Here at Budget Coach USA we are all about helping everyday Americans win with money and we’ve compiled a list of our top 10 money mistakes to avoid so you don’t rob yourself of your best future. Regardless of your income, avoiding these 10 common money mistakes can help you retire with dignity while protecting your family and lifestyle along the way.

We didn’t say that our 10 money mistakes to avoid were easy or fun. If you want to have financial peace of mind in your life it will take some work. As with anything else in life, a little diligence now pays big dividends in the future. So with that said let’s jump into our top 10 money mistakes to avoid.

1. Don’t Borrow for College – Do This Instead.

I can hear you now. “There is no way.” “It isn’t possible to go to college without borrowing money.” “Have you seen tuition rates lately?” I get it but if you want to win with money it is wise to avoid starting your life out in a financial hole.

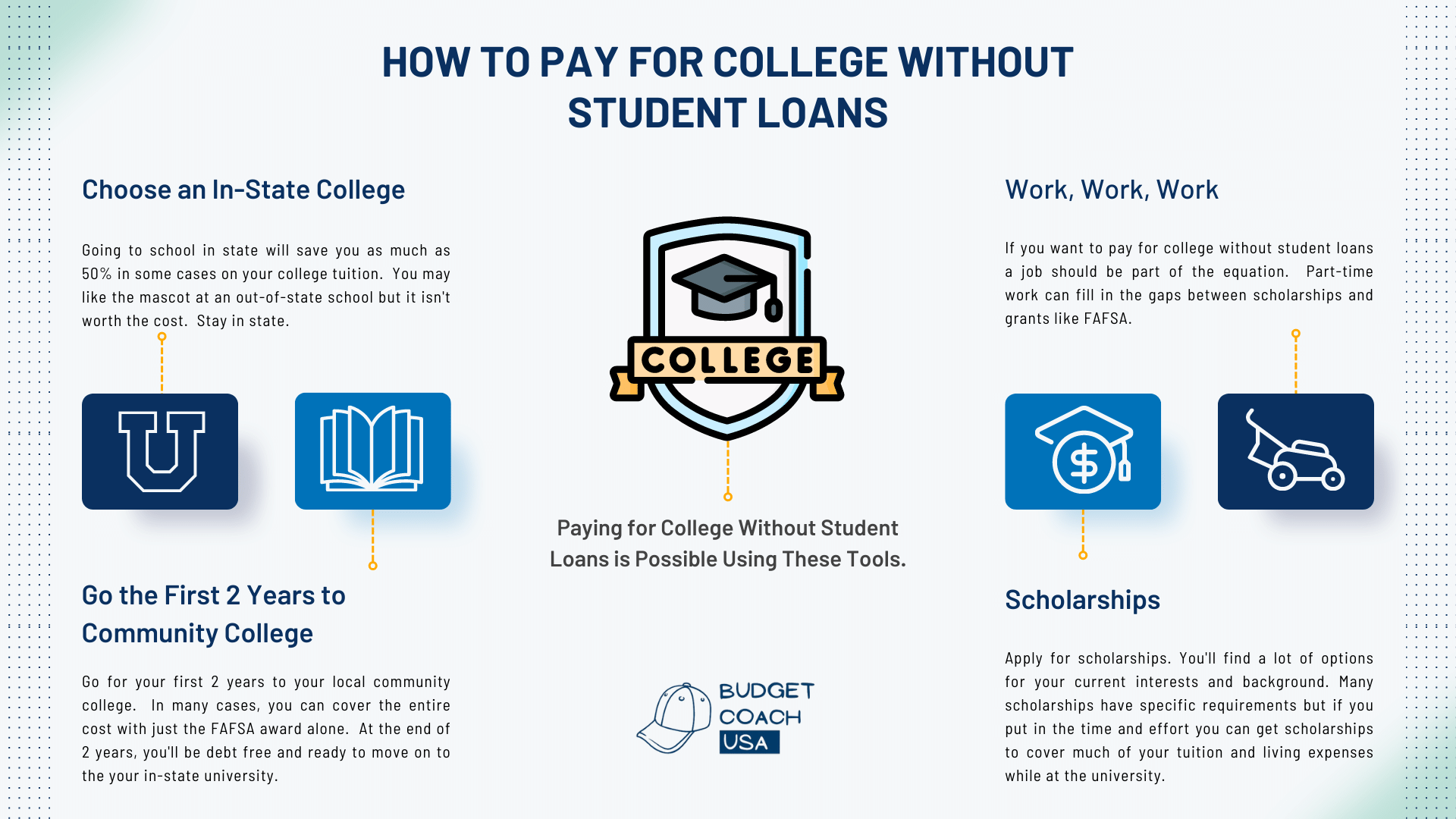

Stay in-state (your state of residency) for college.

I know the boujee college the next state over is the first to have a lazy river running thru campus, but why are we going to college, to begin with? If you can pay cash for all that boujee, great. But if you are going to college on a budget choose a university that is in your state. In many cases, tuition and fees will be half of the out-of-state with the cool mascot.

Go for the first two years to your local community college.

Huge savings here. If you want to go to college without student loans start out at your local community college. You can attend a full year while living at home for in many cases less than $5,000. It is easy to cash flow while working. In many cases, your FAFSA award may cover it all. That is a free 2 years of college. We love free! At the end of 2 years, you’ll be a junior in college and still debt-free! Then with all that money you save at community college you can head off to the in-state university for your major courses.

Scholarships, scholarships, scholarships.

Apply for scholarships. Google search this like it is your new job! You’ll find a lot of options for your current interests and background. Many scholarships have specific requirements but if you put in the time and effort you can get scholarships to cover much of your tuition and living expenses while at the university. Look, you can spend 40 hours applying for scholarships that might yield a $10,000 scholarship or 40 hours a week getting paid $15 an hour to deliver pizzas to make money for college. The math is simple here. Applying for scholarships is worth the time and effort.

