.

9. Automate saving and investing

Set up automatic transfers from checking account to savings account.

Setting up an automatic transfer from your checking to your savings account will pay off hugely in the long run. Set it and forget it. Just be sure that once your savings account is funded with 3 to 6 months of household expenses you begin to divert any additional savings to retirement, education, or paying off your home early.

Set up automatic transfers from your checking to your ROTH IRA

If you have already taken advantage of your employer’s match program for your retirement savings. If you have not yet reached 15% of your gross income invested in retirement, then open a ROTH IRA for your retirement. You can have your contributions automatically deducted from your checking account. Set it and forget it. You’ll be glad you did once retirement time rolls around.

Participate in your employer’s retirement match with automatic deductions from your salary

We recommend that you contribute 15% of your gross income to a retirement plan. What better way to reach a 15% mark than to get your employer to match part of it. The minimum an employer can match for a qualified retirement offering to their employers is 3.5% so why not take advantage of that free money? If you earn $65,000 per year you can get a free $2,275 each year just for participating. It is literally a 3.5% raise! If you want to save money from your salary, participate in your employer’s retirement match program.

10. Carpool to work or for kids’ events.

Last but not least in our 10 ways to save money, carpooling. With gas prices continuing to rise as well as the cost of auto repairs it is smart to look into carpooling. You can save $100 or more this month by organizing a carpool at your place of work or for kids’ sports and events. How? Signup Genius has a great article on some tips and tricks.

Conclusion: 10 ways to save money.

It can sometimes feel like a constant battle to keep on top of rising costs. Businesses are often trying to find a way to get a larger chunk of your wallet. However, with some time and attention, you can battle back. Winning with money doesn’t just happen. It takes attention and wise choices. Regularly shop your insurance, phones, internet, subscriptions, and more. Automate your savings so the money hits your savings account automatically. And don’t waste food. Don’t buy your food twice. Be creative and avoid throwing food out.

Lastly, start a zero-based budget today. It is the best way to save money and will pay big dividends over the years. You can download a free zero-based budget PDF here. Read why a budget is important here.