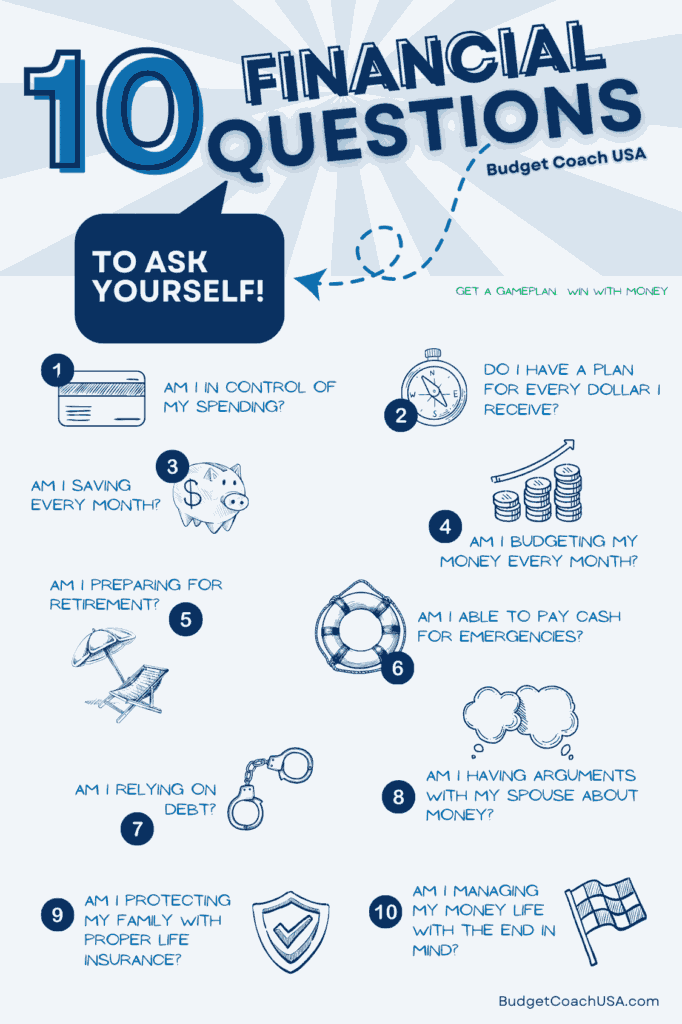

10 Good Financial Questions to Ask Yourself.

Do you want to win with money? Are you tired of paycheck-to-paycheck living? Are you having arguments with your spouse about money? Or, are you just wondering if you have all of your bases covered? If you’ve ever wondered what financial questions you should be asking yourself, you are in the right place. Want to win with money? Start with these 10 financial questions and ask yourself how your habits stack up to these best practices.

1. Am I in control of my spending?

Are you in control of your money? Or is your money in control of you? Have you ever bought something and immediately felt guilty? Most of us know inside ourselves if we are spending our money wisely or not. Wise spending begins with submitting your spending decisions to the boundaries of a monthly zero-based budget. If you are spending money that is not budgeted, you are not in full control of your spending.

2. Do I have a plan for each, and every paycheck?

People who win with money in the long term, have a plan for their money before they receive it. They have a monthly zero-based budget where they anticipate each dollar to be received and an assignment of each dollar within the budget. They do not waste money by spending on things that are not planned. If you want to win with money over the course of your life, budget each dollar before the month begins and have a plan for those paychecks to pay off your debt, save for retirement and build up emergency funds for a rainy day.

3. Am I saving every month?

While it is good to be able to pay your bills on time every month, if that is the only thing you are accomplishing, you’ll have a hard time winning over the longer term. It isn’t enough to just pay the bills. People who win with money set aside dollars for additional savings each month for retirement, education or simply to replace an aging car. If you feel like you don’t have enough at the end of the month to be able to save begin by creating a monthly zero-based budget. As time progresses you will begin to see places where you can be more disciplined in your spending, creating opportunities to save each month.

4. Am I budgeting my money every month?

Are you coming up a little short at the end of every month? Try a monthly zero-based budget. Using a zero-based budget is a great way to keep track of your money each month. In fact, it is the indispensable tool for financial freedom. Using a budget is more than just a monthly plan for your money. It is a plan for your life. As you begin to see dollars accumulating in a savings account for your various goals you begin to see a plan for your life emerge. Budgets create more certainty. Certainty creates less stress.

5. Am I preparing for retirement?

A great financial question to ask yourself is “Am I preparing for retirement”? Preparing for retirement, should, ideally begin in your 20s although many people don’t get around to it until their 30s, 40s, or later. The key is to start. There is an old Chinese proverb that says, “The best time to plant a tree was 20 years ago. The second best time is now.”

6. Am I able to pay cash for emergencies?

Debt sucks. It robs you of your ability to save for your future and disrupts your daily life with added stress and burdens. That is why we always recommend an emergency fund of 3 to 6 months of household expenses in your savings account in case of emergencies. When you can pay cash for emergencies your stress level will reduce and more importantly, your income is not diverted to more debt payments. Your income is used to build a better future. Read more about emergency funds here.

7. Am I relying on debt?

Debt is not a wealth-building tool for you. It is however a wealth-building tool for the bank…at your expense. And they depend on this arrangement to make money. The math is clear. Borrow money from a bank and when you are done paying it back, you’ll have less money than when you started. The more money you borrow, the less money you have in the end.

Instead of relying on debt, start a monthly zero-based budget and a debt snowball plan. Once you are debt-free you can begin to use your income to build wealth and security for your family. Giving your income away to debt payments each month only keeps you poor.

8. Am I having arguments with my spouse about money?

Financial stress can kill a marriage. Arguing, blaming and bitterness are the eventual result of a married couple not in agreement on their spending and financial priorities. If financial stress is killing your marriage there is hope! It doesn’t have to be that way. In fact; learning to work together on your finances can not only relieve money stress, it can bring you closer in many other areas as well. Overall marital satisfaction is improved when you learn how to handle money together. Learn about managing money together here.

9. Am I protecting my spouse and family with the proper insurance?

As a parent, you’ve got a lot on your plate. From changing diapers to chauffeuring your kids around town, it seems like there’s never enough time in the day to get everything done. But when navigating all of the responsibilities of parenthood, there’s one thing you don’t want to overlook: life insurance. Yes, we know it sounds about as exciting as watching paint dry, but trust us – finding the right life insurance can mean the difference between keeping your family safe and secure or leaving them high and dry if something happened to you. Learn more about the best (and worst) types of life insurance here.

10. Am I managing my financial journey with the end in mind?

If we are lucky life is long. So when it comes to money it is wise to manage it with the end in mind. I don’t mean the “end” as in our eventual demise. I mean the latter years of life in retirement. What do you want your life to be like when you can no longer work? So, if your current financial plan is not asking this type of question you are probably missing opportunities.

Your financial questions should always be asking how your current earnings, budgeting, and savings habits are setting the table for your later years in life.

10 Financial Questions to Ask Yourself in Review

Winning with money takes planning and discipline. Using a zero-based budget is a key element in making progress toward a dignified financial life. When times get difficult it is not unusual to have a lot of questions that you ask yourself about financial matters.

Success with money means being in control of your spending and having a plan for every paycheck. Saving and budgeting every month as part of your monthly zero-based budget offers the most reliable path to financial success.

The most important financial question to ask yourself is this: Am I managing my financial life with the end in mind? If not, begin budgeting every month, save every month, and spend only if your budget allows. Doing these things will help you experience less stress in your financial life.