Work! Get a job while you are in college.

Some part-time work will help you pay tuition as you go instead of borrowing. If you will stay in state for school, start out at your local community college to save money, apply for scholarships and take advantage of the FAFSA, you should have no trouble filling in the remaining gaps with some part-time work while you study.

2. Don’t Use Debt to Buy Anything but a Home

Many people consider debt to be a fact of living but this is far from true. While you can get out of debt if you find yourself there, not taking debt in the first place is a better choice. In our list of money mistakes to avoid this one ranks as the most important. Why? Because when you give away your hard-earned money to make debt payments you limit your most important wealth-building tool, your income. Remaining debt-free is a must-do and is achieved through the use of a zero-based household budget which is next on our list.

3. Failing to Use a Budget for Your Monthly Finances

Next on our list of money mistakes to avoid is not using a zero-based budget. Using a budget is “telling your money where to go instead of wondering where it went.” (John Maxwell) If you are not using a budget you are bleeding money that could be put to other uses such as beefing up your emergency fund or saving for a car. A budget is the pillar of financial control. It is your compass and your money bible. When you begin each month with a zero-based budget that assigns every dollar you plan to earn that month to a job, you maximize your income’s potential to accomplish the most important goals in your finances. When you are not using a zero-based budget, your money is likely being used on things that are not a part of your goals…like fufu coffee drinks and expensive meals out. Learn how to make a zero-based budget and tell your money where to go instead of wondering where it went. Do you want more money in your bank account? Use a budget.

4. Lack of an Emergency Fund of 3 to 6 Months of Household Expenses

When life’s inevitable curve balls come your way having an emergency fund pays dividends. Without an emergency fund, you are too likely to reach for a credit card to solve your problem. That is a huge mistake and one of our money mistakes to avoid. Are you wondering how to save an emergency fund? Well, once again we find ourselves back to our old friend, the zero-based budget. Each month, we save aside extra funds into a savings account we call an emergency fund. It is ideal to have 3 to 6 months of household expenses on hand so that when unexpected emergencies surface, you have the funds to cover them without reaching for the credit card.

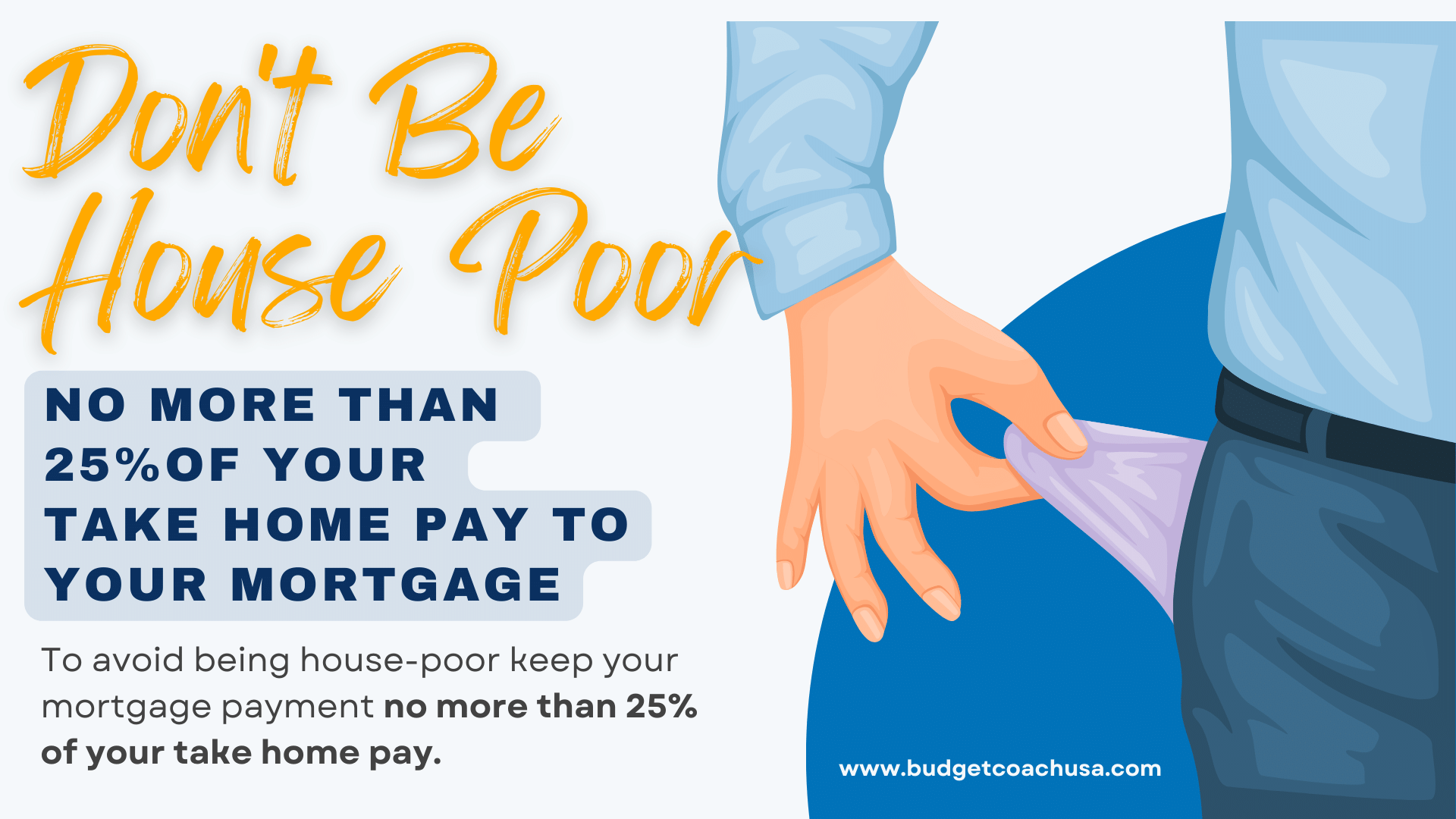

5. Buying Too Much House, Being House Poor

Buying too much house is our next money mistake to avoid. What does house poor mean? Your home mortgage payment should not exceed 25% of your take-home pay each month. If it does, you will begin to feel a squeeze in your bank account. Not only does the mortgage payment create a squeeze, but a home that has more square footage and a larger lot takes more maintenance dollars creating still more problems. Before you know if your dream house is keeping you from other more important financial priorities such as saving for your children’s (or future children’s) college education, saving for retirement or simply being able to pay cash for vacations and cars. A home is your largest investment. If you bite off more than you can chew, you’ll end up house poor. At Budget Coach USA we want you to have a very nice home, we just don’t want your home to have you. Keep your mortgage payment to no more than 25% of your take-home pay.

6. Eating at Restaurants too Much

When you are trying to save money and avoid money mistakes staying out of restaurants is most families’ biggest opportunity. I know it sounds a little different but trust me, it is true. When you need to make an impact on your budget fast the quickest way to accomplish this is to go to the grocery store, pack your lunch and stay out of restaurants. Food is the one single place you can make save a lot of money fast. So when we are talking about money mistakes to avoid, getting your restaurant budget under control can pay big dividends over the course of just one year. Even more so over the course of your adult lifetime.

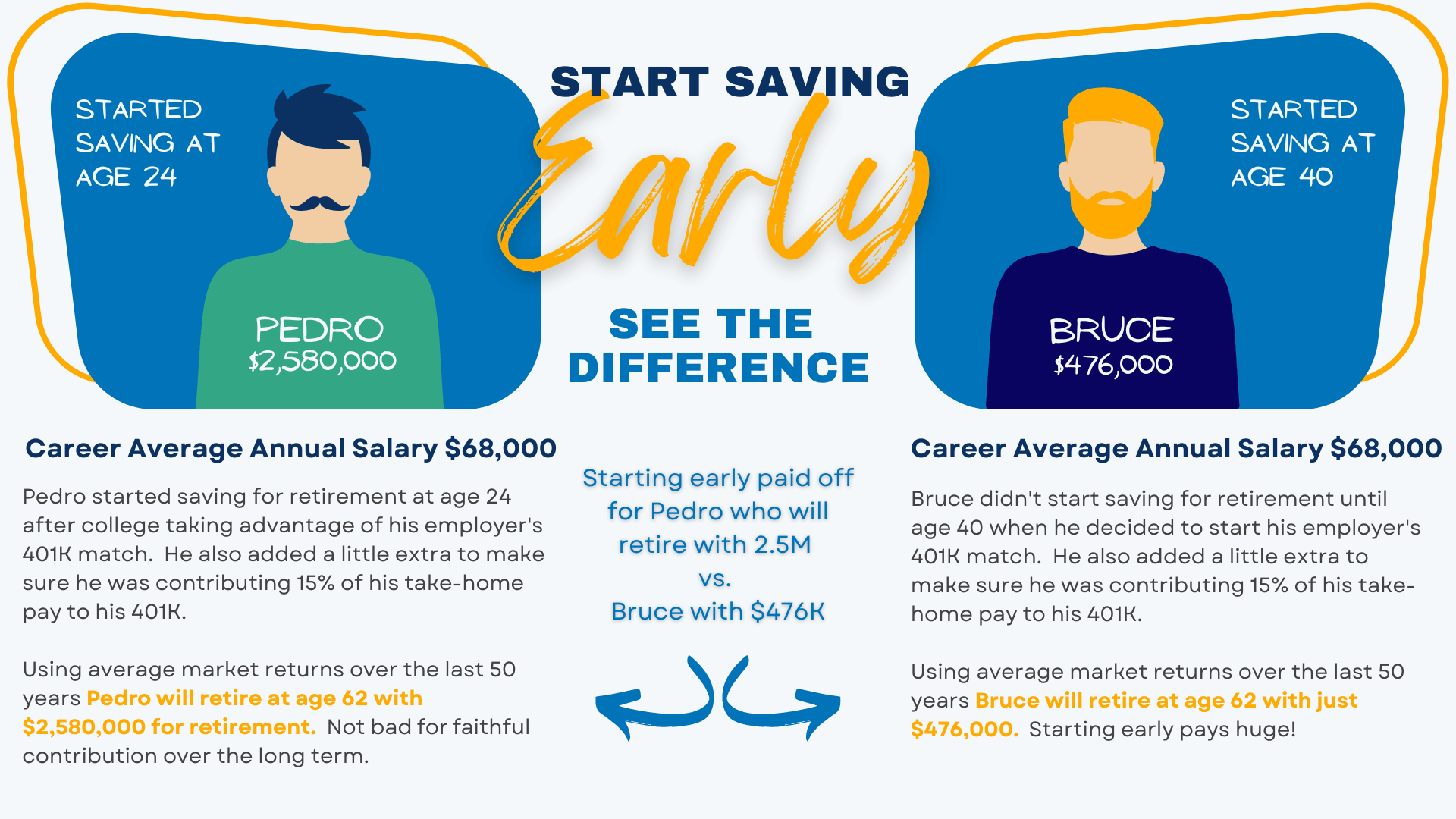

7. Not Starting Retirement Savings by age 30.

The laws of compound interest are easy to see when you compare the two scenarios below. Compound interest picks up a lot of steam the more years you save. So waiting until you are in your 40s or later will have a big impact on your retirement nest egg. At Budget Coach USA we recommend putting 15% of your take-home pay into your retirement savings and doing so beginning in your 20s. Following this simple rule will help you retire with dignity and offer a comfortable retirement lifestyle.

Are you a little later in life and playing catch up? That’s okay too. The important thing is to get started now so you can take advantage of your opportunities. It is never too late to start saving toward your goals. Be sure to use a zero-based budget to maximize your opportunities.

8. Making Emotional Decisions with Your Money

A big money mistake to avoid is making emotional decisions with your money. This is why budgets are so important. They provide factual guidance that can help keep your financial train on track when you are tempted to make emotional decisions with your money. What does an emotional money decision look like? Have you ever bought a new car because the old one wasn’t nice enough or in the best shape? Did it make you feel less secure, didn’t want to deal emotionally with a breakdown on the road? Was the new car in your budget? These emotional decisions can derail your financial train. Instead, always operate your financial decisions against your budget and your goals. Stand up to the emotions and make your financial decisions on facts and budgets.

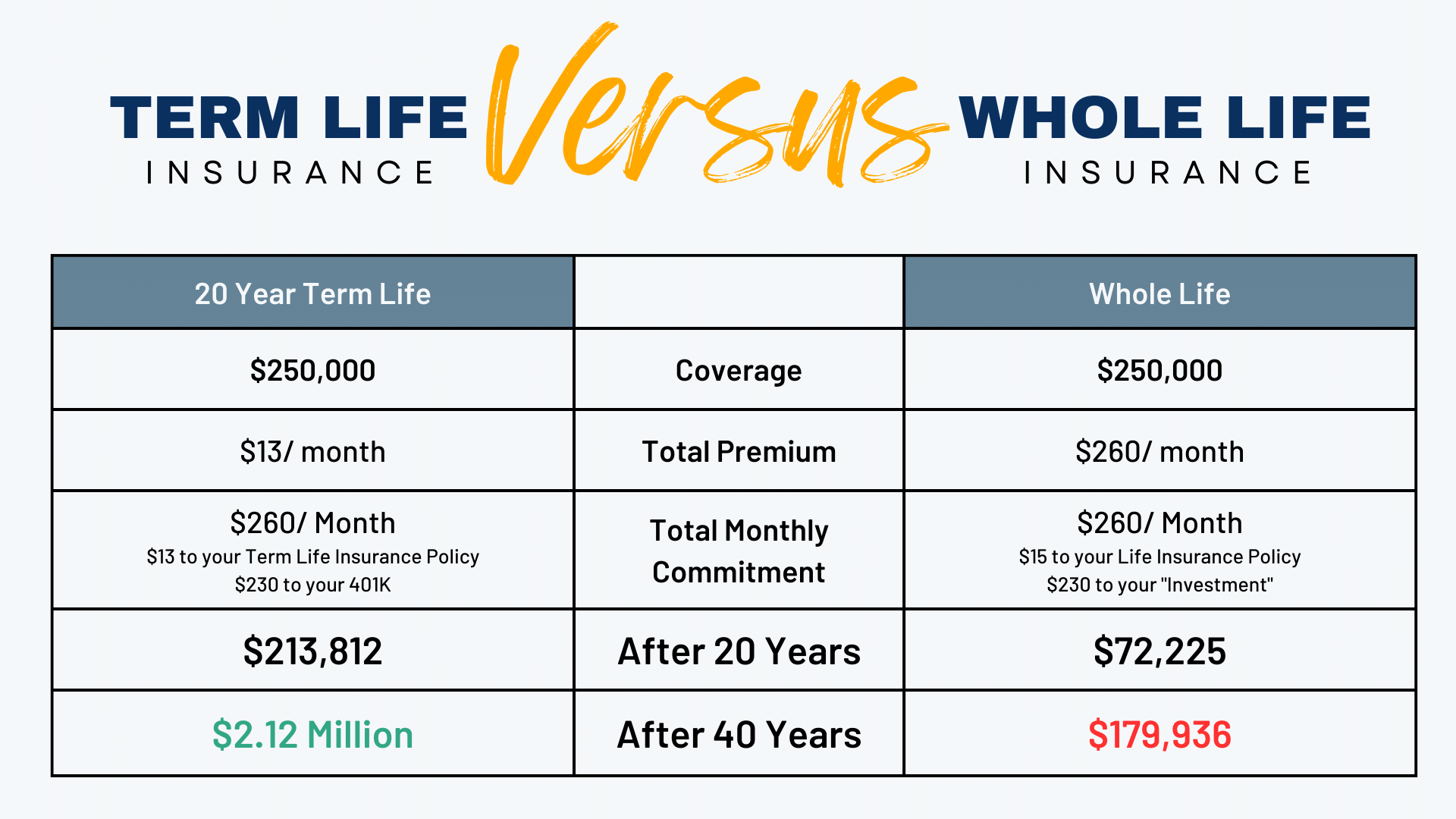

9. Buying Whole Life Insurance

When you mix insurance with investing the salesperson wins. And you lose. Whole life insurance is the combination of life insurance and a (very poor) investment strategy. Do you know why they call it whole life? Because there is a “whole” lot of profit for the salesperson and not a whole lot of benefit to you.

Let me explain. Whole life insurance agents sell you (conflates) an investment component to your life insurance trying to convince you that if you buy term life insurance and don’t die before the end of the term, the premiums are lost, right? Well, yes, and happily so since I’m still alive! Your insurance salesperson wants you to think they can leverage your premium as an investment while at the same time being life insurance. However, if we look at the whole life option closer we see that the investment piece your insurance salesperson is selling you is a whole lot of bull.

Take a look at the graphic below and see why keeping your retirement investments separate from your life insurance is the best strategy.

Get the picture yet? But here’s where it really gets bad. Let’s say we have a friend named Mike who gets a $250,000 whole-life policy at 30 years old. He will pay $260 per month, with $15 going to the insurance and the rest into that “investment” just like the graphic above. After 40 years of paying way too much for his life insurance, Greg is 70 and has $250,000 in life insurance which has roughly $180,000 in cash value if surrendered. Then, Greg dies. How much does the insurance company pay out to his wife and kids? $250,000. However, what happened to the $180,000 of Greg’s hard-earned “investments”? The insurance company keeps it. Yep, that’s right. Sound like a scam? That’s because it is! High on our list of money mistakes to avoid, don’t buy whole life insurance. Buy Term Life instead. (Credit to Ramsey Solutions for this adapted final paragraph and graphic data.)

10. Not Having Disability Insurance

Similar to life insurance, long-term disability is intended to protect your family in the event you can no longer provide thru work. Your family is dependent on your income to provide and if you become disabled in an accident or other condition, disability insurance picks up the slack. When a crisis hits the family, the last concern you want is to worry about the money. Disability insurance picks up the slack and helps you focus on the most important things.

It is relatively inexpensive compared to money stress after a disability occurrence. Disability insurance is based on paying out a percentage of your income beginning either 3 or 6 months after you become disabled and runs for a set term. You can mix and match benefits to your budget and provide peace of mind for your family. Look for long-term disability insurance.

These are our top 10 money mistakes to avoid.

Staying out of these money mistakes will put you on a path to financial success and help you stress less about money. Do you have any others? Let us know in the comments below.